Exploring Jiangxi Hongcheng EnvironmentLtd And Two More Top Dividend Stocks

As global markets respond to easing inflation and interest rate adjustments, China's market presents a unique landscape, particularly after the government's significant measures to stabilize its property sector. In this context, exploring dividend stocks like Jiangxi Hongcheng Environment Ltd offers an intriguing opportunity for investors looking for yield in a market ripe with governmental interventions aimed at economic stabilization.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.03% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.41% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.27% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.30% | ★★★★★★ |

Jiangsu Yanghe Brewery (SZSE:002304) | 4.77% | ★★★★★★ |

Changchun High-Tech Industry (Group) (SZSE:000661) | 3.90% | ★★★★★★ |

Shenzhen Fuanna Bedding and FurnishingLtd (SZSE:002327) | 5.42% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.41% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.57% | ★★★★★★ |

Click here to see the full list of 178 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

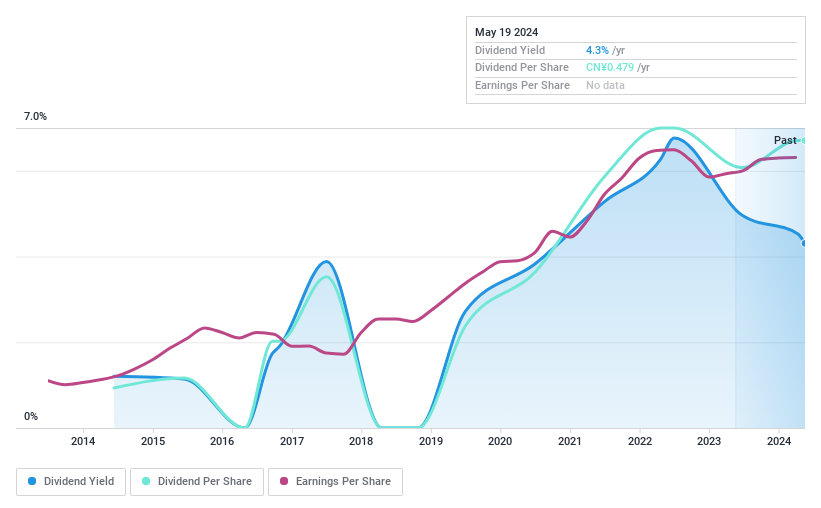

Jiangxi Hongcheng EnvironmentLtd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangxi Hongcheng Environment Co., Ltd. specializes in the production and supply of tap water in China, with a market capitalization of approximately CN¥13.64 billion.

Operations: Jiangxi Hongcheng Environment Co., Ltd. generates its revenue primarily from the production and supply of tap water in China.

Dividend Yield: 4.3%

Jiangxi Hongcheng EnvironmentLtd has shown a revenue increase to CNY 2.15 billion in Q1 2024 from CNY 2.07 billion the previous year, with net income also rising to CNY 323.24 million. Despite a Price-To-Earnings ratio of 12.3x, below the Chinese market average, dividend reliability remains a concern due to historical volatility and insufficient coverage by cash flow, evidenced by a high cash payout ratio of 57.40%. Furthermore, recent acquisition activity could impact financial stability, as seen with Nanchang Water Industry Group's purchase of an additional stake for CNY320 million.

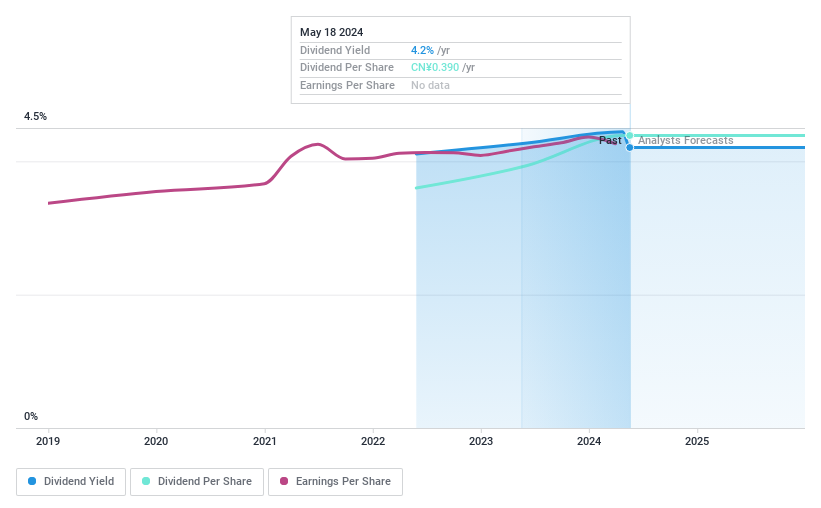

Zhejiang Publishing & Media

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Publishing & Media Co., Ltd. operates in the publishing, distribution, and printing sectors within China, with a market capitalization of approximately CN¥20.60 billion.

Operations: Zhejiang Publishing & Media Co., Ltd. generates its revenue primarily from publishing, distribution, and printing activities in China.

Dividend Yield: 4.2%

Zhejiang Publishing & Media Co., Ltd. offers a dividend yield of 4.21%, ranking in the top 25% of Chinese dividend payers. Despite its reasonable valuation with a Price-To-Earnings ratio of 14x, concerns linger about its short dividend history and future earnings, projected to decline by an average of 7.1% annually over the next three years. Recent financials show a slight increase in quarterly revenue to CNY 2,703.33 million but a drop in net income from CNY 145.73 million to CNY 110.4 million year-over-year.

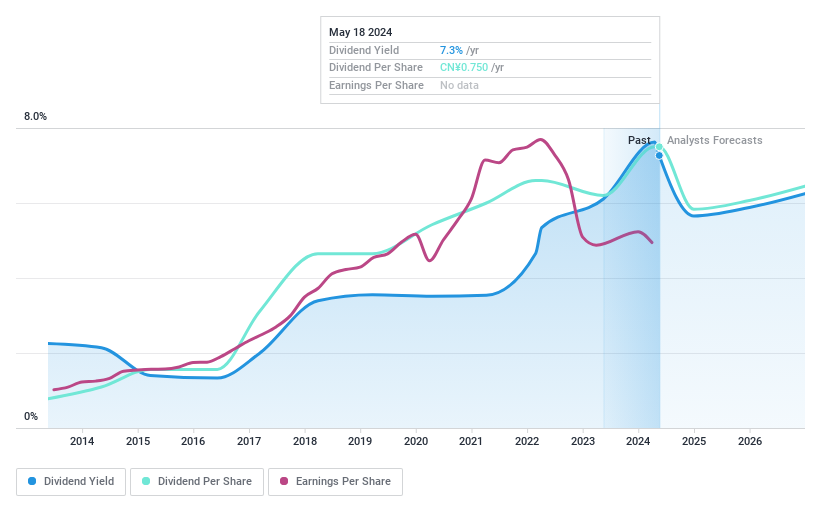

Zhejiang Meida Industrial

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Meida Industrial Co., Ltd. is a Chinese company specializing in the research, development, manufacturing, and sales of household kitchen appliances, particularly integrated stoves, with a market capitalization of approximately CN¥6.67 billion.

Operations: Zhejiang Meida Industrial Co., Ltd. primarily generates its revenue from the sale of integrated stove products in China.

Dividend Yield: 7.3%

Zhejiang Meida Industrial boasts a high dividend yield of 7.27%, placing it among the top 25% of dividend payers in the Chinese market. However, its dividends are not well supported, with a payout ratio of 110.3% and a cash payout ratio of 101.9%, indicating payments are not adequately covered by earnings or cash flows. While dividends have been stable and growing over the past decade, recent financials reveal a decline in quarterly sales and net income as of March 2024, suggesting potential pressure on future payouts.

Next Steps

Gain an insight into the universe of 178 Top Dividend Stocks by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:600461 SHSE:601921 and SZSE:002677.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

雅虎香港財經

雅虎香港財經