Insmed (INSM) Stock Soars 118% on Upbeat Lung Disease Drug Data

Shares of Insmed INSM more than doubled in market value on Tuesday after reporting positive topline results from the phase III ASPEN study which evaluated its investigational oral drug brensocatib in patients with bronchiectasis.

The ASPEN study evaluated two different doses of brensocatib — 10mg and 25mg — against placebo in patients with non-cystic fibrosis bronchiectasis. The study met its primary endpoint — both doses of the drug achieved statistically significant and clinically meaningful reductions in the annualized rate of pulmonary exacerbations (or episodes of worsening disease symptoms) when compared with placebo.

Data from the study showed that patients in the 10 mg group experienced a 21.1% reduction in exacerbations, while those taking the 25 mg dose saw a decline of 19.4%. Treatment with the drug also achieved key secondary endpoints, including prolonged time to first pulmonary exacerbation and an increase in the odds of remaining exacerbation-free over 52 weeks.

These results are based on the primary efficacy analysis of more than 1700 participants, which includes 1680 adults and 41 adolescents.

Bronchiectasis is a chronic lung disease in which the bronchi (airways) can become permanently widened. This leads to patients developing respiratory problems such as chronic cough, shortness of breath and repeated respiratory infections and requiring antibiotic therapy and/or hospitalizations.

Currently, there are no medications specifically approved to treat bronchiectasis. Per management estimates, nearly a million patients living in the United States, Europe and Japan are affected by the disease.

Based on the results and target market size, Insmed expects to submit a regulatory filing for brensocatib in bronchiectasis in fourth-quarter 2024. If approved, the drug will be the first approved treatment for bronchiectasis patients, with a product launch expected in mid-2025. Management expects to commercially launch the drug in Europe and Japan in first-half 2026.

Wall Street was also impressed with the ASPEN study results. The analysts at Leerink Partners compared brensocatib’s commercial potential to blockbuster drugs like Regeneron/Sanofi’s Dupixent and AbbVie’s Humira. These drugs are some of the most successfully marketed medications of all time.

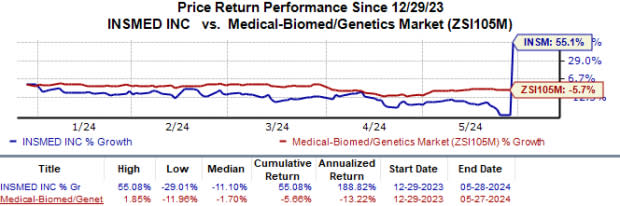

Year to date, the stock has surged 55.1% against the industry’s 5.7% fall.

Image Source: Zacks Investment Research

The ASPEN study results also validate the use of a dipeptidyl peptidase 1 (DPP1) inhibitor like brensocatib. DDP1 is a new class of medicines that Insmed believes has the potential to address a range of neutrophil-mediated diseases. If approved, brensocatib will also be the first DPP1 inhibitor.

Apart from bronchiectasis, the company is also advancing the development of brensocatib in other neutrophil-driven inflammatory diseases. The company is currently evaluating the drug in the phase IIb BiRCh study in patients with chronic rhinosinusitis without nasal polyps (CRSsNP). A data readout is expected next year. Management intends to start a mid-stage study on the drug in hidradenitis suppurativa indication before 2024-end.

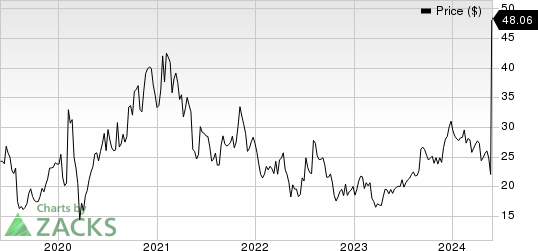

Insmed, Inc. Price

Insmed, Inc. price | Insmed, Inc. Quote

Zacks Rank & Key Picks

Insmed currently carries a Zacks Rank #3 (Buy). Some better-ranked stocks in the overall healthcare sector include Arcutis Biotherapeutics ARQT, Marinus Pharmaceuticals MRNS and Heron Therapeutics HRTX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Arcutis Biotherapeutics’ 2024 loss per share have narrowed from $2.49 to $1.60. During the same period, the loss estimates per share for 2025 have improved from $1.77 to $1.14. Year to date, shares of Arcutis have surged 174.9%.

Earnings of Arcutis Biotherapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. Arcutis delivered a four-quarter average earnings surprise of 14.93%.

In the past 60 days, estimates for Marinus Pharmaceuticals’ 2024 loss per share have improved from $2.43 to $1.87. During the same period, loss estimates for 2025 have narrowed from $1.97 to 90 cents.

Earnings of Marinus Pharmaceuticals beat estimates in two of the last four quarters and met the mark on one occasion while missing the mark on another. Marinus registered a four-quarter average earnings surprise of 3.27%.

In the past 60 days, estimates for Heron Therapeutics’ 2024 loss per sharehave improved from 22 cents to 10 cents. During the same period, estimates for 2025 have improved from a loss of 9 cents to earnings of 1 cent. Year to date, HRTX’s shares have appreciated 100.6%.

Earnings of Heron Therapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. HRTX delivered a four-quarter average earnings surprise of 30.33%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Insmed, Inc. (INSM) : Free Stock Analysis Report

Heron Therapeutics, Inc. (HRTX) : Free Stock Analysis Report

Marinus Pharmaceuticals, Inc. (MRNS) : Free Stock Analysis Report

Arcutis Biotherapeutics, Inc. (ARQT) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經