AbbVie's (ABBV) Ovarian Cancer Therapy Meets Study Goal

AbbVie ABBV announced positive topline results from the phase II PICCOLO study, which evaluated Elahere (mirvetuximab soravtansine) in heavily pre-treated patients with FRα-positive platinum-sensitive ovarian cancer (PSOC).

The PICCOLO study achieved its primary endpoint — patients who were treated with Elahere achieved an objective response rate (ORR) of 51.9%. Though AbbVie did state that the key endpoint of median duration of response (DOR) was 8.25 months, it did not mention whether this endpoint met the study goal.

However, management did confirm that the drug’s safety profile was consistent with the findings from previously-conducted studies. No new safety concerns were identified. The company intends to report full data from the PICCOLO study at a future medical meeting.

Elahere was recently granted full approval by the FDA to treat patients with FRα-positive, platinum-resistant epithelial ovarian, fallopian tube or primary peritoneal adult cancer who have received one to three prior treatments. The drug is also approved for a similar indication in Europe.

Elahere is also being evaluated in multiple studies, both as monotherapy and in combination with other drugs, for ovarian cancer, which will expand the drug’s use in earlier lines of therapy and additional patient populations.

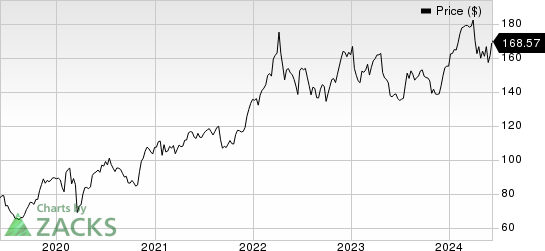

AbbVie’s shares have moved up 8.8% in the year compared with the industry’s 18.9% growth.

Image Source: Zacks Investment Research

A first-in-class antibody-drug conjugate (ADC), Elahere was added to AbbVie’s portfolio earlier this year in February following the acquisition of ImmunoGen for $10.1 billion. The acquisition also added some other promising ADC candidates in AbbVie’s pipeline, like pivekimab sunirine (in phase II studies for blastic plasmacytoid dendritic cell neoplasm and acute myeloid leukemia) and IMGN-151 (in phase I studies for ovarian and endometrial cancers).

ADCs are next-generation treatments that target cancer cells by delivering highly potent cancer-killing agents through a targeted antibody.

Through the ImmunoGen acquisition, management diversified its oncology pipeline and forayed into the ADC space, which has garnered interest from big pharma like AstraZeneca AZN, Merck MRK and Pfizer PFE. These companies have made multi-billion-dollar investments in this space to develop and market novel ADC drugs.

Last month, AstraZeneca announced plans to spend $1.5 billion to build its first manufacturing facility in Singapore which will cover the full manufacturing process for its ADC portfolio. AZN has a broad portfolio of in-house ADCs, including six wholly-owned ADCs in its clinical pipeline and many more in preclinical development.

This focus on ADCs comes from the success achieved by AstraZeneca from its only marketed ADC drug in its portfolio, Enhertu, which has been developed in collaboration with partner Daiichi Sankyo. Since its initial launch in 2019, Enhertu has shown an impressive initial uptake. During first-quarter 2024, Enhertu generated around $339 million in alliance revenues for AstraZeneca.

The AstraZeneca drug is presently approved across multiple indications, including advanced or metastatic HER2-positive gastric cancer, previously treated HER2-mutant metastatic non-small cell lung cancer (NSCLC) and metastatic HER2-positive and HER2-low breast cancer. The fifth indication, i.e., metastatic HER2-positive solid tumors, was approved by the FDA in April.

Pfizer entered into this space when it acquired ADC drugmaker Seagen last year for $43 billion. Post this acquisition, PFE added three ADCs to its portfolio — Adcetris (brentuximab vedotin), Padcev (enfortumab vedotin) and Tivdak (tisotumab vedotin) — all approved across solid tumors and hematologic malignancies. Per the deal, Pfizer also acquired Seagen’s proprietary ADC technology.

To boost its oncology portfolio, Merck entered into an agreement with Daiichi Sankyo last year to jointly develop and market three investigational ADC drugs for a total potential consideration of up to $22 billion. Merck’s deal with Daiichi involves three ADCs, namely patritumab deruxtecan, ifinatamab deruxtecan and raludotatug deruxtecan, which are across multiple solid tumor indications in different stages of clinical development. Per Merck, this deal holds multi-billion dollar worldwide commercial revenue potential for each company approaching the mid-2030s.

AbbVie Inc. Price

AbbVie Inc. price | AbbVie Inc. Quote

Zacks Rank

AbbVie currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經