Jacobs' (J) C2V to Help United Utilities' Water Services

Jacobs Solutions, Inc. J and VolkerStevin’s joint venture company — C2V — will act as a Construction Delivery Partner to support United Utilities’ major capital investment program.

C2V will provide project management, design, build and commissioning solutions services for complex capital projects. These projects will cover water and wastewater treatment, pumping stations, reservoirs, bioresources and energy.

C2V and other companies involved in this specialist framework will form an integrated delivery organization with United Utilities to deliver an estimated $3.8 billion capital program from 2025 to 2030. The program also has an option to extend for an additional five years, from 2030 to 2035.

Meanwhile, the Water Services Regulation Authority for England and Wales, Ofwat, will review United Utilities' proposals and give its draft response by July, with final plans agreed by December this year.

Jacobs’ senior vice president, Kate Kenny, said, "The water sector is facing unprecedented environmental challenges. This framework positions United Utilities to deliver its largest ever program to advance environmental performance and critical water services in North West England."

C2V has supported United Utilities for the past 10 years, delivering both water and wastewater projects providing safe, secure and resilient water resources and improving river water quality across North West England.

Solid Project Execution to Drive Growth

Jacobs' ability to execute projects efficiently has played a pivotal role in driving the company's performance in recent quarters. The continuous success in securing new contracts stands as evidence of this proficiency.

The solid project execution efforts are supported by its ongoing backlog growth. At the fiscal second-quarter end, the company reported a backlog of $29.4 billion, up 2% year over year. This reflects persistent solid demand for Jacobs' consulting services. People & Places Solutions’ backlog was $17.93 billion in the fiscal second quarter compared with $17.56 billion in the year-ago period. The backlog at the Critical Mission Solutions segment was $8.45 billion in the fiscal second quarter, up from $8.14 billion a year ago.

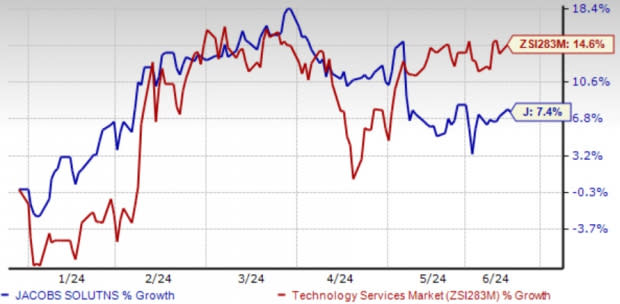

Image Source: Zacks Investment Research

Shares of the company have gained 7.4% so far this year compared with the Zacks Technology Services industry’s 14.6% growth. Although J’s shares have underperformed the industry, its earnings per share (EPS) estimates for fiscal 2024 suggest 10.8% year-over-year growth.

Zacks Rank & Stocks to Consider

Currently, Jacobs carries a Zacks Rank #4 (Sell).

Here are some better-ranked stocks in the same space:

AppLovin Corporation APP currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

APP delivered a trailing four-quarter earnings surprise of 60.9%, on average. The Zacks Consensus Estimate for APP’s 2024 sales and EPS indicates growth of 31.7% and 202%, respectively, from the prior-year levels.

Duolingo, Inc. DUOL currently sports a Zacks Rank of 1. DUOL delivered a trailing four-quarter earnings surprise of 115.2%, on average.

The Zacks Consensus Estimate for DUOL’s 2024 sales and EPS indicates growth of 37.8% and 397.1%, respectively, from the prior-year levels.

SPX Technologies, Inc. SPXC presently flaunts a Zacks Rank of 1. SPXC has a trailing four-quarter earnings surprise of 13.9%, on average.

The Zacks Consensus Estimate for SPXC’s 2024 sales and EPS indicates an increase of 14.7% and 24.4%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AppLovin Corporation (APP) : Free Stock Analysis Report

SPX Technologies, Inc. (SPXC) : Free Stock Analysis Report

Jacobs Solutions Inc. (J) : Free Stock Analysis Report

Duolingo, Inc. (DUOL) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經