Guess? (GES) Q1 Loss Narrower Than Expected, Revenues Up Y/Y

Guess? Inc. GES reported first-quarter fiscal 2025 results, wherein the top line increased year over year and surpassed the Zacks Consensus Estimate. While the bottom line fared better than the Zacks Consensus Estimate, it declined from the prior year.

Revenues benefited from solid brand momentum globally and strong customer response to its diversified portfolio. Management remains optimistic about its robust global platform, which will facilitate strong revenue growth and margin performance in the upcoming quarters.

Management remains positive about the new fiscal, wherein it expects to surpass $3 billion in revenues for the first time, supported by an impressive growth plan for its core business. Moving ahead, the company completed the previously announced acquisition of the New York-based fashion brand rag & bone and is optimistic to derive benefits from this acquisition.

Results in Detail

Guess? reported adjusted loss of 27 cents per share that fared better than the Zacks Consensus Estimate of a loss of 39 cents. However, the bottom line deteriorated from an adjusted loss of 7 cents per share in the year-ago quarter. Earnings were negatively impacted by external factors like share buybacks and currency fluctuations.

Net revenues amounted to $591.9 million, cruising ahead of the consensus mark of $577 million. The metric rose 4% year over year. On a constant-currency (cc) basis, net revenues grew 7%, driven by exceptional performances in Licensing and Americas wholesale divisions, alongside significant gains in the Europe and Asia markets.

Gross margin expanded from 40.7% to 41.9% in the reported quarter. As a percentage of sales, SG&A expenses jumped to 45.1% from 40.6% in the prior-year quarter’s level.

Adjusted loss from operations was $7.7 million against adjusted operating earnings of $1.9 million in the same quarter of the previous year. The adjusted operating margin declined mainly because of higher expenses and the unfavorable impact of currency. This was somewhat mitigated by the favorable impact of higher revenues and initial markups.

Guess?, Inc. Price, Consensus and EPS Surprise

Guess?, Inc. price-consensus-eps-surprise-chart | Guess?, Inc. Quote

Segment Performance

Revenues in the Americas Retail segment remained flat in both U.S. dollars and constant currency. Retail comp sales (including e-commerce) fell 7% and 8% on a reported basis and at cc, respectively. The addition of e-commerce sales boosted the retail comparable sales percentage by 1% in U.S. dollars and 2% in constant currency. The segment’s operating margin fell 4.9% to negative 7.2% in the quarter.

Americas Wholesale revenues soared 21% on a reported basis and 18% at cc. The segment’s operating margin declined 2.8% to 22.7%, due to the impact of new acquired businesses.

The Europe segment’s revenues increased 1% and 7% on a reported basis and at cc, respectively. Retail comp sales (including e-commerce) climbed 4% on a reported basis and 9% at cc. The segmental operating margin loss was 0.2%, down 0.8% year over year.

Asia revenues advanced 3% on a reported basis and 7% at cc. Retail comp sales (including e-commerce) fell 9% and 5% on a reported basis and at cc, respectively. The operating margin for the segment stood at 5.1%, reflecting a 0.3% year-over-year decline, primarily due to lower product margins and higher expenses, with higher revenues offering a partial offset.

Licensing revenues rallied 21% on a reported basis and at cc. Segmental operating margin was 92% compared with 93.3% in the year-ago quarter. The reduction in the operating margin was primarily due to increased expenses, although higher royalties had a partially offsetting favorable impact.

Other Updates

The company exited the quarter with cash and cash equivalents of $241.7 million, and long-term debt and finance lease obligations of nearly $196.9 million. Stockholders’ equity was around $565.5 million.

Net cash from operating activities for the three months ended May 4, 2024, was negative $22.9 million. Free cash flow for the same period amounted to negative $45.6 million. For fiscal 2025, free cash flow is envisioned to be $160 million.

GES announced a quarterly dividend of 30 cents per share on the company’s common stock, payable on Jun 28, 2024, to shareholders on record as of Jun 12, 2024.

In March 2024, Guess? repurchased nearly 0.3 million shares for $10.3 million as part of an additional exchange and subscription offering associated with 2024 notes and 2028 notes. Management boosted its buyback authorization by $200 million. Throughout the first quarter of fiscal 2025, the company refrained from further share repurchases, apart from the aforementioned transaction.

Guidance

For fiscal 2025, Guess? anticipates revenues to grow in the range of 10.7-12.7%.

The adjusted operating margin is likely to be between 7.7% and 8.5%. The GAAP operating margin is expected in the 7.3-8.1% band.

Management expects adjusted earnings per share (EPS) in the band of $2.62-$3.00 in fiscal 2025 compared with $3.14 recorded in fiscal 2024. Adjusted operating margin is projected in the range of 7.7-8.5% in the fiscal. On a GAAP basis, EPS is envisioned in the range of $2.59-$2.89 compared with $3.09 reported in fiscal 2024.

For the second quarter of fiscal 2025, management expects revenue growth in the 9-11% band. Adjusted operating margin is likely to be between 5.3% and 6.1%. On an adjusted basis, EPS is forecast in the range of 38-47 cents. On a GAAP basis, EPS is anticipated in the range of 33-40 cents.

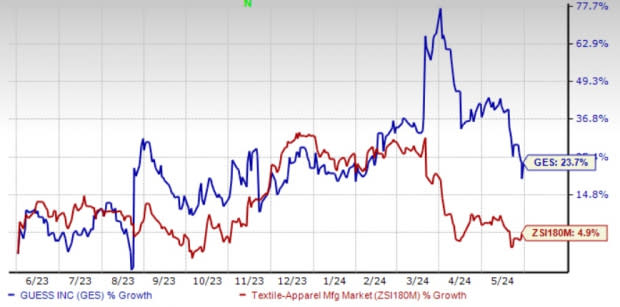

Shares of this Zacks Rank #3 (Hold) company have gained 23.7% in the past year compared with the industry’s 4.9% growth.

Image Source: Zacks Investment Research

3 Picks You Can’t Miss Out On

We have highlighted three better-ranked stocks in the broader sector, namely Hasbro, Inc. HAS, Hanesbrands HBI and Crocs, Inc. CROX.

Hasbro, a leading operator of toy and games company, currently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter average earnings surprise of 17.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for HAS’ current fiscal-year earnings indicate growth of 45.8% from the year-ago reported figures.

Hanesbrands engages in the designing, manufacturing, sourcing and selling of apparel essentials for men, women and children in the United States and internationally. The company currently sports a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 10.2%, on average.

The Zacks Consensus Estimate for Hanesbrands current financial-year earnings suggests growth of 650% from the year-earlier levels.

Crocs develops and manufactures lifestyle footwear and accessories. It currently has a Zacks Rank #2 (Buy). CROCS has a trailing four-quarter earnings surprise of 17.1%, on average.

The Zacks Consensus Estimate for Crocs current financial-year sales and earnings suggests growth of 4.3% and 5.2%, respectively, from the prior-year actuals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

Hanesbrands Inc. (HBI) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經