Universal Stainless (USAP) Surges 48% in 3 Months: Here's Why

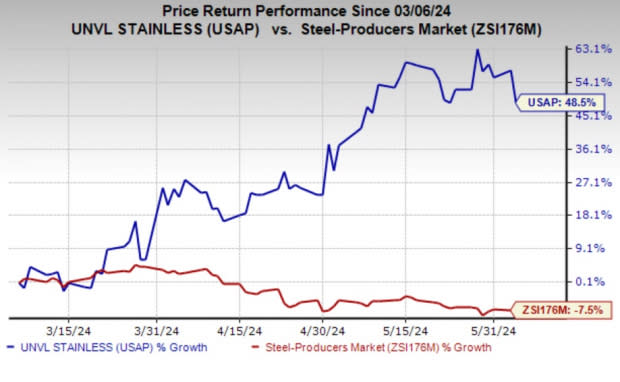

Universal Stainless & Alloy Products, Inc.’ USAP shares have appreciated 48.5% in the past three months. The company also outperformed the industry’s fall of 7.5% and topped the S&P 500’s nearly 3.1% rise over the same period.

Image Source: Zacks Investment Research

Let’s take a look at the factors driving the stock’s price appreciation.

What’s Driving Universal Stainless?

In first-quarter 2024, USAP demonstrated robust performance, marking a notable turnaround from the previous year's figures. The company posted earnings of 43 cents per share, which improved from a loss of 6 cents per share a year ago. This underscores USAP's resilient strategy and strategic advancements.

USAP achieved remarkable sales growth, reaching $77.6 million, increasing 18% from the prior-year quarter’s tally. The upside was primarily driven by outstanding performances in the specialty alloys and premium alloys segments, which registered year-over-year increases of 18% and 14%, respectively. The aerospace sector was particularly notable, with sales surging approximately 23% to $60.2 million, highlighting USAP's strong position in the critical market segment.

USAP's strategic focus on diversification and innovation is evident in its sales distribution across various end markets. While aerospace remains a cornerstone of its success, the company demonstrated adaptability and resilience by achieving growth in sectors such as heavy equipment and general industrial, strengthening its overall market presence.

The company achieved its highest profitability in 12 years in the first quarter, with a gross margin of 18.9% on near-record sales. This performance was driven by robust aerospace demand and the continued realization of base price increases implemented in the past three years.

USAP has a trailing four-quarter average earnings surprise of 44.4%. The Zacks Consensus Estimate for 2024 earnings is pegged at $1.50 per share, indicating a surge of 183% from the previous year's levels.

Universal Stainless & Alloy Products, Inc. Price and Consensus

Universal Stainless & Alloy Products, Inc. price-consensus-chart | Universal Stainless & Alloy Products, Inc. Quote

Zacks Rank & Key Picks

Universal Stainlesscurrently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS, sporting a Zacks Rank #1 (Strong Buy), and ATI Inc. ATI and Ecolab Inc. ECL, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CRS’ earnings beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company’s shares have soared 108.2% in the past year.

ATI’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, with the earnings surprise being 8.34%, on average. The stock has surged 52.4% in the past year.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59, indicating a year-over-year rise of 26.5%. The Zacks Consensus Estimate for ECL’s current-year earnings has moved up in the past 30 days. ECL beat the consensus estimate in each of the last four quarters, with the earnings surprise being 1.3%, on average. The stock has rallied nearly 36% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Universal Stainless & Alloy Products, Inc. (USAP) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經