Annexon (ANNX) Up as Phase III Neuro Disorder Study Meets Goals

Annexon’s ANNX shares jumped 30.8% on Jun 4 after the company announced positive top-line results from its late-stage study evaluating its lead candidate, ANX005, a monoclonal antibody, in patients with Guillain-Barré syndrome (GBS).

Per the data readout from the pivotal phase III study, treatment with a single infusion of the 30 mg/kg dose strength of ANX005 met the study's primary endpoint, achieving a highly statistically significant 2.4-fold improvement on the GBS-disability scale (GBS-DS) at week 8.

Treatment with ANX005 30 mg/kg also showed improvement in key secondary endpoints compared with placebo, which includes early gains in muscle strength as measured by the Medical Research Council sum score at day 8 and week 8 and a median of 28 fewer days on artificial ventilation through week 26.

Furthermore, a 31-day reduction in the median time to walk independently compared with placebo was also observed upon treatment with the candidate's 30 mg/kg dose in a prespecified analysis.

Annexon stated that patients treated with ANX005 30 mg/kg showed signs of improvement sooner compared with placebo on all the above-mentioned assessments. This indicates the candidate’s potential to provide important clinical care outcomes for GBS patients.

Additionally, ANX005 also provided an early reduction in the prespecified analysis of serum levels of neurofilament light chain (NfL), a biomarker of nerve damage. Between week 2 and week 4 of treatment, patients treated with ANX005 30 mg/kg achieved an 11.2% reduction in NfL relative to placebo.

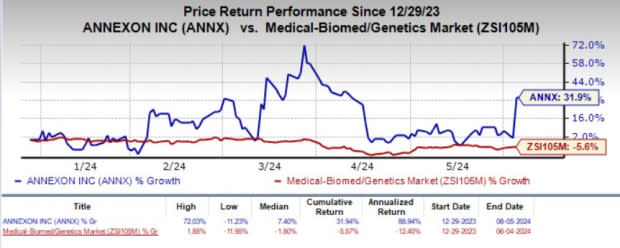

Year to date, shares of Annexon have climbed 31.9% against the industry’s 5.6% decline.

Image Source: Zacks Investment Research

Please note that the phase III GBS study enrolled 241 patients who were randomized to receive either a 30 mg/kg or a 75 mg/kg dose of ANX005. Although rapid and complete suppression of complement activity was observed upon treatment with both doses of the candidate, they differed in the duration of C1q inhibition. The 30 mg/kg dose suppression lasted one week and the 75 mg/kg dose suppression lasted two to three weeks.

Additionally, it was observed that the ANX005 75 mg/kg outperformed placebo on multiple endpoints. However, treatment with the higher dose failed to achieve statistical significance on the primary endpoint of GBS-DS at week 8.

Per ANNX, GBS is a rare neurological disorder that leads to more than 22,000 hospitalizations annually in the United States and EU. At present, there are no FDA-approved treatments for GBS. The current standard of care regimen is treatment with intravenous immunoglobulin.

Based on the favorable phase III results with the ANX005 30 mg/kg dose, Annexon has asserted one week of C1q inhibition as the optimal treatment window for GBS patients.

Both doses of ANX005 in the late-stage study were overall well-tolerated with no new safety signals identified. Most adverse events were mild to moderate in severity.

Based on feedback from the FDA, Annexon has also initiated a real-world evidence comparability protocol to establish comparability of the GBS patient population in its phase III study with patients from the International Guillain-Barré Syndrome Outcomes Study.

Data from this comparison cohort is expected in the first half of 2025, potentially supporting a regulatory filing for ANX005 for GBS.

ANX005 already enjoys the FDA’s Fast Track and Orphan Drug designations in the United States for the GBS indication. The candidate also enjoys the Orphan Drug designation in the EU for the same indication.

Earlier in January, Annexon announced that it has channeled its resources to prioritize three flagship development programs in its clinical-stage pipeline, such as ANX005 for GBS, ANX007 for geographic atrophy and first-in-kind oral complement small molecule and ANX1502 for several autoimmune indications.

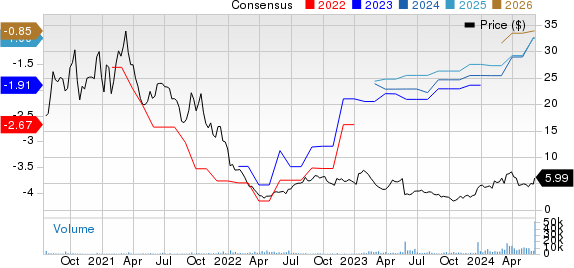

Annexon, Inc. Price and Consensus

Annexon, Inc. price-consensus-chart | Annexon, Inc. Quote

Zacks Rank and Other Stocks to Consider

Annexon currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the drug/biotech industry are ALX Oncology Holdings ALXO, Annovis Bio ANVS and Compugen CGEN, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73. Year to date, shares of ALXO have plunged 39.8%.

ALX Oncology beat estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share has narrowed from $2.93 to $2.46. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.83 to $1.95. Year to date, shares of ANVS have plunged 63.5%.

ANVS beat estimates in three of the trailing four quarters and missed once, delivering an average negative surprise of 1.39%.

In the past 30 days, the Zacks Consensus Estimate for Compugen’s 2024 earnings per share has increased from 2 cents to 5 cents. The consensus estimate for 2025 loss per share is currently pegged at 11 cents. Year to date, shares of CGEN have gained 10.6%.

CGEN’s earnings beat estimates in three of the trailing four quarters and missed once, delivering an average surprise of 5.79%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Compugen Ltd. (CGEN) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Annexon, Inc. (ANNX) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經