Billionaire tech founder ‘abused the trust’ of a colleague with an insider trading deal that made him $415K in profit, SEC alleges

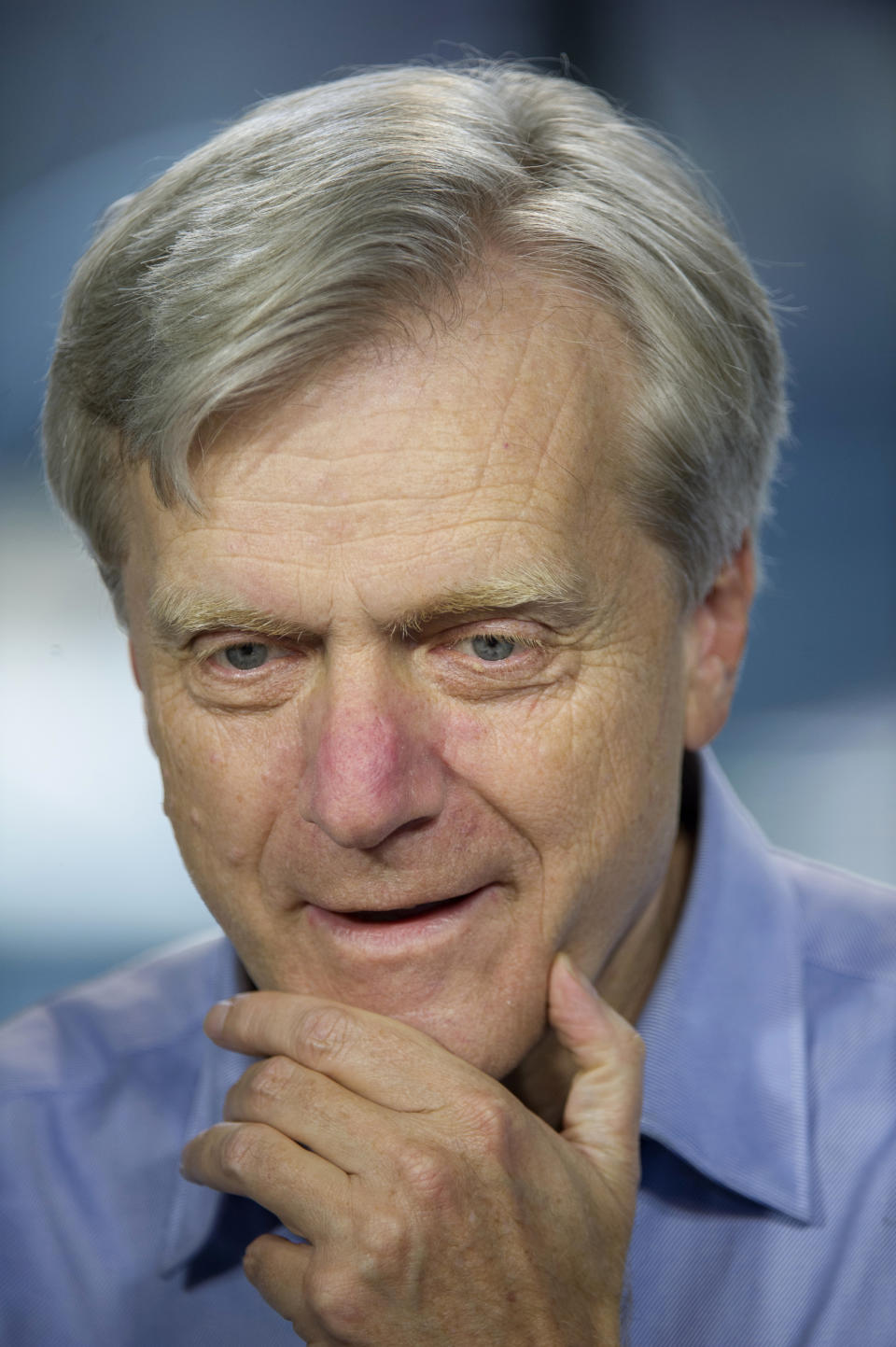

The Securities and Exchange Commission announced today it would bar Sun Microsystems co-founder and early Google investor Andreas “Andy” Bechtolsheim for allegedly improperly trading based on information he learned from a longtime business contact while he was bound by a non-disclosure agreement.

Bechtolsheim, 68, whose net worth is estimated to be around $18 billion, allegedly made $415,000 on the trades, according to the SEC. To settle the charges, Bechtolsheim, who lives in Nevada near Lake Tahoe, agreed to a five-year ban from serving as an officer or director and a civil penalty of $923,740, the SEC said. Bechtolsheim did not admit or deny the SEC’s findings.

Bechtolsheim is the founder and chief architect at Arista Networks, and is responsible for advanced AI, silicon and optics initiatives, according to the company’s website. He is known as a tech legend for having built a modular computer station while he was a doctoral student at Stanford University and he was an early-stage investor in Google and VMware. Arista said in a statement to Fortune today that his role at Arista is in a non-executive capacity and that it shifted in November 2023. The SEC’s complaint states that he resigned as chairman and chief development officer at Arista in December 2023.

“While the SEC announcement did not involve any trading in Arista securities, Arista takes compliance to the company's code of conduct and insider trading policy seriously,” said the Arista spokesperson. “Arista will respond appropriately to the situation.”

Bechtolsheim holds about 14% of Arista Networks either directly or through his family trust, according to a 2023 SEC filing.

According to the SEC’s complaint, Bechtolsheim heard on July 8, 2019 that Cisco Systems was on the cusp of buying high-speed communications products company Acacia Communications after a senior executive at a third, unnamed company contacted him to ask if the exec’s company should make a bid for Acacia. Bechtolsheim’s company and the tech company—and Bechtolsheim and the senior exec—were bound by an NDA, the SEC said.

Yet, that same day Bechtolsheim traded Acacia securities in a close relative’s brokerage account and the account of an associate just before the close of the market, the SEC said. The next morning before the market opened, Acacia and Cisco announced the acquisition, prompting a 35% jump in Acacia’s stock, the agency said. Bechtolsheim, by trading in the two accounts, made total profits of $415,726, the SEC claims. Cisco completed its $4.5 billion acquisition of Acacia in March 2021.

According to the SEC, Bechhtolsheim betrayed a longtime business colleague to make the profitable trades.

“We allege that Bechtolsheim, while serving as the chairman of a publicly traded company, abused the trust of a longtime business contact who had shared highly sensitive information about an imminent corporate acquisition,” said Joseph Sansone, chief of the SEC’s market abuse unit. “We will continue to pursue and prosecute misconduct by trusted insiders at all levels of the corporate hierarchy.”

The agency said Bechtolsheim knew “or was reckless in not knowing” that the information he heard about Acacia and any potential acquisition was material and non-public.

A court must approve the settlement.

This story was originally featured on Fortune.com

雅虎香港財經

雅虎香港財經