Wil Higher Uranium Prices Aid Energy Fuels' (UUUU) Q1 Earnings?

Energy Fuels Inc. UUUU is expected to report year-over-year improvement in both revenues and earnings in its first-quarter 2024 results later this week. The Zacks Consensus Estimate for earnings is 2 cents per share. The estimate has moved up 100% over the past 30 days and the current projection indicates a solid improvement from a loss of 1 cent per share reported in the first quarter of 2023.

The consensus mark for revenues is pegged at $26.3 million, indicating 33.9% growth from the year-ago quarter's actual.

Q4 Earnings

UUUU reported an adjusted loss per share of 13 cents in the fourth quarter of 2023, which was wider than the loss of 11 cents per share in the fourth quarter of 2022. The reported figure missed the Zacks Consensus Estimate of a loss per share of 3 cents. Energy Fuels has a trailing four-quarter negative earnings surprise of 82.1%, on average.

Energy Fuels Inc Price and EPS Surprise

Energy Fuels Inc price-eps-surprise | Energy Fuels Inc Quote

Factors to Note

The company completed the sale of 560,000 pounds of uranium (U3O8) for an average realized price of $59.42 per pound in 2023, resulting in a gross margin of 54%. Energy Fuels also sold 153 metric tons of finished high-purity, partially separated mixed rare earth carbonate for $2.85 million as well as 79,344 pounds of vanadium for $0.87 million. As of Dec 31, 2023, the company held 685,000 pounds of finished uranium, 905,000 pounds of finished vanadium and 11 tons of finished RE Carbonate in inventory.

UUUU held an additional 436,000 pounds of uranium as raw materials and work-in-progress inventory, along with an estimated 1-3 million pounds of solubilized V2O5 in tailings solutions that could be recovered in the future. The company’s robust inventory levels suggest that it was well stocked at the beginning of the quarter to capture market opportunities.

Uranium prices had started the quarter at around $92 per pound and soon crossed the $100 threshold and peaked at a 17-year high of $106 per pound on Jan 22, 2024. This was triggered by fears over a potential supply crunch following the declaration from Kazatomprom, the world's largest uranium mining company based in Kazakhstan, regarding its plans to cut uranium production to 80% of the permitted maximum output. Uranium prices experienced another spike in early February, reaching $105 before undergoing a correction. Uranium prices ended the quarter at around $88 per pound, witnessing a 3.4% decline through the course of the quarter. Despite this decline, uranium prices remained substantially elevated compared with the first quarter of 2023.

The company had stated during its fourth-quarter earnings release that it expects to sell 200,000 to 300,000 pounds of U3O8 into its existing portfolio of long-term uranium contracts in 2024. Of this, 200,000 pounds were sold during the first quarter of 2024 at a realized price of $75.13 per pound, which resulted in a gross profit of $38.29 per pound or a gross margin of 51%.

UUUU also contracted to sell an additional 100,000 pounds of uranium in March 2024 at an average sales price of $102.88 per pound, which it expects to result in a gross profit of approximately $66.04 per pound or an approximate gross margin of 64%.

Higher sales of uranium and the solid trend in prices witnessed in the quarter are expected have reflected in Energy Fuel’s first-quarter results.

What the Zacks Model Unveils

Our model predicts an earnings beat for Energy Fuels this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is precisely the case here.

You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Earnings ESP: UUUU has an Earnings ESP of +50.00%.

Zacks Rank: The company currently carries a Zacks Rank of 2.

Price Performance

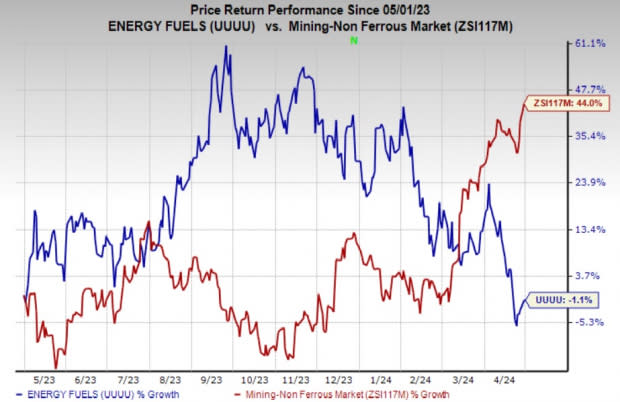

Shares of Energy Fuels have declined 1.1% in the past year against the industry's 44% growth.

Image Source: Zacks Investment Research

Other Stocks to Consider

Here are some other companies in the basic materials space, which according to our model, have the right combination of elements to post an earnings beat this quarter:

Innospec Inc. IOSP, scheduled to release earnings on May 9, has an Earnings ESP of +2.44% and a current Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for IOSP’s earnings for the first quarter is currently pegged at $1.64 per share.

Kinross Gold Corporation KGC, slated to release earnings on May 7, has an Earnings ESP of +4.49% and a Zacks Rank of 3, at present.

The Zacks Consensus Estimate for KGC’s first-quarter earnings is currently pegged at 6 cents per share.

Ingevity Corporation NGVT, scheduled to release first-quarter earnings on May 1, has an Earnings ESP of +39.29%.

The Zacks Consensus Estimate for NGVT's earnings is currently pegged at 37 cents per share. NGVT currently sports a Zacks Rank of 1.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report

Energy Fuels Inc (UUUU) : Free Stock Analysis Report

Ingevity Corporation (NGVT) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經