Candel (CADL) Up on Upbeat Data From Pancreatic Cancer Study

Candel Therapeutics, Inc.’s CADL shares skyrocketed 280.9% on Apr 5, after the company announced positive interim data from the phase II study evaluating its lead candidate, CAN-2409 plus valacyclovir (prodrug), together with standard of care (SoC) chemoradiation, followed by resection for borderline resectable pancreatic ductal adenocarcinoma (PDAC).

The updated interim data from the ongoing phase II study showed that experimental treatment with CAN-2409 led to notable improvements in estimated median overall survival of 28.8 months compared with only 12.5 months in the control group in borderline resectable PDAC.

Patients treated with CAN-2409 had a survival rate of 71.4% versus only 16.7% in the control group after chemoradiation at 24 months of treatment. Moreover, the survival rate was 47.6% for patients treated with CAN-2409 compared with a mere 16.7% in the control group at 36 months.

Per the company, adding the CAN-2409 regimen to SoC was generally well tolerated while no new safety signals were observed. No cases of pancreatitis and dose-limiting toxicities were reported either.

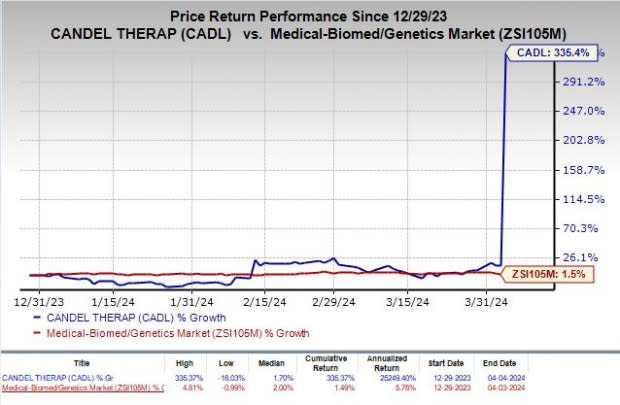

Shares of Candel have skyrocketed 335.4% year to date compared with the industry’s growth of 1.5%.

Image Source: Zacks Investment Research

The above-mentioned survival data were updated with eight months of further follow-up since the first analysis, which was presented in 2023 at the annual meeting of the Society for Immunotherapy.

The FDA granted Fast Track designation to CAN-2409 plus prodrug (valacyclovir) for the treatment of PDAC in December 2023.

If successfully developed and a potential approval for CAN-2409 could present a significant commercial opportunity for Candel, given the frequent recurrence and short survival with SoC chemotherapy for non-metastatic PDAC, there remains a high unmet medical need for effective new treatments for PDAC.

Apart from pancreatic cancer, CADL expects key data readouts for CAN-2409 in non-small cell lung cancer later in the second quarter of 2024, while top-line data in prostate cancer is expected in the fourth quarter of 2024.

In the absence of a marketed product, the successful development of its pipeline candidates remains the key focus for this clinical-stage biopharmaceutical company.

Zacks Rank & Stocks to Consider

Candel currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are ADMA Biologics, Inc. ADMA, Ligand Pharmaceuticals Incorporated LGND and ANI Pharmaceuticals, Inc. ANIP, each flaunting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share have improved from 22 cents to 30 cents. Year to date, shares of ADMA have rallied 38.9%.

ADMA’s earnings beat estimates in three of the trailing four quarters and met the same once, the average surprise being 85.00%.

In the past 60 days, estimates for Ligand’s 2024 earnings per share have improved from $4.42 to $4.56. Year to date, shares of LGND have gained 9.2%.

Earnings of LGND beat estimates in each of the trailing four quarters, the average surprise being 84.81%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share have improved from $4.06 to $4.43. Year to date, shares of ANIP have rallied 23.2%.

Earnings of ANIP beat estimates in each of the trailing four quarters, the average surprise being 109.06%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Candel Therapeutics, Inc. (CADL) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經