RBC Shares Rise Most in Four Years on ‘Best in Show’ Quarter

(Bloomberg) -- Royal Bank of Canada beat analysts’ estimates on strong performance from its capital-markets business and lower-than-expected provisions for potential loan losses. The shares surged 5.2%, the most since 2020.

Most Read from Bloomberg

Donald Trump Becomes First Former US President Guilty of Crimes

Wall Street Billionaires Are Rushing to Back Trump, Verdict Be Damned

World’s Largest Nuclear Plant Sits Idle While Energy Needs Soar

Canada’s biggest lender, which has just completed a landmark deal for HSBC Holdings Plc’s Canadian business, earned C$2.92 a share on an adjusted basis in the fiscal second quarter. That topped the C$2.76 average estimate of analysts in a Bloomberg survey.

The bank’s provisions for credit losses totaled C$920 million ($670 million), it said in a statement Thursday, less than the C$929 million analysts had forecast.

The lender is ready to go “on the offense after being on defense for 18 months” while waiting for the HSBC deal to win approval and close, Chief Executive Officer Dave McKay told investors on a conference call. The bank’s regulatory capital came in strong even after paying for the C$13.5 billion deal — it boosted its dividend and announced plans to buy back shares — and its operating results were solid, all of which won it plaudits from analysts.

The shares closed at C$148.27 in Toronto, the highest level since January 2022. And there’s more room to grow, according to analysts from National Bank of Canada, Toronto-Dominion Bank and Desjardins, who boosted their share-price targets for the stock to C$161, C$160 and C$156, respectively.

Canadian Imperial Bank of Commerce also announced results that topped estimates Thursday, with the lender setting aside C$514 million for possible credit losses, less than the C$567 million analysts had forecast.

The numbers from Royal Bank and CIBC come after Bank of Montreal’s shares tumbled Wednesday when the lender reported higher-than-expected provisions. Bank of Nova Scotia and Toronto-Dominion Bank earlier reported loan-loss provisions of more than C$1 billion each. Set-asides at both Toronto-Dominion and National Bank of Canada came in higher than analysts had forecast.

“With all the Big Six Canadian banks now having reported, we would put Royal Bank at the top of the class this quarter,” Scotiabank analyst Meny Grauman wrote in a note to clients titled “Best in Show.” He said the Street was anticipating a strong quarter from Royal Bank, which has emerged as a favorite of Canadian financial stock pickers, “Yet, clearly the bank managed to exceed expectations.”

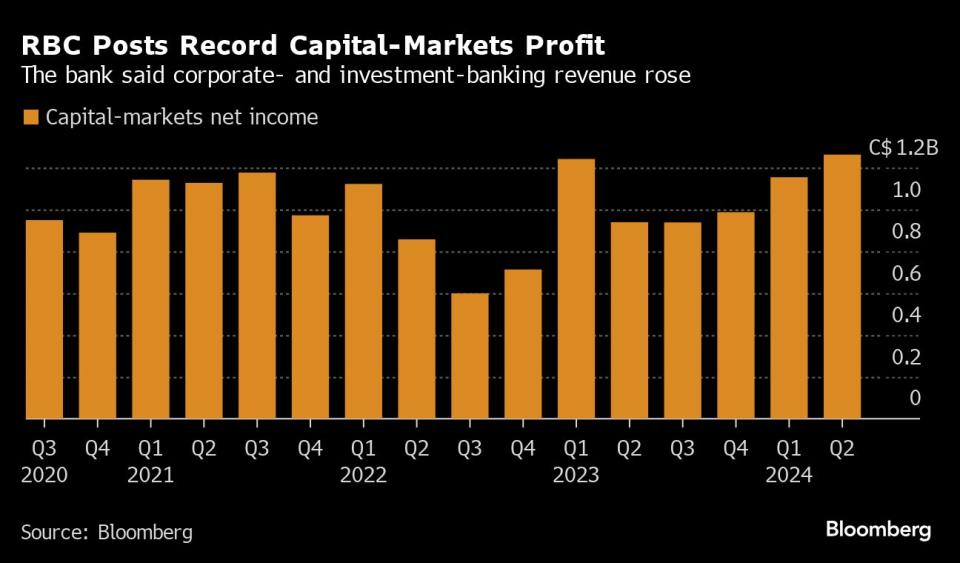

Net income in Royal Bank’s capital-markets business rose 31% from a year earlier to a record C$1.26 billion, primarily the result of higher revenue in corporate and investment banking.

Strategic mergers and acquisitions as well as associated financings have been on the rise as businesses have gained more certainty on the economic outlook, Derek Neldner, group head of the bank’s capital-markets unit, said on the call. “We think those fundamentals will continue and create a healthy environment.”

HSBC Deal

Costs did increase at Royal Bank after closing the HSBC deal — they were up 12% from a year earlier to C$8.31 billion in the three months through April, more than the C$7.95 billion analysts had forecast. The deal closed on March 28, with about one month left to go in the quarter, and Royal Bank immediately began converting branches to its own banner and switching customers and employees over to its own systems.

The lender has also grappled with higher costs at its Los Angeles-based City National Bank subsidiary, where it’s investing in improved risk controls after being hit with a regulatory fine over lapses in compliance practices.

Overall net income at Toronto-based Royal Bank was up 7.3% to C$3.95 billion.

“Not only did we close one of the most complex transactions — and we did a close and convert seamlessly — we didn’t lose any momentum in the business,” McKay told analysts.

It was a “strong quarter” for Royal Bank, Keefe, Bruyette & Woods analyst Mike Rizvanovic wrote in a note to clients, pointing to “an impressive top-line performance, manageable credit costs and a solid capital position following the close of the HSBC Canada acquisition.”

The lender’s Common Equity Tier 1 ratio was 12.8% at the end of the quarter, higher than the 12.5% level it forecast it would hit after closing the HSBC deal. It announced a 4-cent increase in its quarterly dividend to C$1.42 per share and said it plans to buy back as many as 30 million common shares.

Also during the quarter, Royal Bank fired Chief Financial Officer Nadine Ahn, a shock exit that came after the bank said she’d violated its code of conduct by having an undisclosed “close personal relationship” with a colleague who was given preferential treatment. Katherine Gibson was named interim CFO.

CIBC Results

Toronto-based CIBC earned C$1.75 per share on an adjusted basis in the fiscal second quarter, it said Thursday, beating the C$1.65 average estimate of analysts in a Bloomberg survey.

CIBC has grappled with higher credit-loss provisions in the past owing to the bank’s US office-loan portfolio. But executives said earlier this year that the issue was largely behind the lender after it took steps to reduce its exposure to such debt.

The bank’s overall net income increased 3.6% to C$1.75 billion.

CIBC’s Common Equity Tier 1 ratio was 13.1% at the end of the quarter, up from 13% in the prior three months, and the bank said Thursday it’s canceling the discount on its dividend-reinvestment program, a measure used to increase capital.

The bank’s first priority is investing for organic growth and it will also look to return more capital to shareholders, Chief Financial Officer Rob Sedran said in an interview, adding that it could also consider tuck-in acquisitions in the wealth management space.

CIBC’s shares rose 7% on Thursday, also their biggest one-day climb in more than four years, and closed at C$69.22.

Most Read from Bloomberg Businessweek

Disney Is Banking On Sequels to Help Get Pixar Back on Track

The Secret Ozempic Recipe Behind Novo’s Race to Boost Supplies

Why Dave & Buster’s Is Transforming Its Arcades Into Casinos

©2024 Bloomberg L.P.

雅虎香港財經

雅虎香港財經