TREX Partners Paragon Stairs, Boosts Spiral Stairs Collection

Trex Company, Inc. TREX has entered into a strategic partnership with Paragon Stairs, with the latter being the exclusive supplier for its Trex Spiral Stairs collection.

Under the partnership, Paragon will supply two modular systems, Vista Spiral Stair and Summit Spiral Stair, for the Trex Spiral Stairs collection. These two models are specifically designed to pair perfectly with Trex decking and railing, highlighting a modern and sophisticated look along with emphasizing functionality and longevity. Paragon will also offer a free consultation with a design expert, prior to the installation process.

Furthermore, the two models can undergo more than 5,000 possible customizations and the visitors to the Trex Spiral Stairs online platform can also build their own set of spiral stairs using the user-friendly online configurator.

TREX is optimistic about this new partnership with Paragon as it believes this new addition will enhance its already existing product line and increase customer value, thus fostering its prospects in the upcoming period.

Product Portfolio Development Bodes Well

Trex’s consistent product portfolio development and strategic sale initiatives help maintain growth momentum, despite various macroeconomic and inflationary risks. It gains from improved manufacturing performance and other cost-containment actions. Also, the company’s sound relationships with its top-notch channel partners in the industry assist it in achieving industry-leading margins and profitability.

During the first quarter of 2024, the company engaged in developing new projects for its future cost-saving pipeline. One such notable project included the development of new plastic recycling and processing technologies. This is expected to allow Trex to efficiently process contaminated materials and enhance them to be used for a larger variety of recycled materials. Furthermore, it added two modern specialty premium railing options to its portfolio. Given the positive response upon the launch, these products are expected to start shipping in the second quarter.

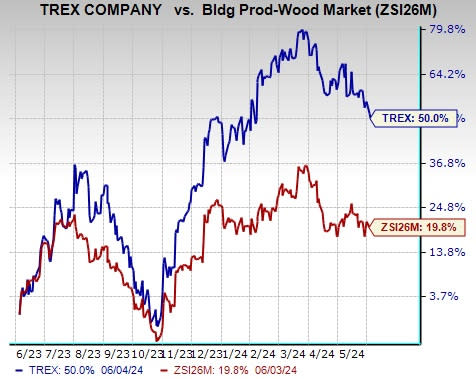

Image Source: Zacks Investment Research

Shares of this manufacturer of wood-alternative decking and railing grew 50% in the past year, outperforming the Zacks Building Products - Wood industry’s 19.8% growth.

New product development is a key driver for the company’s growth and expansion of its market share. Trex aims to continue seeking and implementing product development and enhancement opportunities through strategic collaborations as well as organic investments to foster its prospects and expand top-line growth.

Zacks Rank & Key Picks

Trex currently carries a Zacks Rank #3 (Hold).

Here are better-ranked stocks from the Construction sector.

Owens Corning OC currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

OC delivered a trailing four-quarter earnings surprise of 17.4%, on average. The stock has risen 58% in the past year. The Zacks Consensus Estimate for OC’s 2024 sales and earnings per share (EPS) indicates growth of 16% and 7.4%, respectively, from the prior-year reported levels.

PulteGroup, Inc. PHM currently sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 12.5%, on average. PHM shares have surged 65% in the past year.

The consensus estimate for PHM’s 2024 sales and EPS implies increases of 7.9% and 10%, respectively, from the prior-year reported levels.

Dycom Industries, Inc. DY presently sports a Zacks Rank of 1. DY delivered a trailing four-quarter earnings surprise of 30.2%, on average. The stock has risen 67.8% in the past year.

The Zacks Consensus Estimate for DY’s fiscal 2024 sales and EPS indicates improvements of 9.3% and 5.6%, respectively, from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Owens Corning Inc (OC) : Free Stock Analysis Report

Trex Company, Inc. (TREX) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經