DaVita (DVA) Hits 52-Week High: What's Aiding the Stock?

Shares of DaVita Inc. DVA scaled a new 52-week high of $147.93 on May 30 before closing the session marginally lower at $147.14.

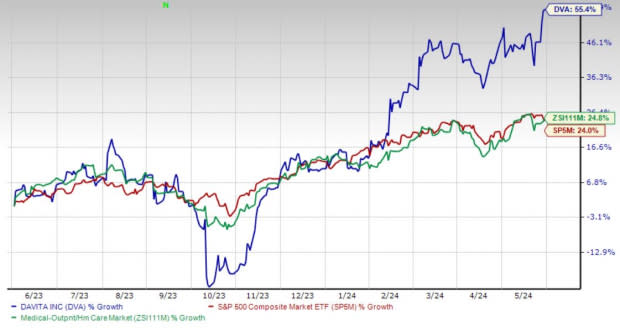

Over the past year, this Zacks Rank #2 (Buy) stock has gained 55.4% compared with the industry’s 24.8% rise and the S&P 500’s 23.9% growth.

Over the past five years, the company registered earnings growth of 15.5% while the industry recorded a 4.2% rise. Its long-term expected growth rate is 13.6% compared with the industry’s projection of 12.5%. DaVita’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 29.4%.

DaVita is witnessing an upward trend in its stock price, prompted by its business model. The optimism led by a solid first-quarter 2024 performance and the acquisition of dialysis centers is expected to contribute further. However, concerns regarding dependence on commercial payers and macroeconomic challenges persist.

Image Source: Zacks Investment Research

Let’s delve deeper.

Key Growth Drivers

Strong Q1 Results: DaVita’s solid first-quarter 2024 results buoy optimism. The company registered an uptick in overall top-line and bottom-line numbers. Strength in both dialysis patient service and Other revenues during the period was also seen. The expansion of both margins bodes well for the stock.

Business Model: Investors are optimistic about DaVita’s patient-centric care model, which leverages its platform of kidney care services to maximize patient choice in both models and modalities of care. Value-based arrangements are proliferating in the kidney health space. These arrangements allow for a much larger degree of collaboration between nephrologists, providers and transplant programs, resulting in a more complete understanding of each patient’s clinical needs. Per management, this is expected to lead to better care coordination and earlier intervention.

Acquisition of Dialysis Centers: Acquiring dialysis centers and businesses that own and operate dialysis centers as well as other ancillary services is DaVita’s preferred business strategy. These strategies have boosted the company’s top line to a large extent, raising investors’ optimism.

As of Mar 31, 2024, DaVita provided dialysis services to around 258,600 patients at 3,092 outpatient dialysis centers, of which 2,665 were in the United States while 427 were located across 12 other countries. In the first quarter of 2024, the company acquired and opened a total of 11 dialysis centers in the United States. It also acquired 67 dialysis centers and opened two dialysis centers outside the United States in the same period.

Downsides

Dependence on Commercial Payers: A significant portion of DaVita’s dialysis and related lab services revenues are generated from patients who have commercial payers as the primary payers. The payments received from commercial payers are the primary generators of profit. However, there remains a risk of people shifting from commercial insurance schemes to government schemes due to the wide disparity in payment rates in case of a rise in unemployment.

Macroeconomic Concerns: DaVita's business is significantly affected by various global economic and market conditions. These include challenges from the COVID-19 pandemic, inflation, rising interest rates, labor market difficulties and supply-chain disruptions. The ongoing conflict between Russia and Ukraine exacerbates these issues, contributing to widespread uncertainty and volatility.

Other Key Picks

A few other top-ranked stocks in the broader medical space are HealthEquity, Inc. HQY, Boston Scientific Corporation BSX and Ecolab Inc. ECL.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 32.3%. HQY’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 17.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

HealthEquity’s shares have rallied 42.2% compared with the industry’s 3.2% rise in the past year.

Boston Scientific, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.5%. BSX’s earnings surpassed estimates in each of the trailing four quarters, with the average being 7.5%.

Boston Scientific has advanced 45.6% compared with the industry’s 2.3% growth in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 14.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.3%.

Ecolab’s shares have rallied 35.2% against the industry’s 8.6% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經