Boston Scientific (BSX) Rides on Emerging Markets, MedSurg

Boston Scientific BSX is gaining traction in the emerging markets. New regulatory approvals bode well for the company’s growth. The stock carries a Zacks Rank #2 (Buy) currently.

Boston Scientific continues to expand operations across different geographies outside the United States. In 2023, 41% of the company’s consolidated revenues came from international regions.

Within its international regions, the company is putting additional efforts to expand its foothold in the emerging markets (defined as all countries except the United States, Western and Central Europe, Japan, Australia, New Zealand and Canada), which hold strong growth potential based on their economic conditions, healthcare sectors and global capabilities. In the first quarter of 2024, despite geopolitical weaknesses, emerging markets registered sturdy growth, primarily driven by continued broad-based momentum across the company’s business and investment in this region.

In Europe, the Middle East and Africa (EMEA) too, Boston Scientific is successfully expanding its base, banking on its diverse portfolio, new launches and commercial execution with healthy underlying market demand. In the first quarter, EMEA sales grew 13.3% year over year on an operational basis, with robust performance in Electrophysiology (EP) as well as double-digit growth in Endoscopy, Urology and PI businesses.

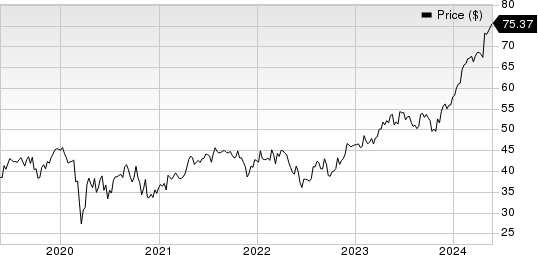

Boston Scientific Corporation Price

Boston Scientific Corporation price | Boston Scientific Corporation Quote

Boston Scientific is consistently gaining market share within its MedSurg segment. The Endoscopy business within MedSurg is gaining from strong worldwide demand for its broad range of gastrointestinal (GI) and pulmonary treatment options. In the first quarter of 2024, the company reported strong organic growth from single-use imaging and AXIOS technologies. Within Urology, Boston Scientific continues to expand its market share globally. In the first quarter, Rezum performed well across all regions and secured reimbursement status in France. Boston Scientific currently looks forward to completing the previously announced acquisition of Axonics in the second half of 2024.

Within Neuromodulation, Boston Scientific’s pain business is consistently gaining traction. It relies on the strength of spinal cord stimulation (SCS), driven by its innovative Alpha portfolio with fast therapy in a cognitive suite of digital tools supporting patient activation. Among the recent developments, the company received FDA approval for an expanded indication of the WaveWriter SCS Systems for people with non-surgical back pain.

On the flip side, the industry-wide trend of difficult macroeconomic conditions in the form of geopolitical pressure leading to disruptions in economic activity, global supply chains and labor markets is creating a challenging business environment for Boston Scientific. International conflicts, including the Russia-Ukraine war and tension between China and Taiwan, have increased cybersecurity risks on a global basis. Further, volatile financial market dynamics and significant volatility in price and availability of goods and services are putting pressure on Boston Scientific’s profitability. With the sustained macroeconomic pressures, the company may struggle to keep its operating expenses in check.

In the first quarter of 2024, the company reported a 16.3% rise in the cost of products sold, resulting in to 67 basis points contraction in gross margin. Further, there was a 12.3% rise in selling, general and administrative expenses.

Other Key Picks

Some other top-ranked stocks in the broader medical space are Hims & Hers Health HIMS, ResMed RMD and Medpace MEDP. Each of them sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks Rank #1 stocks here.

Hims & Hers Heath stock has rallied 84.8% in the past year. Earnings estimates for the company have risen from 10 cents to 18 cents for 2024 and from 23 cents to 32 cents for 2025 in the past 30 days.

HIMS earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. In the last reported quarter, it posted an earnings surprise of a staggering 150%.

Estimates for ResMed’s fiscal 2024 earnings per share have moved to $7.64 from $7.43 in the past 30 days. Shares of the company have decreased 3.2% in the past year compared with the industry’s fall of 1.3%.

RMD’s earnings surpassed estimates in three of the trailing four quarters and missed in one, the average surprise being 2.8%. In the last reported quarter, it delivered an earnings surprise of 10.9%.

Estimates for Medpace’s 2024 earnings per share have moved up to $11.29 from $10.53 in the past 30 days. Shares of the company have surged 87.6% in the past year compared with the industry’s 5% growth.

MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.8%. In the last reported quarter, it delivered an earnings surprise of 30.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經