Kratos' (KTOS) SATCOM System Showcased at Space Symposium

Kratos Defense & Security Solutions, Inc. KTOS recently announced that BlueHalo showcased the capabilities of its completely virtualized satellite communications (SATCOM) ground system, OpenSpace, at the 2024 Space Symposium held in Colorado. At this symposium, BlueHalo exhibited the utility of integrated backend mission services for the U.S. Space Force’s (“USSF”) Satellite Communication Augmentation Resource (“SCAR”) program and the importance of OpenSpace in the backend system.

Benefits of the OpenSpace Platform

Built upon widely accepted industry standards and a containerized architecture, Kratos' OpenSpace Platform is a completely software-defined and managed satellite ground system that enables scalable deployments inside an elastic, cloud-agnostic, virtualized environment. The Space Force can instantiate new services using OpenSpace in minutes as opposed to the weeks or even months that are typically needed with conventional hardware-based ground systems.

It is the industry’s only commercially available digital transformation solution that enables operators of satellites, Ground Systems-as-a-Service (GSaaS) providers, teleports and others in the satellite services supply chain to capitalize on dynamic ground capabilities.

Growth Prospects

Factors like increasing earth observation missions, rapid digitization of industries across the board, rising usage of satellite communications in tactical operations and the growing use of satellite internet services have been boosting reliance on satcom-dependent services. This has prompted major nations like the United States, Germany, China, India, Japan and the United Kingdom to aggressively invest in satellite deployment, thereby significantly bolstering the Satellite Communications market.

Therefore, the Satellite Communications market’s prospects remain robust, particularly driven by rapid growth in the launch of the Low Earth Orbit satellites and the expanding use of satellite technology in military and government applications. To this end, per a report by the Markets and Markets firm, the global SATCOM market is projected to witness a CAGR of 11.3% during the 2023-2028 period.

Such a solid market prediction offers strong growth opportunities to Kratos Defense, which, for more than 30 years, has been providing satellite Command & Control (C2) products and services, with a long history of successful SATCOM NetOps execution of commercial, military, civil and intelligence community satellite ground segment programs. For instance, its EPOCH product provides powerful satellite C2 for individual satellites, as well as small and large constellations of various designs and complexities.

Peer Prospects

Considering the solid growth opportunities offered by the global Satellite Communications market, other defense primes like Lockheed Martin LMT, Airbus SE EADSY and Northrop Grumman Corp. NOC, with a strong presence in this space, should also benefit.

Lockheed Martin uses cutting-edge technology to build capabilities that comprise layered space defense systems. The LM 400, a multi-mission satellite that can be tailored for almost any mission, is LMT’s most flexible satellite bus.

LMT boasts a long-term (three to five years) earnings growth rate of 4.1%. The Zacks Consensus Estimate for 2024 sales indicates an improvement of 3.2% from the previous year's estimated figure.

Airbus is a world leader in military satellite communication services with a broad portfolio of services, including the SATCOMBw, Syracuse 4A and 4B, Skynet 5 and many more. Airbus has been a long-term operator of the SATCOMBw secure satellite communications system for Germany’s Armed Forces.

EADSY boasts a long-term earnings growth rate of 21.4%. The Zacks Consensus Estimate for 2024 sales indicates an improvement of 8.2% from the previous year's estimated figure.

Northrop Grumman’s portfolio of space systems includes Strategic SATCOM, Protected Tactical SATCOM satellites and payloads. Its GEOStar geostationary Earth orbit commercial satellites are among the industry's best-selling small and medium-class communications satellites.

NOC boasts a long-term earnings growth rate of 8.7%. The Zacks Consensus Estimate for 2024 sales implies an improvement of 4.6% from the year-ago estimated figure.

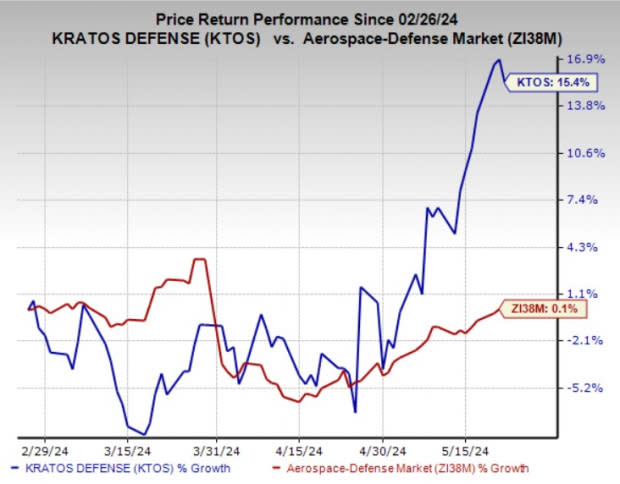

Price Movement

In the past three months, shares of Kratos Defense have risen 15.4% compared with the industry’s average return of 0.1%.

Image Source: Zacks Investment Research

Zacks Rank

Kratos Defense currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

Kratos Defense & Security Solutions, Inc. (KTOS) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經