Hartford Financial (HIG), Marvin Partner to Boost Mental Health

The Hartford Financial Services Group, Inc. HIG recently joined forces with the digital behavioral health services provider, Marvin Behavioral Health, in a bid to offer specialized mental health resources to HIG’s life and disability insurance clients in the healthcare sector. Notably, the aforementioned clients who choose to utilize Marvin’s services may be eligible for a direct discount on the service offerings.

Marvin provides an extensive suite of mental healthcare services for healthcare workers, and under the latest partnership, HIG’s targeted clients will get access to the same. They will be able to consult licensed therapists trained to work with healthcare workers. Round-the-clock video call facility will offer flexibility.

The cost of sessions provided by Marvin is covered by most commercial insurance plans. There remains no restriction on the number of therapy sessions that can be attended. Further, employers gain insights into key clinical metrics and anonymous demographic data to better cater to mental health issues at the workplace.

The recent tie-up reflects Hartford Financial’s efforts to provide specialized insurance coverage to clients of all sizes in the healthcare industry, and thereby, improve their well-being and productivity levels. Access to Marvin’s credible services suite is expected to lure an increased number of similar clients to opt for HIG’s life and disability insurance plans, and subsequently, drive the performance of its Group Benefits business.

A higher client base may fetch increased premiums for HIG, the most significant contributor to the revenues of any insurer. Fully insured ongoing premiums in the Group Benefits business improved 2% year over year in the first quarter.

Additionally, the latest move also seems to be time-opportune on the part of Hartford Financial, considering the rising importance of enhanced mental health support for healthcare employees. Healthcare professionals are frequently confronted with traumatic situations that exert strain on their mental health. And the continued incidence of mental health issues among Americans is likely to sustain the solid demand for behavioral healthcare services in the days ahead, further demonstrating the timeliness of HIG’s move.

According to Hartford’s 2024 Future of Benefits study, 21% of surveyed employees reported that their mental health had a continuous negative impact on their productivity. Among them, 29% suffer from depression or anxiety several times a week, while 63% believed that their employers should have provided them with more mental health resources.

Hartford Financial has remained steadfast in product launches, acquisitions and collaborations to bolster its capabilities and strengthen its nationwide presence. Accordingly, HIG is intensifying its focus on bringing enhanced mental health outcomes for its Group Benefits clients. In April 2024, it teamed up with Active Minds to enhance its Group Benefits offerings with a mental health guide, thereby promoting mental health awareness and improving employee productivity.

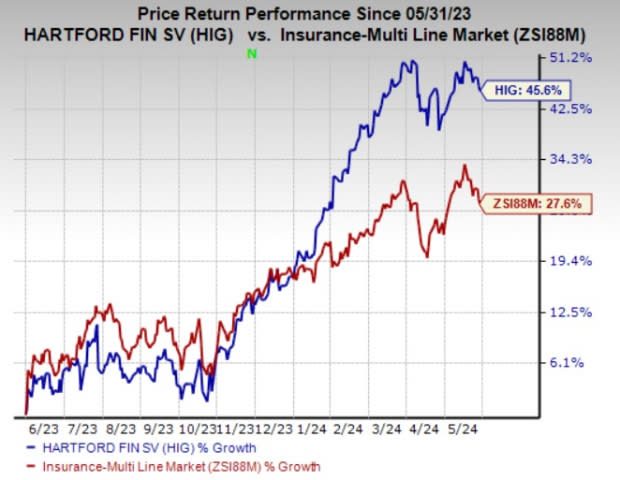

Shares of Hartford Financial have gained 45.6% in the past year compared with the industry’s 27.6% growth. HIG currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the insurance space are HCI Group, Inc. HCI, Old Republic International Corporation ORI and RLI Corp. RLI. While HCI Group sports a Zacks Rank #1 (Strong Buy), Old Republic and RLI carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

HCI Group’s earnings surpassed estimates in each of the last four quarters, the average surprise being 139.15%. The Zacks Consensus Estimate for HCI’s 2024 earnings suggests an improvement of 57.6% from the year-ago reported figure, while the consensus mark for revenues suggests growth of 40.9%. The consensus mark for 2024 earnings has moved 13.1% north in the past 30 days.

The bottom line of Old Republic outpaced earnings estimates in three of the last four quarters and missed the mark once, the average surprise being 6.61%. The Zacks Consensus Estimate for ORI’s 2024 earnings suggests an improvement of 3.8% from the year-ago reported figure, while the consensus mark for revenues suggests growth of 6.8%. The consensus estimate for ORI’s 2024 earnings has been revised 1.1% upward in the past 30 days.

RLI’s earnings surpassed estimates in three of the trailing four quarters and missed the mark once, the average surprise being 132.39%. The Zacks Consensus Estimate for RLI’s 2024 earnings suggests an improvement of 18.2% from the year-ago reported figure, while the same for revenues suggests growth of 15.3%. The consensus estimate for RLI’s 2024 earnings has been revised 1.7% upward in the past 30 days.

Shares of HCI Group, Old Republic and RLI have gained 86.7%, 28.4% and 15.6%, respectively, in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

RLI Corp. (RLI) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

HCI Group, Inc. (HCI) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經