Ares Explores Deal for Real Estate Investor GLP Capital Partners

(Bloomberg) -- Ares Management Corp. is exploring a potential deal for real estate investment firm GLP Capital Partners Ltd., which could rank as one of the biggest combinations in the alternative asset management industry in recent years, people with knowledge of the matter said.

Most Read from Bloomberg

Wells Fargo Fires Over a Dozen for ‘Simulation of Keyboard Activity’

Apple to ‘Pay’ OpenAI for ChatGPT Through Distribution, Not Cash

Tesla Investors Back Musk’s $56 Billion Pay Deal, Texas Move

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

Tech Powers Stocks as Adobe Surges in Late Trading: Markets Wrap

The Los Angeles-based firm is in talks on a possible merger with GCP’s operations outside China, some of the people said, asking not to be identified because the information is private. That would add around $66 billion of assets under management spread across Japan, Southeast Asia, Europe, the US and Brazil, according to one of the people.

GCP runs dozens of funds that deploy money into real assets and private equity with a focus on logistics property, digital infrastructure and renewable energy. Large investment firms have been increasingly pursuing mergers with rivals as they look to push into new areas and bulk up their assets under management, playing to a preference for one-stop shops offering a range of strategies.

Shares of Ares fell as much as 5.7% in Thursday trading, the biggest intraday decline since March 2023. They were down 3.5% at 1:04 p.m. in New York, giving the company a market value of about $41 billion.

Expansion Drive

Ares has been expanding via acquisitions, agreeing last year to buy Asian private equity firm Crescent Point Capital. It also acquired BootstrapLabs, an AI-focused venture capital firm. Ares has said it aims to boost its assets under management more than 75% to surpass $750 billion by the end of 2028.

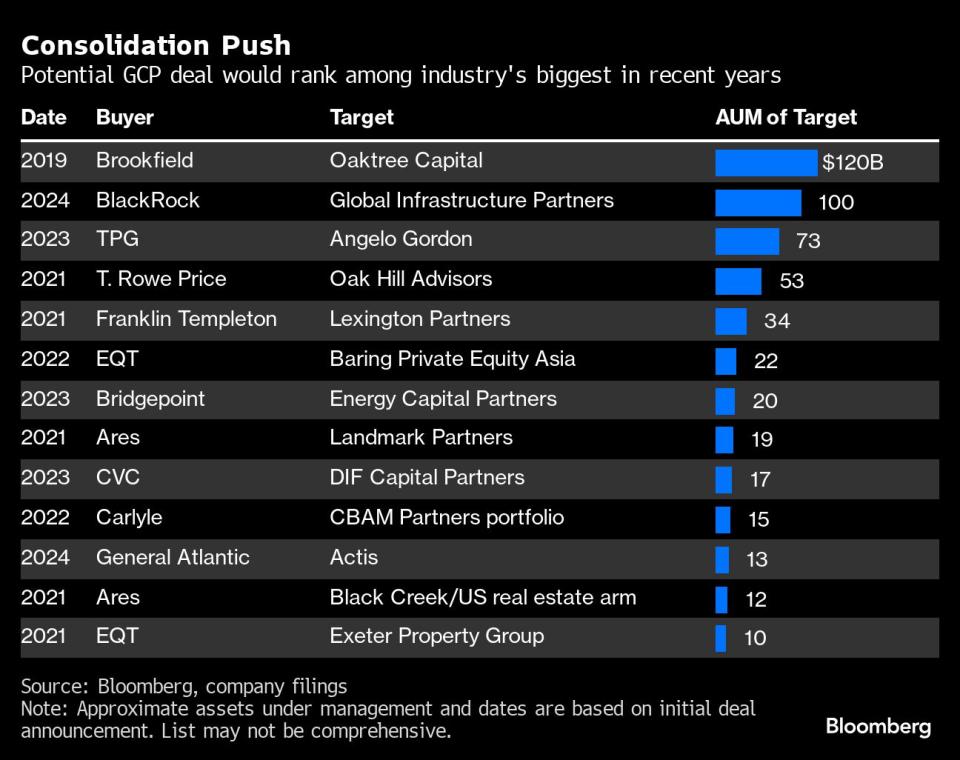

The latest potential deal would rank among the sector’s biggest combinations of the past few years based on the amount of capital GCP oversees. BlackRock Inc. agreed in January to acquire Global Infrastructure Partners for about $12.5 billion, which turned the world’s largest money manager into a major infrastructure player and added over $100 billion of assets.

Other major transactions include TPG Inc.’s agreement last year to pay $2.7 billion for credit specialist Angelo Gordon, which had about $73 billion under management at the time of announcement. T. Rowe Price Group Inc. agreed to acquire Oak Hill Advisors, which oversaw about $53 billion, for as much as $4.2 billion in 2021. European buyout firm EQT AB has also been bulking up, reaching a deal in 2022 to buy Baring Private Equity Asia Ltd.

The structure of any potential deal hasn’t been finalized, and there’s no certainty the deliberations will lead to a transaction, the people said. Other suitors could also emerge, according to the people. Representatives for Ares and GCP declined to comment.

GLP Capital Partners grew out of Singapore-based GLP Pte, a developer and operator of warehouses that has benefitted amid booming e-commerce spending in recent years. GLP set up a fund management arm in 2011 to invest third-party money in the space, and it became a separate entity known as GLP Capital Partners following a series of transactions in 2022.

--With assistance from Dinesh Nair, Jan-Henrik Förster and Elffie Chew.

(Updates shares in fourth paragraph.)

Most Read from Bloomberg Businessweek

Israeli Scientists Are Shunned by Universities Over the Gaza War

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

©2024 Bloomberg L.P.

雅虎香港財經

雅虎香港財經