American Financial (AFG) Q1 Earnings Miss on Higher Expenses

American Financial Group, Inc. AFG reported first-quarter 2024 net operating earnings per share of $2.76, which missed the Zacks Consensus Estimate by 0.3%. The bottom line decreased 4.5% year over year.

American Financial’s results reflected a decline in investment income, lower underwriting profit, higher expenses and catastrophe losses, offset by improved net earned premiums.

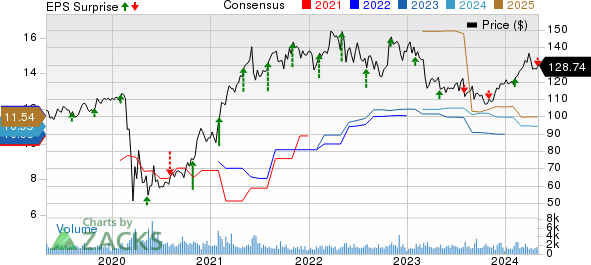

American Financial Group, Inc. Price, Consensus and EPS Surprise

American Financial Group, Inc. price-consensus-eps-surprise-chart | American Financial Group, Inc. Quote

Behind the Headlines

Total revenues of $1.8 billion increased 5.1% year over year in the quarter. The growth came on the back of higher P&C insurance net earned premiums and other income. The top line missed the Zacks Consensus Estimate by 0.2%.

P&C insurance net earned premiums of $1.5 billion climbed 7.5% year over year.

Net investment income decreased 8.7% year over year to $198 million in the quarter under review. The figure was lower than our estimate of $226.8 million.

Total cost and expenses increased 8.5% year over year to $1.6 billion due to higher P&C insurance losses & expenses and other expenses. The figure was lower than our estimate of $1.7 billion.

Segmental Update

The Specialty P&C Insurance segment generated $1.6 billion in net written premiums, which rose 8% year over year, attributable to strong performance across the Property & Transportation, Specialty Casualty and Specialty Financial. A combination of new business opportunities, increased exposures and a good renewal rate environment and additional crop premiums from the Crop Risk Services acquisition in the entire P&C group added to the growth.

While net written premiums in Property & Transportation Group grew 7% year over year to $591 million in the quarter, the same at Specialty Casualty Group increased 4% year over year to $751 million. Further, net written premiums at Specialty Financial jumped 27% year over year while the same at Other divisions decreased 5% year over year.

Pre-tax core operating earnings of the P&C Insurance segment of $340 million in the first quarter decreased 2.8% year over year.

The segment’s underwriting profit dipped 0.6% year over year to $154 million in the quarter. The decrease was due to lower year-over-year underwriting profit in the Specialty Casualty Group.

The combined ratio deteriorated 90 basis points (bps) year over year to 90.1% at the segment due to a deterioration of 230 bps in Specialty Casualty, offset by an improvement of 200 bps in Property & Transportation Group and a rise of 20 bps in Specialty Financial.

Catastrophe losses were $34 million, wider than the year-ago loss of $31 million.

Financial Update

American Financial exited the first quarter with cash and investments of $15.2 billion, which declined 0.05% from the 2023-end level.

As of Mar 31, 2024, long-term debt totaled $1.4 billion, which remained flat from the end of 2023.

As of Mar 31, 2024, the company’s book value per share (excluding unrealized gains/losses on fixed maturities) was $54.32, down 0.7% from the 2023-end level.

Annualized return on equity came in at 21.2% for the first quarter, which expanded 230 bps year over year.

Prudent Capital Deployment

AFG declared cash dividends of $3.21 per share in the first quarter, which include a $2.50 per share special dividend paid in February.

Zacks Rank

American Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other P&C Insurers

Cincinnati Financial Corporation CINF reported first-quarter 2024 operating income of $1.72 per share, which beat the Zacks Consensus Estimate by 1.7%. The bottom line surged 93.2% year over year. Total operating revenues in the quarter under review were $2.3 billion, which missed the Zacks Consensus Estimate by 1.4%. The top line, however, improved 8.8% year over year. Net written premiums climbed 11% year over year to $2.2 billion.

Investment income, net of expenses, increased 17% year over year to $245 million, as bond interest grew 21% and dividends from the equity portfolio jumped 9%. The figure was higher than our estimate of $227.7 million. Total benefits and expenses of Cincinnati Financial increased 0.4% year over year to $1.9 billion. The figure was lower than our estimate of $2 billion. In its property & casualty insurance business, Cincinnati Financial recorded an underwriting income of $131 million against the year-ago loss of $10 million. The figure was higher than our estimate of $60.7 million underwriting income.

AXIS Capital Holdings Limited AXS posted first-quarter 2024 operating income of $2.57 per share, beating the Zacks Consensus Estimate by 1.2%. The bottom line increased 10.3% year over year. Total operating revenues of $1.4 billion missed the Zacks Consensus Estimate by 2.8%. The top line, however, rose 5% year over year. Net investment income jumped 25% year over year to $167 million. Our estimate was $164.8 million.

Total expenses in the quarter under review increased 0.7% year over year to $1.15 billion. Our estimate was $1.1 billion. Pre-tax catastrophe and weather-related losses, and net of reinsurance were $20 million. This compares favorably with the year-ago loss of $38 million. AXIS Capital’s underwriting income of $145.6 million increased 4.5% year over year. Our estimate was $141.5 million. The combined ratio deteriorated 20 bps to 91.1.

Chubb Limited CB reported first-quarter 2024 core operating income of $5.41 per share, which outpaced the Zacks Consensus Estimate by 2.3%. The bottom line climbed 22.7% year over year. Net premiums written improved 14.1% year over year to $12.2 billion in the quarter. Our estimate was $11.4 billion, while the Zacks Consensus Estimate was pegged at $13 billion.

Net investment income was $1.4 billion, up 25.7% year over year. The Zacks Consensus Estimate was pegged at $1.3 billion, while our estimate for the same was $1.4 billion. P&C underwriting income was $1.4 billion, up 16.7% year over year. Global P&C underwriting income, excluding Agriculture, was $1.3 billion, up 10.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chubb Limited (CB) : Free Stock Analysis Report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經