3 S&P 500 Banks With Solid Dividend Yield to Keep an Eye On

Bank stocks are in the spotlight. The year started with optimism about the Federal Reserve cutting the interest rates thrice. Since then, the central bank has dialed back the rate cut outlook to just one, but this rate-sensitive sector continues to draw investors’ interest.

The optimistic stance seems to be driven by decent economic growth, a modest rise in demand for loans as corporates/consumers realize the rates are likely to remain high for a longer duration and the banks’ initiatives to diversify revenues.

Hence, investors must watch fundamentally solid banks, which also offer a robust dividend yield. We believe that these S&P 500 banks — Comerica CMA, KeyCorp KEY and Truist Financial TFC — should remain on investors’ radar for earning solid dividends.

To choose these banks, we ran the Zacks Stocks Screener to identify stocks with a dividend yield in excess of 5.5%. Also, these three stocks currently carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

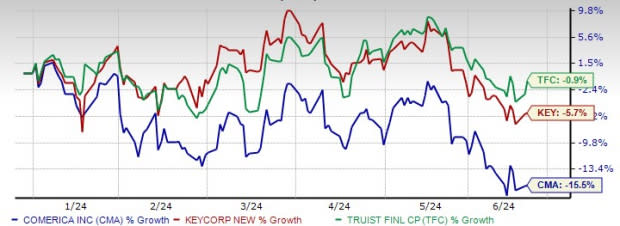

Additionally, all three bank stocks declined this year. Thus, these provide a good entry point for investors.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Now, let’s discuss the abovementioned banks in detail:

Dallas, TX-based Comerica is a banking and financial services company. The company delivers financial services in three primary geographic markets — Texas, California and Michigan — as well as Arizona and Florida.

We remain optimistic about Comerica’s income-generation capability, given its loan growth. Though loans declined in the first quarter of 2024 due to balance sheet management, a robust loan pipeline will support growth going forward. Driven by this and higher rates, the company’s net interest income (NII) continues to aid the top line.

Comerica’s focus on improving operational efficiency and reinvesting in strategic growth will drive future earnings power. The company’s efforts in product enhancements, improvement in sales tools and training, as well as improved customer analytics, bode well for robust growth.

The stock has a dividend yield of 6.03%. The company raised its quarterly dividend twice in the last five years. Check Comerica’s dividend history here.

Comerica Incorporated Dividend Yield (TTM)

Comerica Incorporated dividend-yield-ttm | Comerica Incorporated Quote

KeyCorp, headquartered in Cleveland, OH, is one of the leading regional banks in the country. The company provides a wide range of products and services, such as commercial and retail banking, commercial leasing, investment management, consumer finance and investment banking products.

KeyCorp is well-poised to gain from solid loans and deposit balances, higher interest rates and a robust balance sheet. The company has been witnessing top-line growth over the past several years aided by impressive growth in loans. Supported by decent loan demand, along with the company’s efforts to strengthen fee income, its top line is expected to keep improving.

KeyCorp’s business expansion efforts are commendable. Given the buyouts/expansion initiatives, it has strengthened its product suites and market share. The company is expected to continue with opportunistic acquisitions, which are likely to further help diversify revenues. Also, as demand for digital banking services continues to rise, the company has been consolidating its branch network, with management looking for opportunities to right-size its footprint.

The company has a dividend yield of 6.04%. In the last five years, KeyCorp increased its dividend payout thrice. Check KeyCorp’s dividend history here.

KeyCorp Dividend Yield (TTM)

KeyCorp dividend-yield-ttm | KeyCorp Quote

Truist Financial, headquartered in Charlotte, NC, is one of the largest commercial banks in the United States. The company conducts business operations primarily through its bank subsidiary, Truist Bank, and a few other non-bank subsidiaries.

Growth in loans, higher interest rates and Truist Financial’s efforts to improve fee income are likely to keep aiding financials. It has been recording an improvement in NII due to decent loan demand and rising rates.

Further, management remains open to strategic business restructuring initiatives to further bolster fee income. In sync with this, this May, the company sold its remaining 80% stake in its insurance subsidiary — Truist Insurance Holdings. Subsequently, the bank undertook strategic balance sheet repositioning to support NII going forward. These measures bolstered the bank's capitalization and liquidity profile.

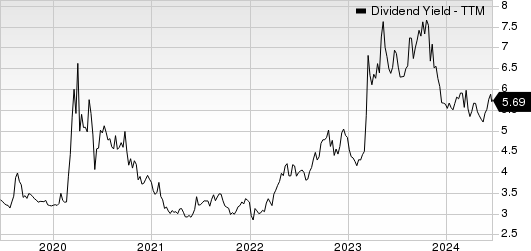

The company has a dividend yield of 5.69%. In the last five years, Truist Financial hiked its dividend payout thrice. Check Truist Financial’s dividend history here.

Truist Financial Corporation Dividend Yield (TTM)

Truist Financial Corporation dividend-yield-ttm | Truist Financial Corporation Quote

Conclusion

Furnishing one’s portfolio with dividend stocks shows prudence, as these provide a source of steady income and a cushion against market risks. Despite the benefits of dividend stocks, it is true that not every company can maintain its dividend-paying steak. So, investors must be judicious while picking dividend stocks for steady returns.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comerica Incorporated (CMA) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

Truist Financial Corporation (TFC) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經