Boot Barn (BOOT) Stock Has Enough Reasons to Stay Invested

Boot Barn Holdings, Inc. BOOT has firmed its position in the retail landscape, demonstrating remarkable resilience and growth in a challenging operating environment. The company is outpacing the industry by leveraging a comprehensive growth strategy that includes aggressive store expansion, strong merchandise margin improvement and strategic use of AI.

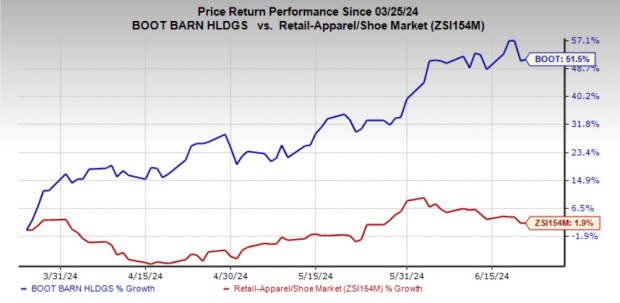

Shares of this Zacks Rank #3 (Hold) company have advanced 51.5% in the past three months compared with the industry's rise of 1.9%. The positive sentiment surrounding Boot Barn Holdings is reflected in the upward revisions of the Zacks Consensus Estimate for earnings per share. Over the past 30 days, analysts have increased the estimate for the current fiscal year by a couple of cents, now standing at $4.82 per share. The estimate for the next fiscal year has also risen by three cents to $5.80 per share.

Let’s Delve Deep

Boot Barn Holdings achieved a milestone in fiscal 2024, with its revenues reaching approximately $1.7 billion. This represents an astounding 100% increase over pre-pandemic levels from just four years ago. Such robust growth is a testament to the company’s ability to navigate and capitalize on market opportunities despite challenging market conditions.

A key driver of Boot Barn’s success is its store expansion strategy. In fiscal 2024 alone, the company opened 55 new stores, exceeding its initial plans. Over the past 12 years, Boot Barn has transformed from a regional retailer with 86 stores in eight states to a national brand with 400 stores across 45 states. The new stores have shown impressive first-year performance, generating a 60% cash-on-cash return on capital.

BOOT's focus on customer segmentation has yielded results. The introduction of artificial intelligence in both in-store and online interactions exemplifies the company’s commitment to enhancing customer experience, fostering brand loyalty and consequently driving sales.

Image Source: Zacks Investment Research

A pivotal aspect of Boot Barn Holdings’ success lies in its exclusive brand penetration, which increased 370 basis points to 37.7% for the full year. This strategic move not only enriches product offerings but also significantly boosts the company's margin profile.

The company’s full-year merchandise margin grew by 160 basis points, driven by a 120-basis point improvement in freight and a 40-basis point increase in the product margin. This growth was attributed to the increased penetration of exclusive brands and buying economies of scale, showcasing the company’s effective cost management and pricing strategies. For the fourth quarter alone, the merchandise margin expanded by 160 basis points due to supply chain efficiencies and improved freight expenses.

For fiscal 2025, Boot Barn Holdings guided total sales between $1.766 billion and $1.800 billion, suggesting growth of 5.9% to 8% over fiscal 2024. The company plans to continue its aggressive expansion, adding 60 new stores and maintaining a steady pace of 15% new unit growth annually. This ambitious growth strategy is supported by strong financial fundamentals and strategic initiatives aimed at enhancing profitability and market share.

Wrapping Up

With an expanding store network, a growing and loyal customer base and a focus on high-margin exclusive brands, Boot Barn Holdings stands poised for sustained growth. The stock provides ample reasons for investors to stay invested.

3 Stocks Looking Hot

Here, we have highlighted some better-ranked stocks, namely Abercrombie & Fitch ANF, The Gap Inc. GPS and DICK'S Sporting Goods DKS.

Abercrombie & Fitch, a leading, global, omnichannel specialty retailer of apparel and accessories for men, women and kids, sports a Zacks Rank #1 (Strong Buy). The company delivered a trailing four-quarter earnings surprise of 210.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current financial-year sales and EPS implies growth of 10.4% and 47.3%, respectively, from the year-ago reported figure.

Gap, one of the largest specialty apparel companies, currently sports a Zacks Rank #1. GPS has a trailing four-quarter earnings surprise of 202.7%, on average.

The Zacks Consensus Estimate for Gap’s current financial-year sales and earnings per share suggests a rise of 0.2% and 21.7%, respectively, from the year-earlier levels.

DICK'S Sporting is the largest U.S.-based full-line omnichannel sporting goods retailer. It currently carries a Zacks Rank #2 (Buy). DKS has a trailing four-quarter earnings surprise of 4.7%, on average.

The Zacks Consensus Estimate for DICK’S Sporting current fiscal-year sales and earnings calls for an improvement of 1.8% and 6.6%, respectively, from the prior-year numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經