Vir Biotechnology (VIR) Up on Positive Data From HDV Study

Vir Biotechnology, Inc. VIR announced new encouraging preliminary data from its phase II SOLSTICE study. Its shares rose 19.7% on the news.

The study is evaluating the safety, tolerability and efficacy of tobevibart and elebsiran for the treatment of people living with chronic hepatitis delta.

Tobevibart is an investigational subcutaneously administered antibody, designed to inhibit the entry of hepatitis B and hepatitis delta viruses into hepatocytes, neutralize both hepatitis B virus and hepatitis delta virus (HDV) virions, and reduce the level of virions and subviral particles in the blood.

Elebsiran is an investigational subcutaneously administered hepatitis B virus-targeting small interfering ribonucleic acid (RNA). It is designed to degrade hepatitis B virus RNA transcripts and limit the production of hepatitis B surface antigens.

While one cohort is evaluating the combination of tobevibart and elebsiran, dosed every four weeks, the second is evaluating the tobevibart monotherapy dosed every two weeks. Approximately 50% of the participants have compensated cirrhosis.

Preliminary data from the study showed that treatment with tobevibart alone or in combination with elebsiran was generally well tolerated and participants achieved high rates of virologic response at weeks 12 and 24, durable virologic response through 48 weeks, and high rates of alanine transaminase (ALT) normalization.

Vir Biotech shared 48-week treatment data on the efficacy and safety of tobevibart and elebsiran on six participants. Data on these participants were previously reported at the 2023 American Association for the Study of Liver Diseases The Liver Meeting.

These participants received 12 weeks of either tobevibart or elebsiran monotherapy and then rolled over into the combination therapy. All six remained on treatment and showed a sustained virologic response at the time of the last visit. At the time of the analysis, five out of the six participants had reached 48 weeks of combination therapy and one had reached 40 weeks. All six participants achieved HDV RNA less than the limit of detection (LOD) or ≥ 2 log10 IU/mL decrease from baseline. 50% of the participants achieved ALT normalization and 50% achieved the combined endpoint. No serious adverse events were observed.

With monthly dosing of the combination of tobevibart and elebsiran, preliminary data demonstrated rapid and high rates of virologic suppression and ALT normalization. At week 12, 100% (27 of 27) achieved HDV RNA less than the LOD or ≥ 2 log10 IU/mL decrease from baseline and 44% (12 of 27) achieved ALT normalization. At week 24, 100% (11 of 11) achieved HDV RNA less than LOD or ≥ 2 log10 IU/mL decrease from baseline and 64% (7 of 11) achieved ALT normalization.

With twice-monthly dosing of tobevibart monotherapy, preliminary data demonstrated high rates of virologic suppression and ALT normalization. At week 12, 73% (19 of 26) achieved HDV RNA less than LOD or ≥ 2 log10 IU/mL decrease from baseline and 54% (14 of 26) achieved ALT normalization. At week 24, 55% (6 of 11) achieved HDV RNA less than LOD or ≥ 2 log10 IU/mL decrease from baseline and 64% (7 of 11) achieved ALT normalization.

Vir Biotech is on track to report additional 24-week treatment data for approximately 60 SOLSTICE participants in the fourth quarter of 2024.

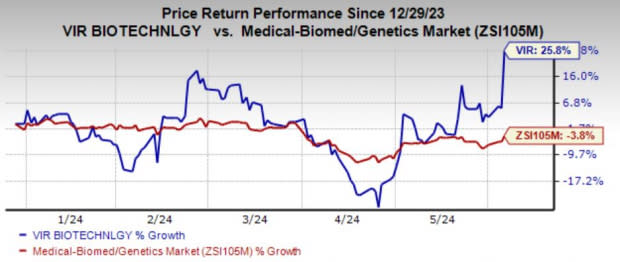

Shares of Vir Biotechnology have risen 25.8% year to date against the industry’s decline of 3.8%.

Image Source: Zacks Investment Research

The company’s current clinical development pipeline consists of candidates targeting HDV, hepatitis B virus (HBV) and human immunodeficiency virus (HIV).

The phase II MARCH Part B trial is fully enrolled. The trial is evaluating the safety, tolerability and antiviral activity of the combination of tobevibart and elebsiran, with and without peginterferon alpha.

Initial data from the phase II PREVAIL platform trial and its THRIVE/STRIVE sub-protocols is expected in the first half of 2025. These trials are evaluating combinations of tobevibart, elebsiran and/or peginterferon alpha in two patient populations — immune-active but treatment-naïve and inactive carriers.

Part A of the phase I study of VIR-1388, an investigational novel T-cell vaccine for the prevention of HIV, is fully enrolled. Initial immunogenicity data is expected in the second half of 2024.

The development of these pipeline candidates is imperative for Vir Biotechnology to maintain its momentum.

Zacks Rank & Stocks to Consider

Vir Biotechnology currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Krystal Biotech, Inc. KRYS, ALX Oncology Holdings ALXO and Minerva Neurosciences, Inc. NERV, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for KRYS’ earnings per share has increased 24 cents to $2.06. KRYS beat on earnings in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 21.46%. Shares of Krystal Biotech have surged 35.2% year to date.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73.

ALX Oncology beat on earnings in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 8.83%.

In the past 60 days, estimates for Minerva Neurosciences’ 2024 loss per share have narrowed from $3.57 to $1.89. Loss per share estimate for 2025 has narrowed from $4.54 to $3.60.

NERV’s earnings beat estimates in one of the trailing four quarters and missed the same in the other three, the average negative surprise being 54.43%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Minerva Neurosciences, Inc (NERV) : Free Stock Analysis Report

Krystal Biotech, Inc. (KRYS) : Free Stock Analysis Report

Vir Biotechnology, Inc. (VIR) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經