AptarGroup (ATR) Q1 Earnings Top Estimates, Revenues Rise Y/Y

AptarGroup, Inc. ATR reported first-quarter 2024 adjusted earnings per share of $1.26, beating the Zacks Consensus Estimate of $1.13. The bottom line increased 31% from 95 cents (including comparable exchange rates) in the year-ago quarter.

On a reported basis, earnings per share were $1.23 compared with the year-ago quarter’s 82 cents.

Total revenues increased 6.4% year over year to $915 million in the reported quarter. The top line surpassed the Zacks Consensus Estimate of $897 million. Core sales, excluding currency and acquisition effects, improved 5% year over year.

AptarGroup, Inc. Price, Consensus and EPS Surprise

AptarGroup, Inc. price-consensus-eps-surprise-chart | AptarGroup, Inc. Quote

Operational Update

Cost of sales increased 4.5% year over year to $583 million. Gross profit increased 9.9% year over year to $333 million. The gross margin was 36.3% in the reported quarter compared with the prior-year quarter’s 35.2%.

Selling, research, development and administrative expenses rose 3.3% year over year to $153 million. Adjusted operating income increased 21.3% year over year to $114.5 million. The adjusted operating margin was 12.5% in the reported quarter, up from the year-ago quarter’s 11%. Adjusted EBITDA increased 16.4% year over year to $179 million in the first quarter.

Segment Performances

Total revenues in the Pharma segment increased 14.4% year over year to $407 million. The reported figure missed our estimate of $431 million. Adjusted operating income in the quarter rose 20.8% year over year to $103 million. We predicted a quarterly adjusted operating income of $111.6 million.

Total revenues in the Beauty segment rose 0.3% year over year to $327 million. Our estimate for the segment’s revenues was $333 million. Operating income improved 17.6% year over year to $19.9 million in the first quarter. The reported figure missed our operating income prediction of $24 million.

Total revenues in the Closures segment increased 1.8% year over year to $181 million. We estimated revenues of $180 million for the quarter. Operating income was $13.6 million in first-quarter 2023, down from $13.9 million in the year-ago quarter. Our prediction for the quarter was $15.3 million.

Financial Performance

AptarGroup reported cash and cash equivalents of $200 million as of Mar 31, 2024, down from $224 million as of Dec 31, 2023. The company generated $92 million of cash flow from operations in the first quarter of 2024 compared with $98 million in the last year.

Outlook

AptarGroup estimates second-quarter 2024 adjusted earnings per share of $1.30-$1.38.

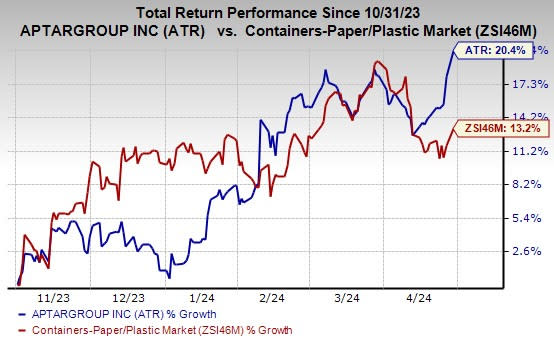

Price Performance

ATR shares have gained 20.4% in the past year compared with the industry’s rise of 13.2%.

Image Source: Zacks Investment Research

Zacks Rank

AptarGroup currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Peers

ATR belongs to the Containers - Paper and Packaging industry along with Greif, Inc. GEF, Packaging Corporation of America PKG and Graphic Packaging Holding Co. GPK. Let us take a look at AptarGroup peers' performances this earnings season.

Greif reported adjusted earnings per share of $1.27 for first-quarter fiscal 2024, beating the Zacks Consensus Estimate of 20 cents. The bottom line increased 20% year over year. Sales moved down 5.1% year over year to $1.20 billion due to lower volumes and average selling prices. However, the top line beat the Zacks Consensus Estimate of $1.19 billion.

Packaging Corp reported adjusted earnings per share of $1.72 in the first quarter of 2024, beating the Zacks Consensus Estimate of $1.63. The bottom line decreased 22% year over year. The figure was above the company’s guidance of $1.54. Sales in the first quarter rose 0.2% year over year to $1.98 billion. The top line surpassed the Zacks Consensus Estimate of $1.91 billion.

Graphic Packaging reported first-quarter 2024 adjusted earnings per share of 66 cents, beating the Zacks Consensus Estimate of 63 cents. The company’s earnings declined 14% from 77 cents in the year-ago quarter. Total revenues decreased 7.5% year over year to $2.26 billion in the reported quarter. The top line missed the Zacks Consensus Estimate of $2.39 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Packaging Corporation of America (PKG) : Free Stock Analysis Report

Graphic Packaging Holding Company (GPK) : Free Stock Analysis Report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經