Watch These 5 Medical Stocks for Q1 Earnings: Beat or Miss?

The Medical space is anticipated to have gained on growing premiums, an aging U.S. population, resumption of elective procedures, a merger and acquisition (M&A) strategy and continuous technological advancements in first-quarter 2024. Elevated medical and operating costs are likely to have been roadblocks for industry participants. Some of the companies, including Humana Inc. HUM, Molina Healthcare, Inc. MOH, Universal Health Services, Inc. UHS, Encompass Health Corporation EHC and Community Health Systems, Inc. CYH, are set to report first-quarter earnings on Apr 24.

Per the latest Earnings Preview, the total earnings of medical companies for first-quarter 2024 are anticipated to decline 5.6% from the prior-year quarter’s reported figure. These companies’ revenues are anticipated to increase 6.1%.

Factors Likely to Shape Medical Stocks’ Q1 Performance

Medical companies, who are health insurers, devise affordable health plans and foray deeper into several U.S. communities grappling with inadequate care access. They keep upgrading these plans with lucrative features from time to time. The beneficial features of the plans continue to fetch contract wins or renewed agreements for health insurers from the federal or state authorities.

This is likely to have contributed to membership growth and drive premiums, the most significant contributor to any health insurer’s top line, in the to-be-reported quarter. An aging U.S. population is expected to have sustained the solid demand for Medicare plans devised by the health insurer.

Healthcare facility operators may have benefited on the back of improved patient volumes, which remain the most significant contributor to its top line. The resumption of deferred elective procedures is expected to fetch a higher number of patients for the companies operating surgery centers in the first quarter. An increase in elective surgeries implies improved inpatient occupancy levels for the companies. However, an increase in elective surgeries may have escalated the operating costs of healthcare facility operators.

The dire need for specialized rehabilitative treatment that helps people recover from chronic illnesses and injuries and return to daily activities is likely to have boosted revenues for medical stocks providing inpatient rehabilitative services. Behavioral health or psychiatric hospital operators may have capitalized on the growing incidence of mental health issues among Americans in the to-be-reported quarter.

Industry players continue to remain active on the M&A front. They are expected to advance their capabilities, bring diversification benefits, broaden the customer base and strengthen their global presence. A solid financial position has provided them with a cushion to pursue these growth initiatives.

In light of the ongoing digitization across every sphere of life and the amount of ease and convenience such services provide, healthcare companies continue to incur substantial investments to devise telehealth services and extend virtual healthcare services to patients. This is likely to have generated a steady revenue stream for industry participants in the to-be-reported quarter. Still, expenses related to such investments often drain the existing cash reserves and exert pressure on margins.

Let’s find out how the following medical stocks are placed before their first-quarter 2024 results on Apr 24.

The Zacks model suggests that a company needs to have the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today's Zacks #1 Rank stocks here.

Humana: The company’s revenues are likely to have benefited from contract wins and a growing pharmacy business. Strength in the Medicare Advantage business might have fetched improved premiums in the first quarter, providing respite to the Insurance unit. A solid provider services business is expected to have driven the quarterly performance of the CenterWell segment. However, continued investments in marketing and distribution and elevated benefits expense are likely to have escalated costs for the health insurer. The stock has declined 28.9% year to date. (Read more: Will Humana Q1 Earnings Beat on CenterWell Strength?)

The Zacks Consensus Estimate for Humana’s first-quarter 2024 earnings is pegged at $6.02 per share, indicating a decline of 35.8% from the prior-year quarter’s reported figure. The consensus mark for revenues is pegged at $28.6 billion, suggesting 7% growth from the year-ago quarter’s reported figure.

HUM has an Earnings ESP of +0.20% and a Zacks Rank #3.

Humana’s earnings outpaced estimates in three of the trailing four quarters and missed the mark once, the average negative surprise being 11.56%. The same is depicted in the chart below:

Humana Inc. Price and EPS Surprise

Humana Inc. price-eps-surprise | Humana Inc. Quote

Molina Healthcare: In the first quarter, growing membership within the Medicare business of Molina Healthcare is expected to have contributed to premium growth. Numerous contract wins from federal and state authorities, renewal of agreements and buyouts may also have served as a means to boost membership growth. However, the disenrolment of members from Medicaid resulting from the redetermination process is expected to have hurt membership in the Medicaid business. The medical care ratio is expected to have remained high in the to-be-reported quarter due to an increase in medical expenses. The stock has inched up 0.6% year to date. (Read more: Will High Medical Care Ratios Hurt Molina's Q1 Earnings?)

The Zacks Consensus Estimate for MOH’s first-quarter 2024 earnings is pegged at $5.46 per share, indicating a 6% decline from the prior-year quarter’s reported figure. The consensus mark for revenues stands at $9.5 billion, suggesting a 16.8% growth from the year-ago quarter’s reported figure.

MOH has an Earnings ESP of 0.00% and a Zacks Rank #3.

MOH’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 7.62%. The same is depicted in the chart below:

Molina Healthcare, Inc. Price and EPS Surprise

Molina Healthcare, Inc. price-eps-surprise | Molina Healthcare, Inc. Quote

Universal Health: Its revenues are expected to have benefited from the solid performances in its Acute Care Hospital Services and Behavioral Health Care Services segments in the first quarter. Quarterly results are likely to have gained from strong patient volumes and higher surgical volumes. The Behavioral Health Care Services segment is expected to have capitalized on the continued incidence of mental health issues among Americans. However, an increase in physician expenses is likely to have hurt the Acute Care Hospital Services segment’s performance. The stock has gained 8.1% year to date. (Read more: Will Acute Care Unit Aid Universal Health's Q1 Earnings?)

The Zacks Consensus Estimate for UHS’ first-quarter 2024 earnings is pegged at $3.14 per share, which indicates a 34.2% rise from the prior-year quarter’s reported figure. The consensus mark for revenues is pegged at $3.8 billion, suggesting 8.7% growth from the year-ago quarter’s reported figure.

Universal Health has an Earnings ESP of +8.56% and a Zacks Rank of #2.

UHS’ earnings outpaced estimates in each of the trailing four quarters, the average surprise being 5.87%. The same is depicted in the chart below:

Universal Health Services, Inc. Price and EPS Surprise

Universal Health Services, Inc. price-eps-surprise | Universal Health Services, Inc. Quote

Encompass Health: Its first-quarter performance is expected to have been aided by improved patient volumes and higher discharges. Encompass Health’s investments aimed at capacity expansion are likely to enable it to capitalize on a growing inpatient rehabilitative services market. An expanding healthcare portfolio is expected to welcome a higher number of patients and fetch greater revenues to EHC. Elevated operating expenses, despite several expense management initiatives, are likely to have dented margins in the to-be-reported quarter. Its shares have gained 21.6% year to date. (Read more: Should You Buy Encompass Health Ahead of Q1 Earnings?)

The Zacks Consensus Estimate for EHC’s first-quarter 2024 earnings is pegged at 93 cents per share, which implies a 5.7% rise from the prior-year quarter’s reported figure. The consensus mark for revenues is pegged at $1.3 billion, suggesting 9.5% growth from the year-ago quarter’s reading.

Encompass Health has an Earnings ESP of 0.00% and is Zacks #2 Ranked.

EHC’s earnings beat estimates in each of the trailing four quarters, the average surprise being 20.06%. The same is depicted in the chart below:

Encompass Health Corporation Price and EPS Surprise

Encompass Health Corporation price-eps-surprise | Encompass Health Corporation Quote

Community Health: In the first quarter, Community Health’s performance is likely to have benefited on the back of a higher occupancy rate and a decline in total operating costs. Lower salaries and benefits costs, supply costs, lease costs and rent expenses are expected to have provided some respite to margins. However, quarterly results might have been hurt by a fall in adjusted admissions, beds in services and patient days. Its shares have declined 7.4% year to date. (Read more: Will Low Patient Days Impact Community Health Q1 Earnings?)

The Zacks Consensus Estimate for CYH’s first-quarter 2024 earnings is pegged at a loss of 19 cents per share, narrower than the prior-year quarter’s loss of 43 cents. The consensus mark for revenues is pegged at $3.1 billion, suggesting a 0.5% drop from the year-ago quarter’s reported figure.

Community Health has an Earnings ESP of 0.00% and a Zacks Rank #5 (Strong Sell).

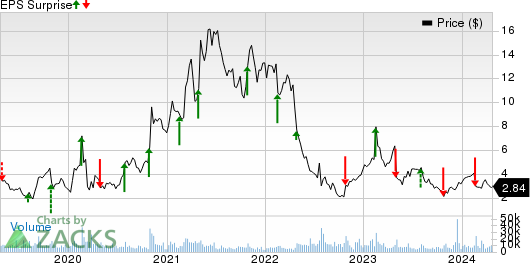

CYH’s earnings outpaced estimates in one of the trailing four quarters and missed the mark thrice, the average negative surprise being 411.06%. The same is depicted in the chart below:

Community Health Systems, Inc. Price and EPS Surprise

Community Health Systems, Inc. price-eps-surprise | Community Health Systems, Inc. Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Humana Inc. (HUM) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Community Health Systems, Inc. (CYH) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經