AMD Chief Lisa Su Foresees Massive Gains in AI and Data Center Efficiency

Advanced Micro Devices, Inc (NASDAQ:AMD) CEO Lisa Su emphasized the chip designer’s progress toward its 30×25 goal, aiming for a 30x increase in compute node power efficiency by 2025 and now foreseeing a potential 100x improvement by 2026-2027 at a recent event.

Su highlighted AMD’s foresight in addressing AI’s power consumption issues since 2021, focusing on improving data center power efficiency. She noted that the explosion of generative AI models like ChatGPT had intensified concerns about AI’s power appetite, Tom’s Hardware reports.

Also Read: Nvidia’s Leading Position Challenged as Industry Giants Support OpenAI’s New Developer Software

AMD set its 30×25 goal to improve data center efficiency, specifically targeting AI and HPC power consumption as critical challenges.

Su explained that the rapid expansion of data centers, driven by AI advancements, is straining public power grids.

Su pointed out that the computing requirements for AI model training are increasing at an unprecedented rate, outpacing advancements in computing and memory technology.

To address these challenges, AMD employs a multi-pronged strategy that includes silicon advancements, AI-specific architectures, system-level tuning, and hardware-software co-design initiatives.

Su highlighted the role of 3nm Gate All Around (GAA) transistors in improving power efficiency and performance, along with advanced packaging techniques to maximize compute-per-watt efficiency.

Su also emphasized the importance of data locality in reducing power consumption, citing AMD’s MI300X chip as an example of efficient design.

Moreover, Su stressed the benefits of hardware and software co-optimization, significantly boosting power efficiency and performance.

Recent reports indicated that Microsoft Corp (NASDAQ:MSFT) is considering integrating AMD’s MI300X AI chips into Azure.

Recent reports also flagged AMD gaining market share in the x86 processor market for client and server categories.

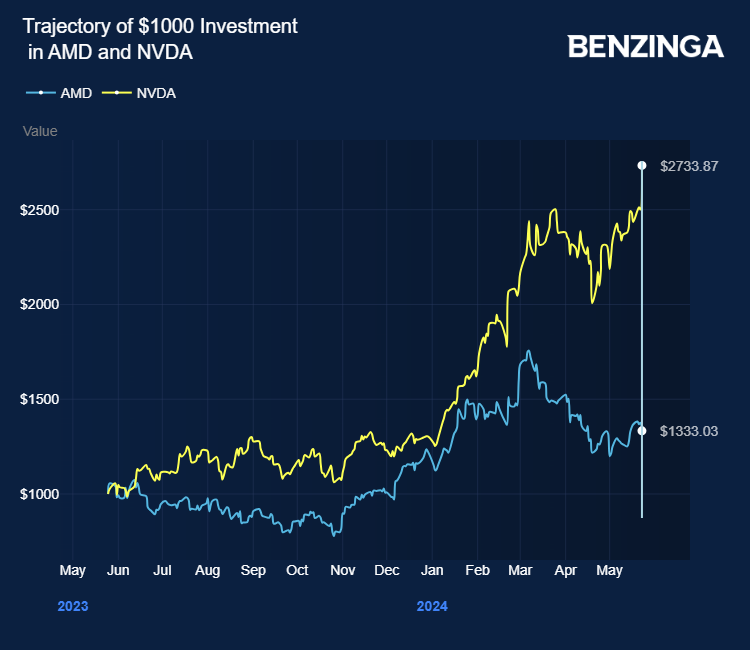

Analysts highlighted AMD’s, the next most vital AI beneficiary after Nvidia Corp (NASDAQ:NVDA) gains in the server CPU market and its successful capture of market share in the merchant accelerator sector.

AMD stock gained over 48% in the last 12 months. Investors can gain exposure to the stock via Advisor Managed Portfolios Trenchless Fund ETF (NYSE:RVER) and REX FANG & Innovation Equity Premium Income ETF (NASDAQ:FEPI).

Price Actions: AMD shares traded higher by 3.18% at $165.53 at the last check on Friday.

Also Read: Nvidia Set For Steady Gains With Software-Centric Shift And Blackwell Transition, Analysts Say

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article AMD Chief Lisa Su Foresees Massive Gains in AI and Data Center Efficiency originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

雅虎香港財經

雅虎香港財經