Utilities Sector Surprisingly Flourishes in 2024: 5 Top Picks

The utilities sector is generally defensive in nature. U.S. stock markets witnessed an impressive bull run in 2023, but the utility sector suffered a blow. Of the 11 broad sectors of the market’s benchmark — the S&P 500 Index — the Utility sector declined more than 11%.

Wall Street’s bull-run continues in 2024 except for a brief setback in April. Cooling economic data, especially the labor market data, a slow GDP growth rate and a slowly declining inflation rate boosted investors’ confidence in risky assets like equities. However, surprisingly, the defensive utilities sector has become a major part of this year’s rally so far.

Year to date, of the 11 broad sectors of the market’s benchmark — the S&P 500 Index — the utilities sector has rallied 12.8%, only second to a 16.9% surge in the Communication Services Select Sector SPDR (XLC). So far, the utilities sector has outpaced the growth-oriented Technology Sector (12.1%) and the S&P 500 Index (12.3%) itself.

The primary driver of the 2024 rally is market participants’ expectation of at least one 25-basis point cut in the Fed fund rate by the central bank this year. Utility operations are capital-intensive, as consistent investments are required to upgrade, maintain and replace older wires, electric poles and power stations.

Hence, apart from internal fund sources, utilities depend on the credit market for funds to carry on upgrades. Therefore, a reduction in the benchmark lending rate will provide a boost to this sector.

Utilities Immune to Vagaries of Economic Cycle

Utilities are mature and fundamentally strong as demand for such services is generally immune to the changes in the economic cycle. Such companies provide basic services like electricity, gas, water and telecommunications, which will always be in demand.

Consequently, adding stocks from the utility basket usually lends more stability to a portfolio in an uncertain market condition. Moreover, the sector is known for the stability and visibility of its earnings and cash flows. Stable earnings enable utilities to pay out consistent dividends that make them more attractive to income-oriented investors.

Utility companies enjoy a reputation for being safe, given the regulated nature of their business. This lends their revenues a high level of certainty. These companies also benefit from the domestic orientation of their business, which shields them from foreign currency translation issues.

Additionally, these companies generally provide a good dividend. Investment in a high dividend yield and a favorable Zacks Rank may be the best option if volatility persists for the rest of 2024.

Our Top Picks

We have narrowed our search to five utility stocks that are regular dividend payers. These stocks have good potential for the rest of 2024 and have seen positive earnings estimate revisions within the last 60 days. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

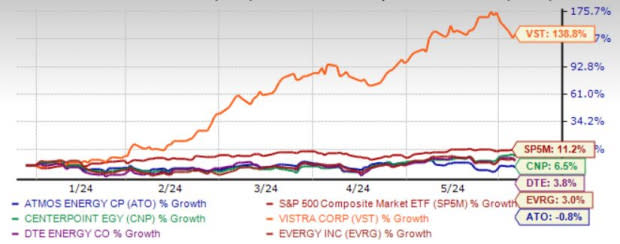

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Atmos Energy Corp. ATO continues to benefit from rising demand, courtesy of an expanding customer base. ATO’s long-term investment plan will further help increase the safety and reliability of its natural gas pipelines.

ATO gains from industrial customer additions and constructive rate outcomes. Returns within a year of capital investment will further boost the company’s performance. ATO has enough liquidity to meet debt obligations.

Atmos Energy has an expected revenue and earnings growth rate of 10.1% and 9.2%, respectively, for the current year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.9% over the last 30 days. ATO has a current dividend yield of 2.8%.

CenterPoint Energy Inc. CNP is a domestic energy delivery company that provides electric transmission & distribution, natural gas distribution and competitive natural gas sales and services operations.

CNP continues to invest substantially in upgrading its infrastructure and improving the reliability of its operations. CNP plans to spend $3.7 billion on infrastructure upgrades in 2024 and $44.5 billion for 10 years. CNP projects an industry-leading rate base growth rate of 10% through 2030.

CenterPoint Energy has an expected revenue and earnings growth rate of 1% and 8%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has improved 0.1% over the last 60 days. CNP has a current dividend yield of 2.6%.

Vistra Corp. VST operates as an integrated retail electricity and power generation company. VST retails electricity and natural gas to residential, commercial, and industrial customers across 20 states in the United States and the District of Columbia.

VST operates through six segments: Retail, Texas, East, West, Sunset, and Asset Closure. VST is involved in electricity generation, wholesale energy purchases and sales, commodity risk management, fuel production, and fuel logistics management activities.

Vistra has an expected revenue and earnings growth rate of 20.8% and 5.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 5.3% over the last 30 days. VST has a current dividend yield of 1%.

DTE Energy Co. DTE is a diversified energy company that follows a disciplined capital spending program to maintain and upgrade its infrastructure to enhance the reliability of its utility systems. DTE follows a disciplined capital spending program to maintain and upgrade its infrastructure to enhance the reliability of its utility systems.

To promote clean energy, DTE invests heftily in renewable generation assets and aims to reduce its carbon footprint significantly. Such clean energy initiatives must have enabled DTE to outperform its peers.

DTE Energy has an expected revenue and earnings growth rate of 1.7% and 16.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last 30 days. DTE has a current dividend yield of 3.5%.

Evergy Inc. EVRG continues to benefit from its expansion of operations in the transmission market through collaborations, strategic acquisitions and partnerships. Through planned investments and the Integrated Resource Plan, EVRG aims to add more renewable assets and become carbon neutral by 2045. EVRGimproves shareholders’ value through dividend payments and has enough liquidity to meet debt obligations.

Evergy has an expected revenue and earnings growth rate of 2.8% and 8.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 60 days. EVRG has a current dividend yield of 4.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DTE Energy Company (DTE) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

Evergy Inc. (EVRG) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經