Does ServiceNow's (NOW) AI Prowess Make the Stock a Buy?

ServiceNow’s NOW workflow solutions have been getting adopted by enterprises undergoing digital transformation. NOW’s initiatives to expand AI-powered capabilities in its portfolio have been a game changer in this regard.

NOW is extensively leveraging AI and machine learning technologies to boost the potency of its solutions. The enhanced capabilities are helping it to rapidly expand its footprint in the insurTech, strategic portfolio management, cloud management, talent development and public sector domains.

Innovative Portfolio Driving NOW’s Clientele

IDC expects worldwide spending on AI solutions to grow to more than $500 billion by 2027. ServiceNow’s innovative portfolio and expanding Generative AI (GenAI) capabilities make it well-positioned to benefit from this trend. Its total addressable market is expected to hit $275 billion in 2026, driven by GenAI.

NOW’s Prospects Bright On Rising TAM

Image Source: ServiceNow

Through its Washington, D.C. platform update, ServiceNow introduced a host of cutting-edge features aimed at streamlining operations, enhancing productivity and advancing the adoption of GenAI across various sectors.

In May, it unveiled new AI capabilities to foster talent development. Solutions like Now Assist for HR Service Delivery use GenAI to answer and act on questions related to talent development. Its Digital End-User Experience solution helps improve employee productivity and satisfaction while reducing costs.

NOW has added enhancements to Contracts Management Pro, Security Operations and Field Service Management solutions. The new ServiceNow Project RaptorDB provides businesses with the speed and flexibility needed to thrive in the modern AI-driven landscape.

The innovative AI-powered portfolio is helping NOW rapidly expand its clientele. ServiceNow ended the first quarter of 2024 with 1933 total customers with more than $1 million in annual contract value (ACV).

GenAI deals continued to gain traction with record-breaking net new ACV for Pro Plus, making it the fastest-selling product in ServiceNow’s history in the first quarter of 2024. Gen AI products were in seven of the company’s top 10 deals, and NOW closed seven deals over $1 million in ACV in the reported quarter.

Strong Partner Base Aids NOW Stock's Prospect

A strong partner base that includes the likes of Microsoft MSFT, NVIDIA NVDA, International Business Machines IBM, Infosys and Equinix is strengthening NOW’s AI capabilities.

ServiceNow has expanded its collaboration with Microsoft. The new ServiceNow Now Assist and Microsoft Copilot integration brings the power of two GenAI assistants into one seamless enterprise experience, making it easier to create value for enterprise workers and for employees to unlock new productivity avenues.

ServiceNow unveiled AI avatars leveraging NVIDIA’s Avatar Cloud Engine speech, large language model (LLM), and animation technologies that bring digital characters to life using generative AI.

NOW and IBM are combining the Now Platform with IBM watsonx to boost productivity for mutual customers and partners. ServiceNow will also incorporate watsonx.ai and IBM Granite foundation LLMs into its Now Assist GenAI experience for ServiceNow customers.

ServiceNow's 2024 Estimate Revisions Positive

For 2024, ServiceNow expects subscription revenues to be $10.56-$10.575 billion (up $20 million from the previous guidance), which suggests a rise between 21.5% and 22% from 2023 on a GAAP basis. At constant currency, subscription revenues are expected to grow 21.5% over 2023.

ServiceNow expects the non-GAAP subscription gross margin to be 84.5% and the non-GAAP operating margin to be 29%. Moreover, the free cash flow margin is expected to be 31%.

The Zacks Consensus Estimate for 2024 revenues is pegged at $10.88 billion, indicating 21.31% growth year over year. The consensus for earnings is pegged at $13.51 per share, up 2.03% over the past 30 days and indicating a 25.32% year-over-year increase.

Conclusion

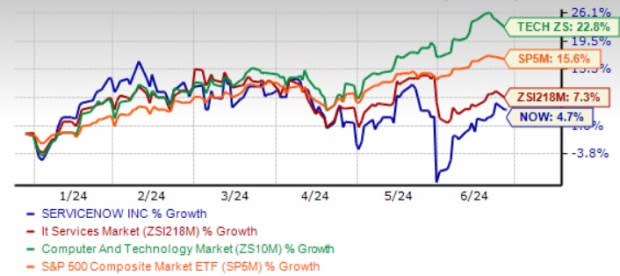

ServiceNow shares have returned 4.7% year to date, underperforming the Zacks Computer & Technology sector’s gain of 22.8% and the S&P 500’s 15.6%. It has been suffering from challenging macroeconomic conditions including persistent inflation that has led to lengthening in deal closure timings. The Value Style Score of F also suggests stretched valuation in the near term.

NOW Underperforms Industry

Image Source: Zacks Investment Research

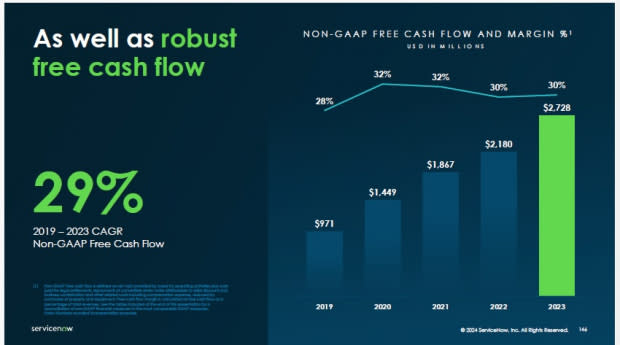

Nevertheless, ServiceNow’s innovative portfolio and expanding GenAI offerings are expected to help it continue winning customers. A strong liquidity position with a cash balance of $8.8 billion and robust free cash flow generating ability ($3.3 billion estimated in 2024 compared with $2.7 billion reported in 2023) make the stock an attractive pick.

NOW’s FCF To RISE Y/Y

Image Source: ServiceNow

This Zacks Rank #2 (Buy) stock has a Growth Style Score of A, a favorable combination that offers a strong investment opportunity, per the Zacks Proprietary methodology. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經