Eaton (ETN) Rewards Shareholders With 9% Dividend Increase

Eaton Corporation plc. ETN announced that its board of directors has approved an increase in quarterly dividend rate to 94 cents or 9% over its last figure. The revised quarterly dividend will be payable on Mar 29, 2024, to shareholders of record at the close of business on Mar 11, 2024.

The new annualized payout amounts to $3.76 per share and the current annualized dividend yield is 1.3%, higher than the industry average of 0.6%. The increase in distributable income speaks for the company’s successfully executed investment growth strategy.

Can the Company Sustain the Dividend Increase?

There is no surety that a company paying dividend in this quarter will continue to pay dividend in the next. Yet, the initiatives undertaken by a firm to improve operation and profits indicate whether it can sustain the shareholder friendly initiatives in the future.

Eaton presently operates high quality assets and expects organic growth in the range of 6.5-8.5% in 2024. It is consistently investing in research and development to improve existing products and innovate new ones. These initiatives will allow the company to gain a higher market share in its product segments.

ETN is also expanding its operations through the acquisition and transformation of existing business operations. Management has invested more than $8 billion in transformative portfolio management and will be able to focus on the remaining businesses that will allow it to further improve earnings in the long run.

It continues to generate a stable cash inflow through proficient handling of operating activities. Courtesy of its stable cash flow, ETN has been increasing shareholder value through dividend payments and share repurchases.

Long History of Dividend Payments

Eaton has distributed dividends each year since 1923. However, it is not the only company having a long legacy of dividend payment.

Companies like Consolidated Edison, Inc. ED, UGI Corporation UGI and The York Water Company YORW are also rewarding their shareholders with dividend payments for more than 100 years without fail.

The current dividend yields of ED, UGI and YORW are pegged at 3.8%, 6.1% and 2.4%, respectively.

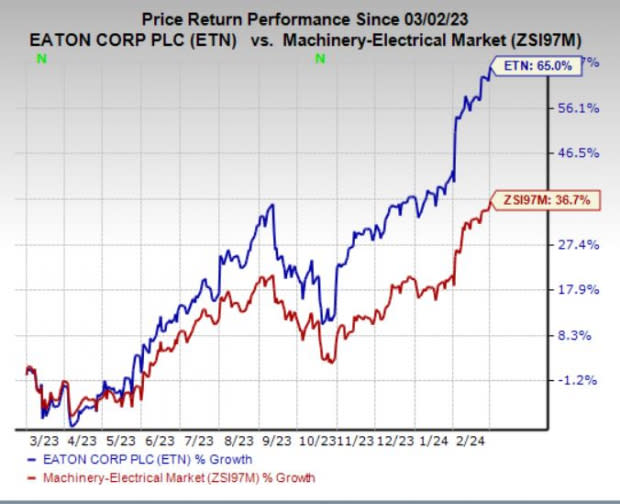

Price Performance

In the past 12 months, shares of Eaton have gained 65%, outperforming the industry’s growth of 36.7%.

Image Source: Zacks Investment Research

Zacks Rank

The company currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

The York Water Company (YORW) : Free Stock Analysis Report

UGI Corporation (UGI) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經