Warren Buffett: Investors handicapped by debt miss 'extraordinary opportunities'

It’s impossible to accurately know when the next market decline will be, according to legendary investor Warren Buffett.

“Stocks surge and swoon, seemingly untethered to any year-to-year buildup in their underlying value. Over time, however, Ben Graham’s oft-quoted maxim proves true: ‘In the short run the market is a voting machine; in the long run, however, it becomes a weighing machine,’” Buffett wrote in his newest annual shareholder letter.

It’s important to remember that even Buffett’s Berkshire Hathaway (BRK-A, BRK-B) hasn’t been immune to significant swings in its stock price either.

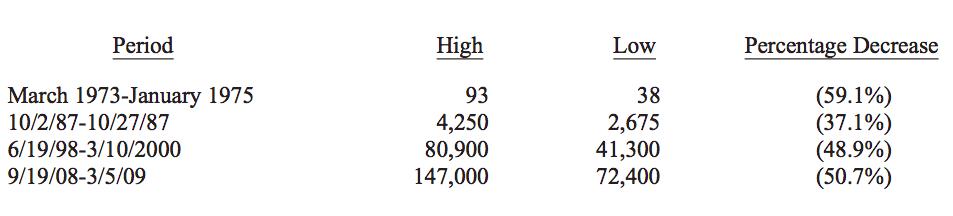

“For the last 53 years, the company has built value by reinvesting its earnings and letting compound interest work its magic. Year by year, we have moved forward. Yet Berkshire shares have suffered four truly major dips,” Buffett notes. He included in his letter the following chart of “gory details”:

“This table offers the strongest argument I can muster against ever using borrowed money to own stocks. There is simply no telling how far stocks can fall in a short period. Even if your borrowings are small and your positions aren’t immediately threatened by the plunging market, your mind may well become rattled by scary headlines and breathless commentary. And an unsettled mind will not make good decisions,” Buffett wrote.

When an investor is investing with borrowed money, losses are amplified when prices go down. And since the best opportunities to buy occur when prices are down, those getting crushed by their leverage bets gone bad won’t be able to take advantage.

Buffett emphasized that no one can predict market declines, and said that declines “offer extraordinary opportunities to those who are not handicapped by debt.”

“That’s the time to heed these lines from [Rudyard] Kipling’s If:

‘If you can keep your head when all about you are losing theirs…

If you can wait and not be tired by waiting…

If you can think — and not make thoughts your aim…

If you can trust yourself when all men doubt you…

Yours is the Earth and everything that’s in it.’

—

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.

雅虎香港財經

雅虎香港財經