Reasons to Retain Trane Technologies (TT) in Your Portfolio Now

Trane Technologies TT stock has had an impressive run over the past year. Shares of the company have gained 79.2% compared with the 48.2% rally of the industry it belongs to and the 26.4% rise of the Zacks S&P 500 composite.

The company’s revenues for 2024 and 2025 are expected to improve 8.3% and 6.7%, respectively, year over year. Earnings are anticipated to increase 15.7% in 2024 and 10.8% in 2025. The company has an expected long-term (three to five years) earnings per share growth rate of 12%.

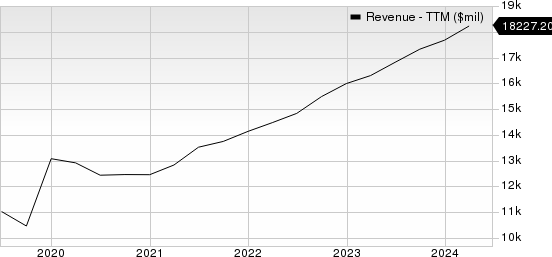

Trane Technologies plc Revenue (TTM)

Trane Technologies plc revenue-ttm | Trane Technologies plc Quote

Factors That Auger Well

The company remains focused on improving its business operating system and innovation through business transformation initiatives and investments. It surpassed the goal of $300 million in annualized savings in 2023.

Trane Technologies’ HVAC pipeline continues to remain robust globally. The company witnesses tremendous growth opportunities for the future as well. TT’s strong growth profile allows it optionality to propel key investments in 2024 while delivering strong leverage, EPS and free cash flow. Net revenues are estimated to grow 8%, 6.1% and 9.8% in 2024, 2025 and 2026, respectively.

The company’s booking strength is broad-based with growth across all the vertical markets. Trane delivers exceptional growth in booking across its applied solutions, leveraging the power of its direct sales force, deep customer relationships and leading innovation to capitalize rising complexity of projects in high-growth verticals. We anticipate total bookings to increase 13.3%, 12.9% and 12.8% in 2024, 2025 and 2026, respectively.

Risks

Diversity across products and services puts Trane Technologies in the face of a variety of competitors. Its competitors include regional, and larger U.S. and non-U.S. companies that vary by product lines and services. The company has to face strong competition in terms of price, quantity, delivery, service, support, technology and innovation. Managing price pressure, and customer acquisition and retention becomes a difficult task.

The company’s current ratio at the end of first-quarter 2024 was pegged at 1.13, lower than the prior quarter's 1.14 and the year-ago quarter's 1.26. A decreasing current ratio does not bode well.

Zacks Rank & Stocks to Consider

Trane Technologiescurrently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the broader Zacks Business Services sector are Harte Hanks HHS and Veralto Corporation VLTO.

Harte Hanks currently carries a Zacks Rank of 2 (Buy). It has a long-term earnings growth expectation of 12%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

HHS delivered a trailing four-quarter earnings surprise of 61.5%, on average.

Veralto presently has a Zacks Rank of 2. It has a long-term earnings growth expectation of 6.5%.

VLTO delivered a trailing four-quarter earnings surprise of 9.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Harte Hanks, Inc. (HHS) : Free Stock Analysis Report

Trane Technologies plc (TT) : Free Stock Analysis Report

Veralto Corporation (VLTO) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經