Ansys (ANSS) Shareholders Approve Acquisition by Synopsys

Ansys ANSS announced that its shareholders have voted to approve the proposed acquisition by Synopsys. The terms of the agreement outline that Ansys shareholders will receive $197 in cash along with 0.3450 shares of Synopsys common stock for each Ansys share.

Ansys added that about 98.7% of the shareholders voted in favor of the acquisition, which represented approximately 83.8% of the total outstanding shares of the company’s common stock. This deal, valued at approximately $35 billion, reflects an implied per-share consideration of $390.19 and represents a premium of about 29% over Ansys' closing stock price on Dec 21, 2023.

The deal is anticipated to close in the first half of 2025 and is subject to customary closing conditions, including receipt of outstanding regulatory approvals.

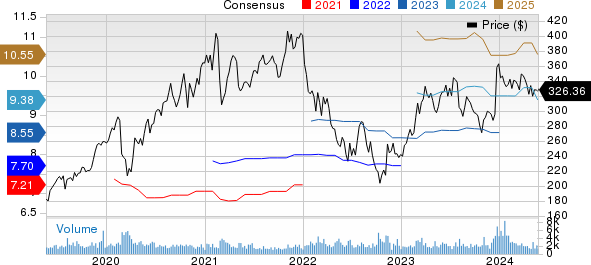

ANSYS, Inc. Price and Consensus

ANSYS, Inc. price-consensus-chart | ANSYS, Inc. Quote

Potential Synergies

The deal will give rise to a giant in the electronic design automation (EDA) software space as ANSS and SNPS have a market capitalization of $30 billion and $73.6 billion, respectively. Per a report from Grand View Research, the global electronic design automation software market size was valued at $11.10 billion in 2022 and is projected to witness a CAGR of 9.1% from 2023 to 2030.

The partnership between Synopsys' advanced semiconductor EDA and Ansys' simulation and analysis tools is set to revolutionize the silicon and systems design market. This collaboration addresses the growing need for improved computing performance and efficiency, driven by the increasing complexity of AI, the spread of silicon technology, and software-defined systems.

The collaboration aims to provide engineers with comprehensive, powerful, and system-focused solutions to meet the evolving needs of intelligent systems. This partnership also accelerates growth in key areas like Automotive, Aerospace, and Industrial sectors.

The merger is expected to increase Synopsys' total addressable market by 1.5 times, reaching around $28 billion, with an estimated annual growth rate of 11%. This growth is fueled by the convergence of electronics and physics across various industries.

In the first year after the merger, Synopsys anticipates its unlevered free cash flow margins will improve by about 75 basis points (bps) and its non-GAAP operating margin by around 125 bps. By the second year post-merger, the deal is expected to significantly boost non-GAAP earnings per share (EPS).

The combined company plans to rapidly reduce debt, aiming for a long-term leverage ratio of less than 1x. The merger is projected to yield significant cost and revenue synergies, with about $400 million in annual cost savings by the third year post-merger and $400 million in annual revenue synergies by the fourth year, potentially exceeding $1 billion annually in the long run.

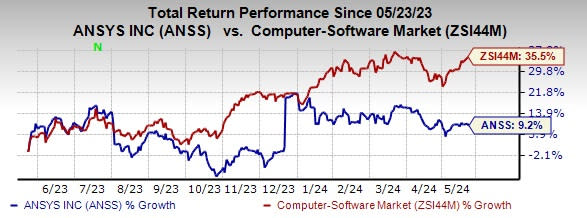

ANSS currently carries a Zacks Rank #4 (Sell). Shares of Ansys have gained 9.2% in the past year compared with the sub-industry’s growth of 35.5%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Woodward WWD, Arista Networks ANET and Super Micro Computer SMCI. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Woodward’s fiscal 2024 EPS has moved up 11.1% in the past 60 days to $5.86. WWD’s long-term earnings growth rate is 16.3%.

Woodward’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average surprise of 26.1%. WWD shares have risen 62% in the past year.

The Zacks Consensus Estimate for ANET’s 2024 EPS has increased 6.2% in the past 60 days to $7.92. ANET’s long-term earnings growth rate is 15.7%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average earnings surprise of 15.4%. Shares of ANET have gained 127.3% in the past year.

The Zacks Consensus Estimate for Super Micro Computer’s fiscal 2024 EPS has improved 8.3% in the past 60 days to $23.51. SMCI’s long-term earnings growth rate is 52.3%.

SMCI’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 6.9%. Shares of SMCI have risen 481% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

ANSYS, Inc. (ANSS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經