Here's Why You Should Retain Delta Air Lines (DAL) Stock Now

Delta Air Lines’ DAL top line is bolstered by robust air travel demand. Shareholder-friendly actions and fleet upgrade efforts are commendable. However, DAL is grappling with elevated fuel costs and labor costs.

Factors Favoring DAL

Strong domestic air travel demand is boosting DAL’s top line. This positive trend is reflected in DAL's share price, which has seen significant gains so far in 2024. Capitalizing on this buoyant market, Delta Air Lines' management is projecting a 5-7% year-over-year increase in adjusted total revenues for the second quarter of 2024.

Delta Air Lines ended the first quarter of 2024 with cash and cash equivalents of $4.46 billion, much higher than the current debt level of $2.81 billion. This implies that the company has sufficient cash to meet its current debt obligations and reflects a robust financial position.

DAL's management resumed quarterly dividends last year after a COVID-19-induced pause, which highlights its shareholder-friendly stance. The most recent quarterly payout was in June 2024, when DAL paid a dividend worth 10 cents per share, indicating progress on its three-year financial plan, including more than $10 billion in debt repayment.

Delta Air Lines' commendable fleet modernization efforts include a deal with Airbus for 20 A350-1000 jets, with deliveries beginning in 2026, along with options for an additional 20 aircraft. Additionally, the agreement with Rolls Royce encompasses servicing for its Trent XWB-97 engines.

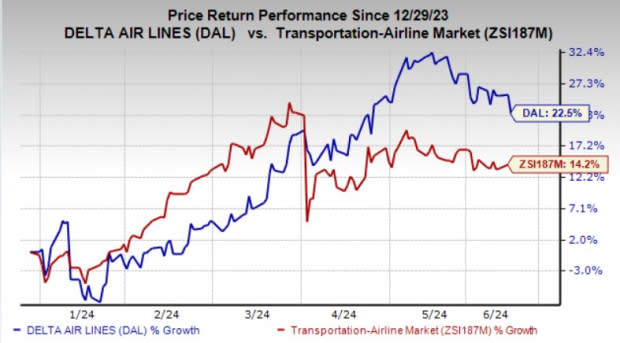

Shares of DAL have risen 22.5% year to date compared with its industry’s growth of 14.2%.

Image Source: Zacks Investment Research

Key Risks

Rising fuel costs are hindering DAL’s bottom line. This trend is primarily due to the ongoing production cuts adopted by major oil-producing nations and geopolitical tensions. In the first quarter of 2024, oil prices increased 16%. Expectations for the second quarter of 2024 place fuel prices between $2.70 and $2.90 per gallon. Our estimate is currently pegged at $2.85 per gallon.

In the first quarter of 2024, Delta Air Lines saw a 1.5% year-over-year rise in non-fuel unit costs. Salaries and related expenses jumped 12% to $3.79 billion due to a new pilot contract ratified in March 2023. For the June quarter, DAL expects non-fuel unit costs to increase 2% from second-quarter 2023 levels.

Zacks Rank

DAL is currently carrying a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks from the Zacks Transportation sector are Wabtec Corporation WAB and Kirby Corporation KEX.

Wabtec currently sports a Zacks Rank #1 (Strong Buy) and has an expected earnings growth rate of 22.6% for the current year. You can see the complete list of today’s Zacks #1 Rank stocks here.

WAB has an impressive earnings surprise history. Its earnings outpaced the Zacks Consensus Estimate in three of the trailing four quarters and missed once, delivering an average surprise of 11.5%. Shares of Wabtec have soared 59.4% in the past year.

KEX currently sports a Zacks Rank #1 and has an expected earnings growth rate of 42.2% for the current year.

The company has an encouraging track record with respect to earnings surprise, having surpassed the Zacks Consensus Estimate in each of the trailing four quarters. The average beat is 10.3%. Shares of Kirby have jumped 57.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Kirby Corporation (KEX) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經