Here's Why Investors Should Retain AON Stock in Their Portfolio

Aon plc AON is well-poised for growth, capitalizing on strong retention, new business, and currency benefits across segments. Its solid property and casualty business, coupled with organic growth strategies and strategic acquisitions, drive expansion and success.

Headquartered in Dublin, Ireland, AON offers risk management services, insurance, facultative reinsurance, brokerage and other services. It operates in more than 120 countries and has a market cap of $64.1 billion. With solid prospects, this Zacks Rank #3 (Hold) stock is deemed worthwhile for holding on to at the moment.

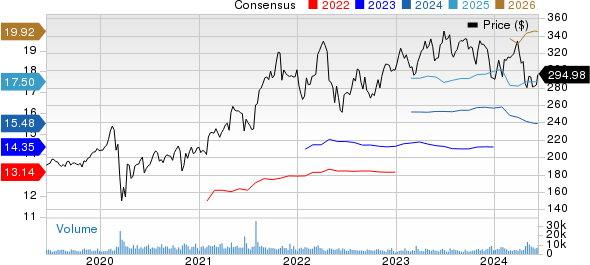

Aon plc Price and Consensus

Aon plc price-consensus-chart | Aon plc Quote

Key Drivers

AON is projected to reach $15.5 billion in revenues for 2024, with 9.5% year-over-year growth. The company expects sustained mid-single-digit or higher organic revenue growth, with Commercial Risk Solutions and Health Solutions driving significant contributions.

For 2024, we expect 4.2% organic revenue growth in Commercial Risk Solutions, exceeding $7.8 billion in total, backed by well-performing construction, property and casualty businesses in U.S. operations. Strength in retail brokerage and new business growth will also aid the segment.

The Health Solutions segment is anticipated to experience 5.7% organic revenue growth, reaching more than $2.8 billion, buoyed by expanding core health and benefits brokerage business. Strength in Consumer Benefit Solutions and an improvement in the Talent business are likely to drive further growth.

Our model projects around 6.7% organic revenue growth in Reinsurance Solutions, reaching more than $2.6 billion, driven by the new business and strong retention rates. Growth in facultative placements and investment banking can also play crucial roles in the segment’s advancement.

Aon employs acquisitions and partnerships as key growth strategies, focusing on expanding its capabilities, market reach, geographical footprint and product portfolio. AON closed the NFP acquisition on Apr 25, which is expected to unlock new markets for the company. It also doesn’t shy away from shedding non-core assets to improve margins. These initiatives position Aon for sustained long-term growth while boosting profitability.

Its trailing 12-month return on capital of 26.5% has outpaced the industry's average of 11.9%. This underscores the company's adeptness in generating substantial returns relative to the capital invested compared to industry benchmarks. The Zacks Consensus Estimate for AON’s 2024 earnings is pegged at $15.48 per share, which indicates 9.5% year-over-year growth.

AON’s cash-generating abilities help it undertake shareholder value-boosting measures. Although AON expects free cash flow to witness a decline in the short term, management remains optimistic to revert to its history of double-digit free cash flow growth in the long term. Increasing operating income and continued working capital improvements are expected to help in this regard. In the first quarter of 2024, AON bought back shares worth $250 million and had around $3.1 billion of authorization left under its share repurchase program at the first-quarter end.

Risks

However, there are some factors that investors should keep a careful eye on.

Aon exited the first quarter with cash and cash equivalents of $995 million, which contrasts with a substantial long-term debt of $15.9 billion. Also, short-term debt and the current portion of long-term debt were at $606 million.

The debt-heavy balance sheet has led to an increase in interest expenses. During the first quarter of 2024, interest expenses surged by 29.7% year over year. For 2024, we expect the metric to jump nearly 64.5% to $796.3 million. Nevertheless, we believe that a systematic and strategic plan of action will drive growth and reduce its leverage in the long term.

Key Picks

Investors interested in the broader Finance space may look at some better-ranked players like Ambac Financial Group, Inc. AMBC, Brown & Brown, Inc. BRO and Root, Inc. ROOT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ambac Financial’s current-year earnings is pegged at $1.45 per share, which witnessed one upward estimate revision in the past 60 days against no movement in the opposite direction. AMBC beat earnings estimates in all the past four quarters, with an average surprise of 893.5%.

The Zacks Consensus Estimate for Brown & Brown’s current-year earnings is pegged at $3.61 per share, which indicates 28.5% year-over-year growth. It has witnessed one upward estimate revision against none in the opposite direction during the past month. BRO beat earnings estimates in each of the past four quarters, with an average surprise of 11.9%.

The consensus mark for ROOT’s current-year earnings indicates a 53% year-over-year improvement. It beat earnings estimates in all the past four quarters, with an average surprise of 34.1%. Furthermore, the consensus estimate for Root’s 2024 revenues suggests 125.3% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Aon plc (AON) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Ambac Financial Group, Inc. (AMBC) : Free Stock Analysis Report

Root, Inc. (ROOT) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經