Arcos Dorados (ARCO) Q1 Earnings Fall Y/Y, Sales Top Estimates

Arcos Dorados Holdings Inc. ARCO reported first-quarter 2024 results, with revenues beating the Zacks Consensus Estimate. The top line increased year-over-year, while the bottom line fell from the prior-year quarter’s figure.

During the quarter, the company stated benefits from the integration of the business model with the Three-D's strategy (Digital, Delivery, and Drive-thru). Also, the emphasis on pricing, product assortment and guest traffic management resulted in comparable sales growth exceeding inflation rates across its operations.

Following the results, the company’s shares fell 5.7% during trading hours on May 15. Negative investor sentiments were witnessed as the company cited sales pressure in the short term due to the persistent challenging macroeconomic conditions.

Delving Deeper

During the first quarter, the company reported adjusted earnings per share (EPS) of 14 cents. The bottom line fell 22% year over year from 18 cents reported in the year-ago quarter.

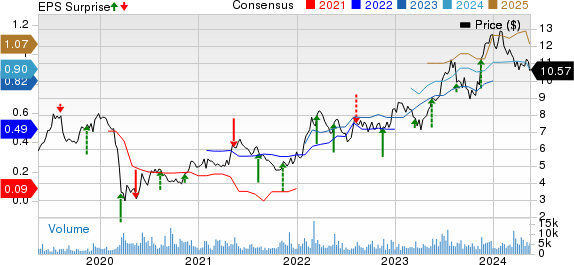

Arcos Dorados Holdings Inc. Price, Consensus and EPS Surprise

Arcos Dorados Holdings Inc. price-consensus-eps-surprise-chart | Arcos Dorados Holdings Inc. Quote

During the quarter, the company reported revenues of $1.08 billion, beating the consensus mark of $1.04 billion. The top line increased 9.1% on a year-over-year basis.

Off-premise sales, including Delivery and Drive-thru, rose 14% (in U.S. dollars), contributing 44% to systemwide sales. On-premise sales rose by 7% year over year and contributed 56% to systemwide sales.

Digital channel sales during the quarter rose 30% year over year and represented 55% of systemwide sales. The Company’s Digital platform benefitted from strong penetration of sales through Self-order kiosks and the Own Delivery and Mobile Order and Pay functionalities on the Mobile App.

During the first quarter, comparable restaurant sales increased 38.6% year over year, courtesy of strong guest volume growth.

Operating Highlights

During the first quarter, operating income amounted to $67.6 million compared with $66.3 million reported in the prior-year quarter.

During the quarter, food and paper costs came in at $361 million compared with $333.9 million reported in the prior-year quarter. General and administrative expenses in the first quarter came in at $68.7 million compared with $65.6 million in the prior-year period.

Adjusted EBITDA in the first quarter came in at $108.9 million compared with $100.5 million reported in the prior-year quarter.

Balance Sheet

Total cash and cash equivalents as of Mar 31, 2024, totaled $127.5 million compared with $196.7 million on Dec 31, 2023.

Net debt (total financial debt minus total cash and cash equivalents) as of Mar 31, 2024, was $577.5 million, up from $481.3 million at 2023-end.

Store Developments

During the first quarter, the company opened 22 Experience of the Future (EOTF) restaurants, including 19 free-standing units. The Brazil division opened 11 EOTF restaurants with 10 new free-standing units.

Zacks Rank

Arcos Dorados currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Recent Retail-Wholesale Releases

Yum China Holdings, Inc. YUMC reported impressive first-quarter 2024 results, with earnings and revenues beating the Zacks Consensus Estimate. The top and the bottom line increased on a year-over-year basis. The upside can be attributed to robust total system sales growth and new unit contribution.

During the quarter, YUMC reported adjusted EPS of 71 cents, beating the Zacks Consensus Estimate of 66 cents. The bottom line moved up 2.9% from 69 cents reported a year ago. Quarterly revenues of $2.96 billion outpaced the consensus mark of $2.94 billion. The top line inched up 1% on a year-over-year basis. Excluding foreign currency translation, revenues increased 7% year over year.

Chipotle Mexican Grill, Inc. CMG released stellar first-quarter 2024 results, with earnings and revenues beating the Zacks Consensus Estimate. The top and the bottom line increased on a year-over-year basis. During the quarter, the company reported benefits from enhanced throughput and effective marketing initiatives like Braised Beef Barbacoa and Chicken Al Pastor, leading to strong sales and transaction growth. The company stated that the momentum continued into April.

During the quarter, CMG reported adjusted EPS of $13.37, outpacing the Zacks Consensus Estimate of $11.63. The bottom line increased 27.3% from $10.50 reported in the year-ago quarter. Quarterly revenues of $2.7 billion surpassed the consensus mark of $2.68 billion by 1%. The top line rose 14.1% on a year-over-year basis on the back of strong comparable restaurant sales growth and new restaurant openings.

McDonald's Corporation MCD posted mixed first-quarter 2024 results, with earnings missing the Zacks Consensus Estimate and revenues beating the same. The top and the bottom line increased on a year-over-year basis.

During the quarter, MCD registered adjusted EPS of $2.70, missing the Zacks Consensus Estimate of $2.71. EPS increased 2% year over year. Quarterly net revenues of $6,169 million beat the consensus mark of $6,168 million. The top line rose 5% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McDonald's Corporation (MCD) : Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Yum China (YUMC) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經