Entergy's (ETR) Q1 Earnings Lag Estimates, Revenues Drop Y/Y

Entergy Corporation ETR reported first-quarter 2024 adjusted earnings of $1.08 per share, which missed the Zacks Consensus Estimate of $1.44 per share by 25%. The bottom line also came in lower than the company’s prior-year quarter’s reported earnings of $1.14 per share by 5.3%.

The company reported GAAP earnings per share of 35 cents, down significantly from the year-ago quarter’s level of $1.47 per share.

Q1 Revenues

Entergy reported revenues of $2.79 billion, which missed the Zacks Consensus Estimate of $3.18 billion by 12%. The figure also declined 6.3% from the $2.98 billion reported in the year-ago quarter due to lower revenues from all of its segments.

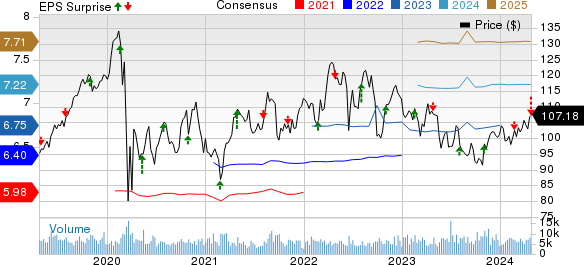

Entergy Corporation Price, Consensus and EPS Surprise

Entergy Corporation price-consensus-eps-surprise-chart | Entergy Corporation Quote

Segmental Results

Utility: The segment’s quarterly earnings were 91 cents per share compared with $1.87 in the prior-year quarter.

Parent & Other: The segment reported a loss of 56 cents per share compared with the year-ago quarter’s loss of 41 cents.

Highlights of the Release

Operating expenses totaled $2.56 billion, up 1.5% from $2.51 billion recorded in the prior-year quarter.

The operating income amounted to $238 million, down 48.5% from $462.1 million registered in the year-ago period.

Total interest expenses were $267.2 million, up 8.7% from $245.7 million reported in the comparable period of 2022.

As of Mar 31, 2024, the total retail customers served by the company increased 0.7% to 3.01 million.

Financial Highlights

As of Mar 31, 2024, Entergy had cash and cash equivalents of $1.29 billion compared with $132.5 million as of Dec 31, 2023.

Long-term debt totaled $24.31 billion as of Mar 31, 2024 compared with $23.01 billion as of Dec 31, 2023.

As of Mar 31, 2024, ETR generated cash from operating activities of $521.1 million compared with $959.5 million in the year-ago period.

Guidance

Entergy’s financial guidance for 2024 remains unchanged. The company still expects to generate adjusted earnings in the range of $7.05-$7.35 per share. The Zacks Consensus Estimate for ETR’s 2024 earnings is currently pegged at $7.22 per share, which is above the midpoint of the company’s guided range.

Zacks Rank

Entergy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Utility Releases

Alliant Energy Corporation LNT is slated to report first-quarter 2024 results on May 2 before market open. The Zacks Consensus Estimate for LNT’s first-quarter earnings is pegged at 66 cents per share, which suggests growth of 1.5% from the prior year quarter’s reported figure.

The Zacks Consensus Estimate for LNT’s first-quarter sales is pegged at $1.17 billion, which indicates an improvement of 8.3% from the prior year quarter’s reported figure.

FirstEnergy FE is slated to report first-quarter 2024 results on Apr 25 after market close. The Zacks Consensus Estimate for FE’s first-quarter earnings is pegged at 54 cents per share, which calls for a decline of 10% from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for FE’s first-quarter sales is pegged at $3.36 billion, which indicates an improvement of 3.9% from the prior-year quarter’s reported figure.

PPL Corporation PPL is slated to report first-quarter 2024 results on May 1 before market open. The Zacks Consensus Estimate for PPL’s first-quarter earnings is pegged at 53 cents per share, which suggests growth of 10.4% from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for PPL’s first-quarter sales is pegged at $2.48 billion, which implies an improvement of 2.6% from the prior-year quarter’s reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPL Corporation (PPL) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經