3 Computer Software Stocks That Could Keep Rising in 2024

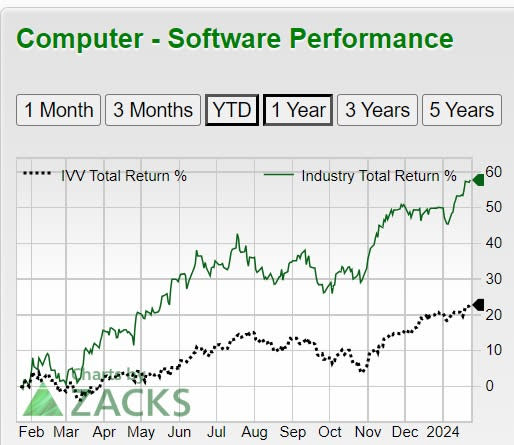

Many of the players in the Zacks Computer-Software Industry have helped boost the strong performance of the Nasdaq over the last year.

To that point, the Zacks Computer-Software Industry's one-year return is +58% to easily beat the S&P 500’s +21% and even top the Nasdaq’s +36%.

The prospects of easing inflation and lower interest rates bode well for consumer spending on non-essential items like tech products. Correlating with such the outlook for several top-rated computer software stocks has become very intriguing again.

With that being said, here are three expansive software companies that could see their stocks rise even more in 2024.

Image Source: Zacks Investment Research

Blackbaud BLKB

Currently coveting a Zacks Rank #1 (Strong Buy) Blackbaud offers a full spectrum of cloud-based and on-premise software solutions. More appealing to investors is that Blackbaud provides its leading software solutions for social causes combining technology and expertise to help organizations achieve their missions.

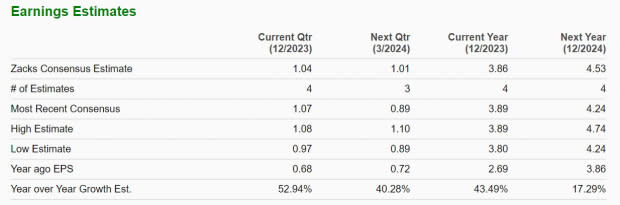

Steady top-line growth and expansive profitability have pushed Blackbaud’s stock up +35% over the last year. The company is now expected to round out its fiscal 2023 with earnings up 43% to $3.86 per share versus $2.69 a share in 2022. More impressive, FY24 EPS is projected to expand another 17% with total sales now anticipated to rise 5% in FY23 and jump another 8% this year to $1.2 billion.

Image Source: Zacks Investment Research

Further reassuring investors is that Blackbaud has now surpassed earnings expectations for six consecutive quarters with its fourth quarter report scheduled for February 12. Blackbaud most recently beat Q3 earnings expectations by 15% in October with EPS at $1.12 per share compared to estimates of $0.97 a share.

Image Source: Zacks Investment Research

Microsoft MSFT

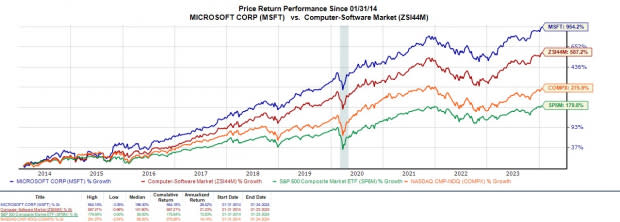

Nowadays it's still hard to have a top software list without Microsoft which sports a Zacks Rank #2 (Buy) and notably has an “A” Zacks Style Scores grade for Growth. Microsoft shares have climbed +64% in the last year to outpace the Zacks Computer-Software Industry’s strong performance.

Even better, over the last five years, Microsoft’s stock is up +273% and has now climbed almost 1000% in the last decade which has comfortably eclipsed the performance of the broader indexes and the Zacks Computer-Software Markets’ +587%.

Image Source: Zacks Investment Research

Microsoft's growth has continued to be fueled by enterprise-to-consumer software solutions and leading cloud capabilities through Microsoft Azure along with lucrative acquisitions including the likes of LinkedIn, Skype, and most recently Activision Blizzard. Artificial intelligence should keep propelling Microsoft's software capabilities going forward having a stake and long-term partnership in OpenAI the creator of ChatGPT.

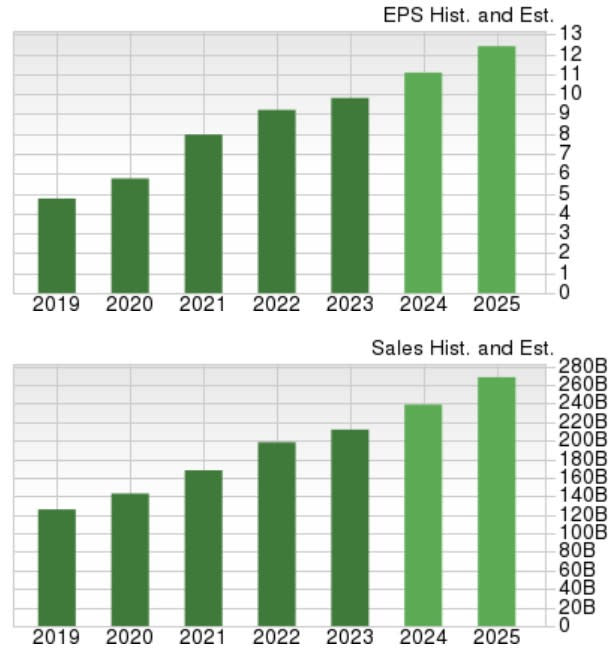

Hitting 52-week highs today, Microsoft will be reporting its fiscal second quarter results next Tuesday with Q2 EPS projected to be up 19% to $2.76 per share. Quarterly sales are forecasted to jump 16% to $61.03 billion as Microsoft is expected to post double-digit percentage growth on its top and bottom-lines in FY24 and FY25.

Image Source: Zacks Investment Research

Trend Micro TMICY

While Trend Micro may be playing catch up on its growth story its stock has an “A” Zacks Style Scores grade for Momentum and boasts a Zacks Rank #1 (Strong Buy). The Japan-based software solutions provider has increasing relevance due to its endpoint and Web security software and services.

Trend Micro’s stock has risen a very respectable +15% over the last year with shares rebounding and soaring +52% in the last three months. As one of the hottest performers in the market of late, fiscal 2024 EPS estimates have climbed 20% in the last 30 days from projections of $1.48 a share to $1.78 per share.

Furthermore, FY24 EPS projections would also represent a sharp rebound and 86% growth from end-of-the-year projections that call for annual earnings of $0.95 a share for FY23.

Image Source: Zacks Investment Research

Boosting Trend Micro’s bottom line recovery is steady top line growth as total sales are now forecasted to rise 3% in FY23 and pop another 9% in FY24 to $1.93 billion. Trend Micro will be reporting its Q4 results for fiscal 2023 on February 15 and positive guidance that reconfirms the company's stronger FY24 outlook could keep the rally going.

Image Source: Zacks Investment Research

Bottom Line

At the moment the Zacks Computer-Software Industry is still in the top 40 percentile of over 250 Zacks industries with Blackbaud, Microsoft, and Trend Micro being three of the most recent winners to pay attention to.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Trend Micro Inc. (TMICY) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經