Dividend Watch: 3 Companies Boosting Payouts

Everybody loves dividends, as they provide a passive income stream, limit drawdowns in other positions, and provide more than one way to profit from an investment.

Recently, several companies, including Taiwan Semiconductor Manufacturing TSM, PACCAR PCAR, and PepsiCo PEP, have announced a boost to their quarterly payouts. For those interested in income, let’s take a closer look at each.

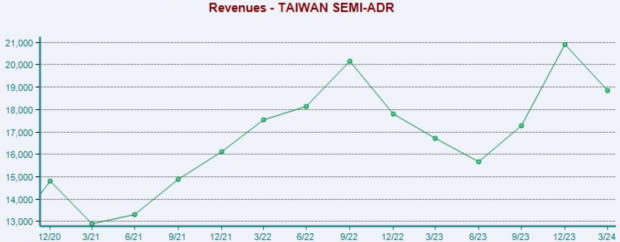

Taiwan Semiconductor

TSM posted better-than-expected results in its latest release, exceeding the Zacks Consensus EPS estimate by nearly 7% and posting sales 2.7% ahead of expectations. Earnings grew 5% year-over-year, whereas revenue jumped 13% from the year-ago period.

Image Source: Zacks Investment Research

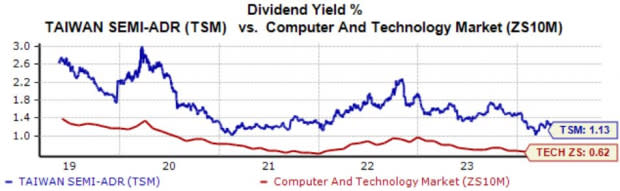

The company announced a 10% boost to its payout, bringing the quarterly total to $0.45/share. TSM’s commitment to increasingly rewarding shareholders has kept it a favorite among income-focused investors seeking technology exposure.

Shares currently yield 1.1% annually, nicely above the Zacks Computer & Technology sector average.

Image Source: Zacks Investment Research

TSM shares have been notable outperformers in 2024 on the back of the semiconductor trade, up nearly 50% and crushing the S&P 500.

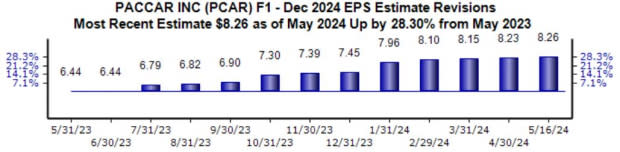

PACCAR

PACCAR is a leading manufacturer of heavy-duty trucks worldwide, with substantial manufacturing exposure to light/medium trucks. The company recently announced an 11% boost to its payout, bringing the quarterly total to $0.30/share.

The earnings estimate revisions trend has been considerably bullish for its current fiscal year (FY24), up nearly 30% to $8.26 per share over the last year. Growth is expected to cool in FY24, with earnings forecasted to see a decline before resuming growth in FY25.

Image Source: Zacks Investment Research

The company’s quarterly results have consistently beat our expectations as of late, exceeding the Zacks Consensus EPS estimate by an average of 12% across its last four releases.

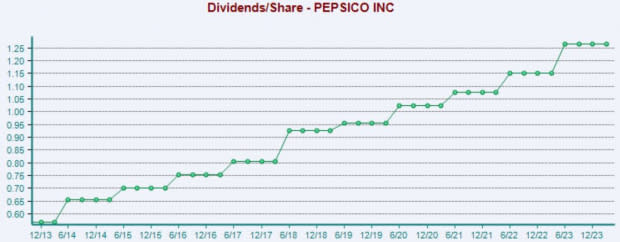

PepsiCo

PepsiCo, a current Zacks Rank #2 (Buy), manufactures, markets, and distributes grain-based snack foods, beverages, and other products. The company upped its quarterly payout by 7%, bringing the total to $1.35/share.

The company has long been a favorite among income-focused investors, holding the ranks of a Dividend Aristocrat.

Image Source: Zacks Investment Research

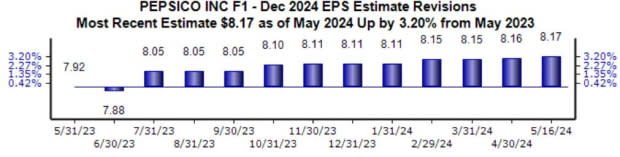

The earnings estimate revisions trend has been considerably bullish for its current fiscal year, up 3% to $8.17 per share over the last year and suggesting 7% year-over-year growth. Better-than-expected quarterly results have kept analysts positive, with the company exceeding the Zacks Consensus EPS estimate by an average of 5% across its last four releases.

Image Source: Zacks Investment Research

Bottom Line

Targeting dividend-paying stocks is an excellent strategy that investors can deploy.

Dividends soften the blow from drawdowns in other positions, provide more than one way to reap a return from an investment, and allow maximum returns through dividend reinvestment.

And all three companies above – Taiwan Semiconductor Manufacturing TSM, PACCAR PCAR, and PepsiCo PEP – have recently boosted their payouts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經