AI Stocks Get Slammed: Time to Buy the Dip?

We've heard it many times this year: "Nvidia is the only thing holding up this market!" But is it really?

Nvidia (NVDA) is currently experiencing its second worst correction of 2024, now ~14% off its all-time high. And yet the S&P 500 has barely budged – it's a point off its all-time high.

Nvidia, Qualcomm and Broadcom Stocks Sell Off

Nvidia isn’t alone in this correction either, several other leading AI stocks have taken a hit over the last week, led primarily by fellow semiconductor stocks.

Along with Nvidia, Qualcomm (QCOM), and Broadcom (AVGO), who have been major beneficiaries of the AI boom have taken some heat as well, both down ~14% from their recent record highs.

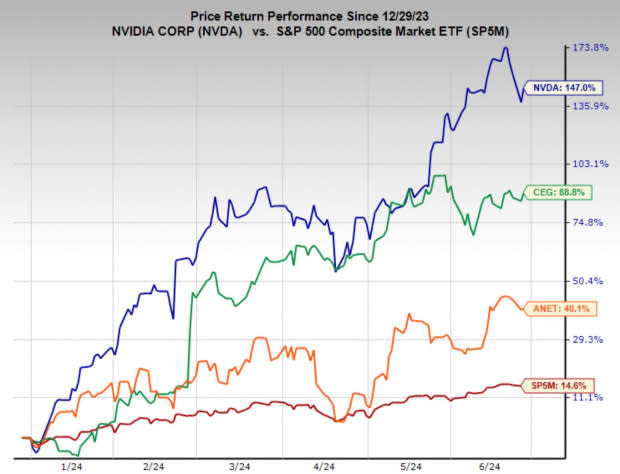

Despite the recent correction, these stocks are still up considerably year-to-date. Nvidia has gained 147% YTD, Broadcom 42% and Qualcomm 40% respectively.

Constellation Energy Corporation and Arista Networks Offer Top AI Opportunities

However, while this is a strong group of stocks, there are two AI-adjacent stocks that I think offer a better opportunity than Qualcomm and Broadcom. In addition to Nvidia, Constellation Energy Corporation (CEG) and Arista Networks (ANET) are two top Zacks rank stocks that are crushing the market and remain attractive investments.

Image Source: Zacks Investment Research

Constellation Energy Corporation Fuels the AI Boom

The AI boom is driving a surge in energy demand, and Constellation Energy Corporation is well-positioned to benefit. As a leading provider of clean and reliable nuclear power, CEG offers a stable energy source for the massive data centers that fuel AI innovation.

Unlike many utilities, CEG is a major player in the nuclear energy sector, one of the few clean and reliable baseload power sources available. This makes CEG a unique investment opportunity for those seeking exposure to the AI boom while also prioritizing a clean energy future. With nuclear power's consistent and powerful output, CEG can ensure the data centers powering AI advancements have the reliable energy they need to operate efficiently.

CEG also enjoys a Zacks Rank #1 (Strong Buy) rating and has enjoyed this top rank for months thanks to continuous earnings estimate upgrades. The earnings revision trend has been steadily climbing higher since mid-2023.

Finally, the technical chart setup on CEG stands out to me. After consolidating for the last two months, the price action has formed a compelling bull flag, which could lead to a breakout. If CEG share price can trade above the $224.50 level, it should signal a breakout and rapidly send the stock to new highs.

Image Source: TradingView

Arista Networks Enables AI Through Bandwidth Capacity

The AI revolution demands a high-speed information highway, and Arista Networks is building it. It provides the crucial networking infrastructure for the massive data flow required by AI applications.

ANET’s powerful hardware ensures smooth data movement, while their commitment to open standards allows for seamless integration with various AI components.

Arista goes beyond just hardware, offering software with advanced analytics to optimize network performance for AI workloads. They're even incorporating AI itself into their network management, creating a self-optimizing and secure foundation for the future of AI.

Arista Network’s stock price appreciation and earnings trend speak for themselves. Over the last five years the stock has compounded at an annual rate of 39%, which has been powered by an explosion in profits.

EPS have grown from $1.95 per share in 2020 to $6.69 per share in the trailing twelve months.

Not surprisingly, Arista Networks boasts a Zacks Rank #1 (Strong Buy) rating, reflected by recent analysts upgrades. Just this week, FY25 EPS was bumped higher again.

Image Source: Zacks Investment Research

Nvidia Leads the Revolution

When it comes to the AI boom, Nvidia stands out as a leader. Their powerful graphics processing units (GPUs) were originally designed for gaming but have proven to be perfectly suited for the complex calculations required by AI tasks.

Unlike traditional central processing units (CPUs), GPUs excel at handling the massive datasets and parallel processing needed for training and running AI models. This advantage has made Nvidia's GPUs the go-to choice for researchers and developers working on cutting-edge AI applications. As the demand for AI continues to surge, Nvidia is well-positioned to remain at the forefront of this technological revolution.

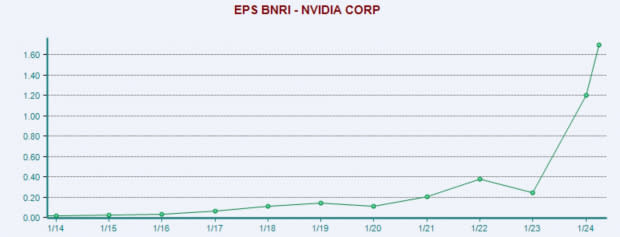

While the incredible price appreciation Nvidia’s stock has experienced over the last two years is truly astounding, even more impressive is the increase in sales and profits.

It is hard to understate just how rapidly sales and earnings grew at Nvidia. Between 2020 and today, annual sales have grown from $11 billion to $80 billion, and EPS have climbed from $0.11 per share to $1.70 per share.

Earnings have grown so fast that Nvidia actually has a lower earnings multiple today, than it did in 2020.

Nvidia has sat atop the Zacks rank for the better part of the last two years.

Image Source: Zacks Investment Research

Shares in AI Stocks Power Ahead

Don't let market pessimism scare you away. Many of these stocks are not unreasonably priced, and the AI boom shows promise of lasting for years. Just today, AI stocks surged again, led by Nvidia and closely followed by Arista Networks and Constellation Energy.

For hesitant investors, these three companies are worthy additions to consider for their portfolios.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Constellation Energy Corporation (CEG) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經