iRhythm Stock May Gain on Its Latest Deal With BioIntelliSense

iRhythm Technologies IRTC recently announced that it had signed an exclusive license agreement with BioIntelliSense, Inc., a continuous health monitoring and clinical intelligence company, to develop and commercialize certain patented technology assets within ambulatory cardiac monitoring (ACM).

With the agreement, it is likely to utilize BioIntelliSense’s multiparameter sensing technologies to expand the capabilities of its platform. IRTC's management believes that the licensed technology from BioIntelliSense can improve its premium positioning within ACM and further enable it to enter other adjacent indications, such as obstructive sleep apnea, over time.

The agreement is likely to boost IRTC’s business and add to revenue growth in the ACM segment. This licensing agreement is further expected to interest the investors and help the company increase its share price.

More on the IRTC & BioIntelliSense Agreement

BioIntelliSense offers a set of vital sign indicators that enable early identification and detection of adverse trends. This helps to improve patient monitoring from the hospital to home through medical-grade wearables and data services.

BioIntelliSense also has patented capabilities that represent a significant advancement in the field of oximetry with its white-light enhanced pulse oximetry (SpO2) sensor chipset and integrated processing technology. These capabilities facilitate the measurement of blood oxygen levels across the full range of light to very dark skin pigmentations with unique motion-tolerance capabilities.

Under the agreement, BioIntelliSense granted iRhythm an exclusive license to develop and commercialize pulse oximetry, accelerometry and trending non-invasive blood pressure technologies for use within iRhythm’s ACM products and services.

In accordance with the terms of the license agreement, iRhythm will pay an upfront payment, along with additional payments compensation contingent on regulatory milestones and subsequent technology validation to BioIntelliSense through Dec. 31, 2026. In addition, BioIntelliSense will be qualified to get royalties from yearly net sales of goods and services that have licensing rights in the domain of home sleep testing.

Per the press release, the license consideration payable to BioIntelliSense will be recognized as acquired in-process research and development (IPR&D) expense by iRhythm.

Following the agreement, iRhythm reaffirmed its existing 2024 financial guidance. Per the second-quarter results, iRhythm projects revenues for the full year 2024 to increase approximately 18% to 20% compared with prior-year results, ranging from roughly $580 million to $590 million. Gross margin for 2024 is expected to be in the range of 68.5%-69%, and adjusted EBITDA margin for 2024 is expected to be in the range of approximately 3.5% to 4% of revenues.

The company anticipates no material incremental development expenses in 2024 other than the acquired IPR&D expense associated with the transaction.

Favorable Industry Prospects for IRTC

Per a report by Grand View Research, the ambulatory cardiac monitoring market size was estimated to be $5.8 billion in 2022 and is expected to witness a CAGR of 10.4% from 2023 to 2030.

Given the market potential, IRTC’s new agreement with BioIntelliSense is likely to provide a boost to IRTC’s business.

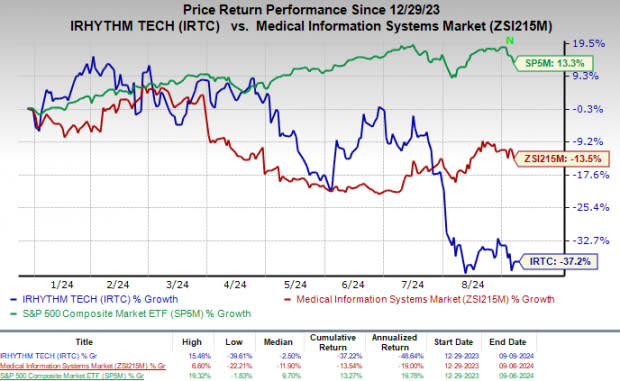

IRTC’s Price Performance

In the past six months, IRTC shares have gained 29.8% compared with the industry’s growth of 8.9%. The S&P 500 has gained 17.3% in the same time frame.

Image Source: Zacks Investment Research

IRTC’s Zacks Rank and Stocks to Consider

Currently, iRhythm has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Universal Health Service UHS, Quest Diagnostics DGX and ABM Industries ABM. While Universal Health Service sports a Zacks Rank #1 (Strong Buy), Quest Diagnostics and ABM Industries presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Universal Health Service has an estimated long-term growth rate of 19%. UHS’ earnings surpassed estimates in each of the trailing four quarters, with the average being 14.58%.

Universal Health Service has gained 56.1% so far this year compared with the industry's 48.1% rise.

Quest Diagnostics has an estimated long-term growth rate of 6.20%. DGX’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 3.31%.

Quest Diagnostics shares have gained 13.9% so far this year compared with the industry’s 17.9% rise.

ABM Industries’ earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 7.34%.

ABM's shares have risen 27.4% so far this year compared with the industry’s 17% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

ABM Industries Incorporated (ABM) : Free Stock Analysis Report

iRhythm Technologies (IRTC) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經