Watch These 5 Stocks That Recently Hiked Dividends

Amid high volatility, major U.S. indexes like the Dow, the S&P 500 and the Nasdaq have managed to stay positive with 1.1%, 9.8% and 11.5% gains, respectively, over the year-to-date period.

However, key concerns of investors are sticky inflation, the slowest gross domestic product (GDP) growth rate in nearly two years, and uncertainty over how long the central bank wants to continue with a higher interest rate to tame inflation.

According to the Consumer Price Index (CPI) data, published by the Bureau of Labor Statistics, inflation for the month of April increased 3.4% year over year. It rose 0.3% month over month, slightly below the consensus estimate of 0.4%. The Producer Price Index (PPI) increased 2.2%, on an annual basis, marking the biggest gain in a year. The numbers from early in the second quarter indicate that sticky inflation will remain a major concern for investors and the Federal Reserve.

According to the data published by the Department of Commerce, the U.S. GDP growth rate for Q1 was revised downward to 1.3% from 1.6% reported earlier, compared to 3.4% GDP growth rate in Q4 of 2023. The sluggishness in growth is the weakest since the spring of 2022.

Consumer spending in the first quarter rose at an annual rate of 2%, down from earlier estimate of 2.5%. A slower pace than previously thought of is a sign of a broader slowdown in the economy due to high interest rates and lingering inflation.

The Fed expects to bring down inflation within the accepted range of 2% by keeping the interest rate higher for longer. Higher interest rates make borrowing money more expensive for corporates and individuals, thereby cooling off demand. However, the challenge that remains for the Fed is to create a soft landing for the economy by striking the right balance between inflation and growth.

In such a situation, prudent investors who wish to invest their money for regular income and capital preservation can remain invested or buy dividend stocks. These companies, due to their well-established businesses, pay out regular dividends and remain profitable due to their proven business models. Companies that tend to reward investors with a high dividend payout outperform non-dividend-paying stocks in a highly volatile market.

On that note, let us look at companies like Hamilton Lane HLNE, Ralph Lauren RL, SpartanNash SPTN, Equitable Holdings EQH and Medtronic MDT that have lately hiked their dividend payouts.

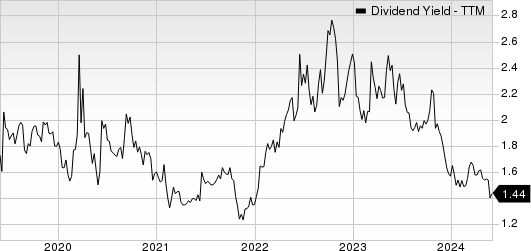

Hamilton Lane is an investment management firm, which provides private market solutions. This Conshohocken, PA-based company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank stocks here.

On May 23, HLNE declared that its shareholders would receive a dividend of 49 cents a share on Jul 5, 2024. HLNE has a dividend yield of 1.4%.

Over the past five years, HLNE has increased its dividend six times, and its payout ratio presently sits at 45% of earnings. Check Hamilton Lane’s dividend history here.

Hamilton Lane Inc. Dividend Yield (TTM)

Hamilton Lane Inc. dividend-yield-ttm | Hamilton Lane Inc. Quote

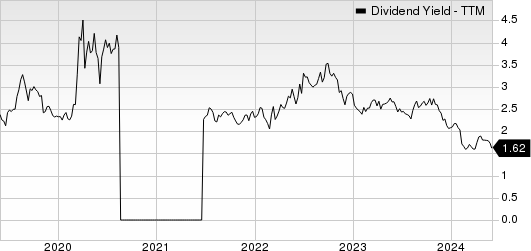

Ralph Lauren is headquartered in New York, NY. This Zacks Rank #3 company is a major designer, marketer and distributor of premium lifestyle products in North America, Europe, Asia, and internationally.

On May 23, RL declared that its shareholders would receive a dividend of 83 cents a share on Jul 12, 2024. RL has a dividend yield of 1.6%.

In the past five years, RL has increased its dividend three times. Its payout ratio at present sits at 29% of earnings. Check Ralph Lauren’s dividend history here.

Ralph Lauren Corporation Dividend Yield (TTM)

Ralph Lauren Corporation dividend-yield-ttm | Ralph Lauren Corporation Quote

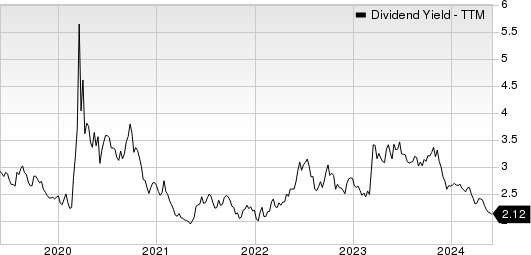

SpartanNash is a food distributor serving military commissaries and exchanges in the United States. The Zacks Rank #3 company is headquartered in Grand Rapids, MI.

On May 23, SPTN announced that its shareholders would receive a dividend of 22 cents a share on Jun 28, 2024. SPTN has a dividend yield of 4.4%.

Over the past five years, SPTN has increased its dividend five times. Its payout ratio now sits at 39% of earnings. Check SpartanNash's dividend history here.

SpartanNash Company Dividend Yield (TTM)

SpartanNash Company dividend-yield-ttm | SpartanNash Company Quote

Equitable Holdings is a financial service holding company, which provides advice protection and retirement strategies to individuals, families and small businesses. The New York-based company currently carries a Zacks Rank #3.

On May 22, EQH declared that its shareholders would receive a dividend of 24 cents a share on Jun 10, 2024. EQH has a dividend yield of 2.2%.

Over the past five years, EQH has increased its dividend five times, and its payout ratio presently sits at 17% of earnings. Check Equitable Holdings’ dividend history here.

Equitable Holdings, Inc. Dividend Yield (TTM)

Equitable Holdings, Inc. dividend-yield-ttm | Equitable Holdings, Inc. Quote

Medtronic is headquartered in Dublin, Ireland. This Zacks Rank #3 company develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide.

On May 22, MDT declared that its shareholders would receive a dividend of 70 cents a share on Jul 12, 2024. MDT has a dividend yield of 3.4%.

In the past five years, MDT has increased its dividend six times. Its payout ratio at present sits at 53% of earnings. Check Medtronic’s dividend history here.

Medtronic PLC Dividend Yield (TTM)

Medtronic PLC dividend-yield-ttm | Medtronic PLC Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Medtronic PLC (MDT) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

SpartanNash Company (SPTN) : Free Stock Analysis Report

Hamilton Lane Inc. (HLNE) : Free Stock Analysis Report

Equitable Holdings, Inc. (EQH) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經