Zhejiang Huatie Emergency Equipment Science & TechnologyLtd And Two More Chinese Exchange Growth Companies With High Insider Stakes

As global markets navigate through varying economic signals, China's recent historic measures to stabilize its property sector reflect a proactive approach amidst ongoing challenges in the housing market and broader economy. In this context, understanding the significance of high insider ownership can provide insights into companies with potentially resilient growth trajectories in China's complex market landscape.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

YanKer shop FoodLtd (SZSE:002847) | 29.2% | 23.9% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 25.4% |

Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.5% |

Jiangsu Cnano Technology (SHSE:688116) | 18.5% | 33.9% |

Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 69.2% |

Offcn Education Technology (SZSE:002607) | 26.1% | 72.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Zhejiang Huatie Emergency Equipment Science & TechnologyLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Huatie Emergency Equipment Science & Technology Co., Ltd. specializes in the development, production, and sale of emergency rescue security equipment, with a market capitalization of approximately CN¥12.80 billion.

Operations: The company generates its revenue primarily from the development, production, and sale of emergency rescue security equipment.

Insider Ownership: 12.1%

Revenue Growth Forecast: 27.4% p.a.

Zhejiang Huatie Emergency Equipment Science & Technology Co., Ltd. is experiencing robust growth with its revenue and earnings expanding significantly, outpacing the broader Chinese market. The company's recent financial performance underscores this trend, with a substantial increase in sales and net income reported for both the latest quarter and full year. Despite these positives, there is concern due to a high level of debt and shareholder dilution over the past year. Additionally, while trading at a considerable discount to estimated fair value, its forecasted Return on Equity remains relatively low compared to benchmarks.

Beijing Tricolor Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Tricolor Technology Co., Ltd. is a global manufacturer and seller of professional audio and video products, with a market capitalization of approximately CN¥7.66 billion.

Operations: The company generates its revenue from the global sales of professional audio and video products.

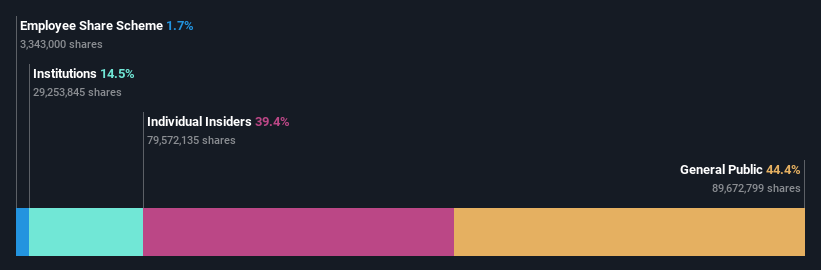

Insider Ownership: 39.4%

Revenue Growth Forecast: 37.3% p.a.

Beijing Tricolor Technology has demonstrated a robust turnaround, transitioning from a net loss to generating CNY 5.99 million in net income as of Q1 2024. This recovery is underscored by an impressive annual revenue growth of 37.3%, significantly outpacing the broader Chinese market's growth rate. Despite these gains, shareholder dilution over the past year and high share price volatility remain concerns. The company also completed a share buyback program recently, purchasing shares for CNY 9.8 million.

Eoptolink Technology

Simply Wall St Growth Rating: ★★★★★★

Overview: Eoptolink Technology Inc., Ltd. is a company based in China that specializes in the research, development, manufacturing, and sale of optical transceivers both domestically and internationally, with a market capitalization of approximately CN¥60.34 billion.

Operations: The company generates CN¥3.61 billion from its optical communication equipment segment.

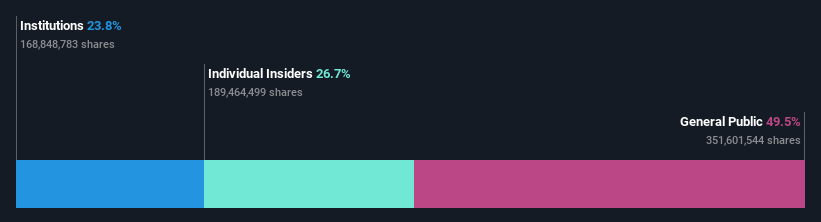

Insider Ownership: 26.7%

Revenue Growth Forecast: 36.3% p.a.

Eoptolink Technology, a growth-oriented firm with high insider ownership, reported a substantial year-over-year increase in Q1 2024 revenues to CNY 1.11 billion and net income to CNY 324.54 million. The company's earnings are expected to grow by 38.77% annually, outperforming the Chinese market forecast of 23.3%. Despite these financial gains, the company's share price has been highly volatile recently. Additionally, Eoptolink is expanding its innovative product lines in optical transceiver modules for emerging tech applications.

Take a closer look at Eoptolink Technology's potential here in our earnings growth report.

Our expertly prepared valuation report Eoptolink Technology implies its share price may be too high.

Next Steps

Unlock more gems! Our Fast Growing Chinese Companies With High Insider Ownership screener has unearthed 405 more companies for you to explore.Click here to unveil our expertly curated list of 408 Fast Growing Chinese Companies With High Insider Ownership.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603300 SHSE:603516SZSE:300502.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

雅虎香港財經

雅虎香港財經