Bear of the Day: Lovesac (LOVE)

The Lovesac Company LOVE is hoping to buck the trend of slower sales in the furniture industry in fiscal 2025. This Zacks Rank #5 (Strong Sell) is still expected to deliver double digit earnings growth this year.

Lovesac designs and manufactures furniture that it intends to last a lifetime. It's current product offering is made up of modular couches, called Sectionals, premium foam beanbag chairs called Sacs and their associated home decor accessories.

It sells primarily online through its web site but also has 116 retail showrooms.

A Miss in the Fiscal Fourth Quarter 2024

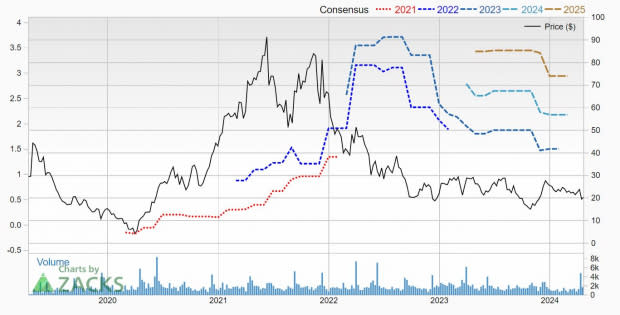

On Apr 11, 2024, Lovesac reported its fiscal fourth quarter and full year 2024 results. It missed on the Zacks Consensus, reporting $1.87 versus the Zacks Consensus of $1.93. It was a miss of $0.06.

While furniture sales industry-wide have fallen as home sales have fallen, Lovesac saw revenue grow 7.5% to $700.3 million, with the caveat that there was an additional week of sales in fiscal 2024.

The year was boosted by showroom net sales, which included kiosks and mobile concierges, which rose 9.8%. Internet net sales also increased, rising 13.2%. Only the "other" category fell. That primarily included pop-up-shops and shop-in-shops. Sales fell 17.5%.

Gross margin for the year rose 450 basis points to 57.3% from 52.8% a year ago.

Guided Below Consensus for Fiscal 2025

While the company is seeing better-than-expected demand, it guided for full year 2025 in the range of $1.06 to $1.59. This was below the Zacks Consensus.

Lovesac is a small cap company, with a market cap of just $315 million. It doesn't have a lot of analyst coverage on Zacks.com.

One estimate has been cut since the earnings report. That has pushed the Zacks Consensus Estimate down to $1.86 from $2.22.

That's still above the guidance range. It's also earnings growth of 28.3% in fiscal 2025 as the company made $1.45 last year.

1 estimate was also cut in the last 7 days for fiscal 2026. That pushed the Zacks Consensus down to $2.64 from $3.00. But it's still another 42.2% earnings growth.

Image Source: Zacks Investment Research

Shares Fall in 2024

Shares of Lovesac have fallen 22.7% year-to-date.

Image Source: Zacks Investment Research

It's cheap. It trades with a forward P/E of just 10.8. It also has a PEG ratio of just 0.3. A PEG under 1.0 usually indicates a company has growth and value.

But until the estimates start going the other way, which means up, investors might want to stay on the sidelines.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Lovesac Company (LOVE) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經