3 Industrial Services Stocks to Watch Amid Persistent Industry Challenges

The Zacks Industrial Services industry has been bearing the brunt of the prolonged contraction in the manufacturing sector and cost inflation. Even though there has been a slight pickup in orders recently, its sustainability remains uncertain.

The rise in e-commerce activities is expected to support the industry. Companies like Siemens SIEGY, W.W. Grainger, Inc. GWW and Andritz ADRZY are positioned for growth, leveraging strategies to capitalize on this demand. The companies have also been focusing on increasing productivity and efficiency, and investing in automation and digitization, which will aid growth.

About the Industry

The Zacks Industrial Services industry comprises companies that provide industrial equipment products and MRO (maintenance, repair and operations) services. It includes activities, such as routine maintenance work, emergency maintenance and spare part inventory control, which keep a facility and its equipment in good operating condition. Industry participants serve a wide array of customers, ranging from commercial, government and healthcare to manufacturing. The industry's products (power tools, hand tools, cutting fluids, lubricants, personal protective equipment and consumables) are utilized in production and plant maintenance but are not directly related to customers’ core products or services. By offering inventory management, and process and procurement solutions, these companies reduce MRO supply-chain costs and improve customers' plant floor productivity.

Trends Shaping the Future of the Industrial Services Industry

Contraction in Manufacturing Activity Raises Concerns: The manufacturing sector contributes around 70% to the industry's revenues. Customer activity trends are historically correlated to changes in the Industrial Production Index. Per the Federal Reserve’s last update, industrial production inched up 0.4% in March 2024. Despite this uptick, industrial production has been stagnant over the 12 months ended March 2024. The durable goods manufacturing index saw a slight increase of 0.3% in March, but it marked a slowdown from the 1.3% gain witnessed in February. The Institute for Supply Management’s manufacturing index was 50.3% for March, which marked an end to the prolonged contraction of 16 months, hinting at a potential recovery. However, this was short-lived, with the index slipping to the contraction territory with a 49.2% reading in April. The average for the 12 months ended April 2024 is 47.7%, reflecting lower customer spending amid inflationary trends. The New Orders Index also moved back into contraction in April, registering 49.1%, which was lower than the 51.4% witnessed in March. Notably, some industry players have reported that supply-chain issues have been gradually easing. The delivery of goods from suppliers to manufacturing organizations was reported to be marginally faster for the second consecutive month in April. Once the situation normalizes, strong demand in the diverse end markets will drive the industry’s growth.

Pricing Actions to Combat High Costs: The industry has been experiencing significant inflation levels, including higher prices for labor, freight and fuel. The companies are witnessing labor shortages for some positions and incurring steep labor costs to meet demand. Industry players are focusing on pricing actions, cost-cutting measures, efforts to improve productivity and efficiency, and the diversification of the supplier base to mitigate some of these headwinds.

E-commerce Acts as A Key Catalyst: MRO demand is significantly impacted by the evolution of e-commerce. Customer demand for highly tailored solutions, with real-time access to information and rapid delivery of products, is rising. Customers want to execute their business activities in the most efficient way possible, which often means online. According to Statista, global e-commerce sales were $5.8 trillion in 2023, and this figure is expected to reach $8 trillion by 2027, seeing a CAGR of 8.4%. The United States is expected to lead the retail e-commerce development, witnessing a CAGR of 11.82% over 2024-2028. The current valuation of the U.S. e-commerce market is $843 billion and it is anticipated to surpass the $1-trillion mark in 2026. India and Mexico are expected to follow suit, seeing a CAGR of 11.79% and 11.71%, respectively. To capitalize on this trend, industrial service companies are heavily investing in improving their digital capabilities and increasing their share in e-commerce.

Zacks Industry Rank Indicates Dull Prospects

The group’s Zacks Industry Rank, basically the average of the Zacks Rank of all the member stocks, indicates bearish prospects in the near term. The Zacks Industrial Services Industry, a 19-stock group within the broader Zacks Industrial Products sector, currently carries a Zacks Industry Rank #209, which places it in the bottom 16% of 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few Industrial services stocks that investors can add to their portfolio, it is worth taking a look at the industry’s stock-market performance and its valuation picture.

Industry Versus S&P 500 & Sector

The Industrial Services industry has underperformed its sector and the Zacks S&P 500 composite over the past year.

Over this period, the industry has risen 3.9% compared with the sector’s growth of 28.6%. The Zacks S&P 500 composite has moved up 27%.

One-Year Price Performance

Industry's Current Valuation

On the basis of the forward 12-month EV/EBITDA ratio, a commonly used multiple for valuing Industrial Services companies, we see that the industry is currently trading at 24.80X compared with the S&P 500’s 12.02X and the Industrial Products sector’s forward 12-month EV/EBITDA of 18.92X. This is shown in the charts below.

Enterprise Value/EBITDA (EV/EBITDA) F12M Ratio

Enterprise Value/EBITDA (EV/EBITDA) F12M Ratio

Over the last five years, the industry traded as high as 33.20X and as low as 6.04X, the median being 21.69X.

3 Industrial Services Stocks to Keep an Eye on

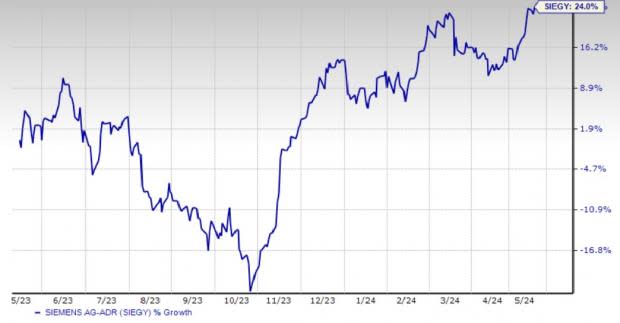

Siemens: The company recently entered an agreement to acquire the industrial drive technology business of ebm-papst. This move will strengthen Siemens’ position as a leading technology company in the field of factory automation and digitalization. SIEGY will be able to tap new businesses and customers in the promising markets for intelligent, battery-powered drive solutions in intralogistics and mobile robot solutions. Siemens also recently unveiled a breakthrough in automation technology with the new Simatic Workstation, which will provide software-defined automation and unprecedented control over factory automation and security. Ford will be the first customer to deploy and scale this technology in its manufacturing operations. Siemens is poised well for growth, backed by ongoing momentum in its industrial businesses. In Digital Industries, global demand in the automation businesses, particularly in China, is expected to pick up in the second half of 2024, as customer destocking is now over. In Smart Infrastructure, order intake remains high, supported by strong demand from data center customers. The company has partnerships with Microsoft and AWS to make artificial intelligence even more accessible and help its customers in their digital and sustainability transformation.

The Zacks Consensus Estimate for the Munich, Germany-based company’s fiscal 2024 earnings has been revised 0.5% upward in the past 30 days. The consensus mark indicates year-over-year growth of 8.7%. SIEGY has a trailing four-quarter earnings surprise of 33.5%, on average. The company currently has a long-term estimated earnings growth rate of 8.5% and a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

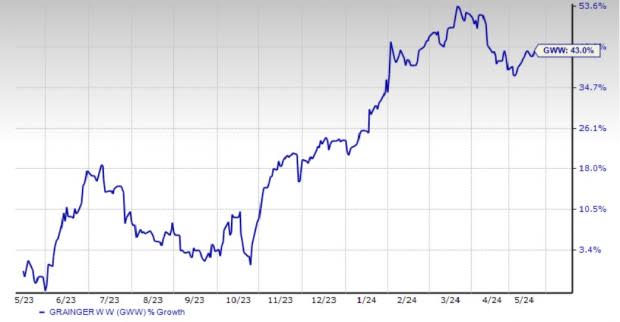

Price: SIEGY

Grainger: The company continues to deliver improved results, aided by margin improvements in its segments, as well as a strong operating performance. GWW is well-poised to gain from efforts to increase its customer base through incremental marketing investments and effective marketing strategies. The High Touch Solutions North America segment will continue to benefit from pricing actions and volume growth. The Endless Assortment segment is gaining from customer acquisitions at its Zoro and MonotaRO businesses. Cost-control measures undertaken by GWW will sustain margins. The company is also focused on improving the end-to-end customer experience by investing in its e-commerce and digital capabilities, and executing improvement initiatives within its supply chain.

Lake Forest, IL-based Grainger is a broad-line, business-to-business distributor of MRO supplies, and other related products and services. The Zacks Consensus Estimate for 2024 earnings has moved up 0.2% in the past 30 days. The consensus mark indicates growth of 7.3% from the prior-year reported number. GWW currently has a trailing four-quarter earnings surprise of 3.6%, on average. GWW has an estimated long-term earnings growth rate of 13% and a Zacks Rank #3 at present.

Price: GWW

Andritz: The company recently collaborated with Microsoft to drive innovation in the process industry, aiming to establish fully autonomous factories and a reliable data ecosystem using the ANDRITZ Metris digital platform and Microsoft Cloud for Manufacturing. This will also help the company speed up its internal processes. This marks a notable advancement in expediting the digital transformation within the manufacturing sector. Andritz continues to strengthen its promising Environment & Energy platform and recently acquired a 13.8% stake in Norwegian tech company HydrogenPro. Together, they will provide integrated solutions for the supply of green hydrogen plants. Given that ADRZY offers a broad product portfolio of sustainable solutions (renewable energy, recycling, biofuels, etc.), the solid and sustained demand from this sector will aid growth for ADRZY. The company has made 11 acquisitions from 2021 to 2023. It has outlined plans to continue its merger and acquisition strategy, focusing on existing business areas, while emphasizing service and digitalization initiatives.

Headquartered in Graz, Austria, Andritz offers a broad portfolio of innovative plants, equipment, systems, services and digital solutions for different industries and end markets. The Zacks Consensus Estimate for ADRZY’s fiscal 2024 earnings has been unchanged over the past 30 days. The company has an estimated long-term earnings growth rate of 5.5%. ADRZY currently carries a Zacks Rank #3.

Price: ADRZY

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Siemens AG (SIEGY) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

Andritz (ADRZY) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經