Beyond Inc (BYON) Reports Q1 2024 Earnings: A Detailed Review Against Analyst Expectations

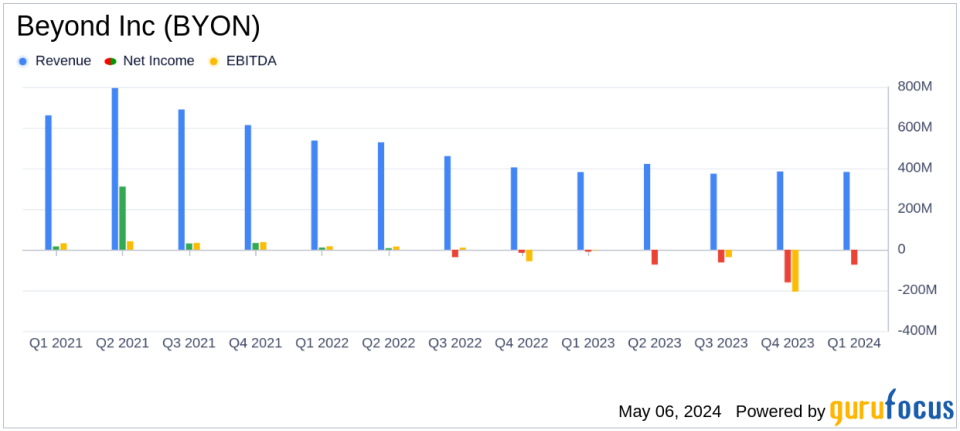

Revenue: Reported at $382 million, a slight increase of 0.3% year-over-year, falling short of estimates of $389.26 million.

Net Loss: Deepened to $74 million, significantly above the estimated loss of $36.91 million.

Earnings Per Share (EPS): Recorded a diluted net loss per share of $1.62, underperforming against the estimated loss per share of $0.87.

Active Customers: Grew by 26% year-over-year, reaching 6 million, highlighting strong customer growth dynamics.

Orders Delivered: Increased by 27% year-over-year to 2.2 million, indicating robust transaction volume growth.

Gross Profit: Amounted to $74 million, representing 19.5% of total net revenue.

Cash Position: Ended the quarter with $256 million in cash and cash equivalents, down from $302 million at the end of the previous period.

On May 6, 2024, Beyond Inc (NYSE:BYON) released its 8-K filing, unveiling the financial outcomes for the first quarter ended March 31, 2024. The company, a prominent online retailer known for its diverse product offerings ranging from home furnishings to electronics, reported a slight revenue increase and a significant rise in transaction volume, alongside strategic acquisitions and brand developments.

Company Overview

Beyond Inc operates through a direct business model, selling products from its own inventory, and a partner business model, offering goods from third-party manufacturers and distributors. The company's revenue primarily comes from its partner business and is predominantly generated in the U.S. market. The home and garden category is a significant revenue driver for Beyond Inc.

Financial Highlights and Analyst Comparisons

The first quarter of 2024 saw Beyond Inc achieving a total net revenue of $382 million, a marginal increase of 0.3% year-over-year, slightly missing the analyst's expectation of $389.26 million. The company reported a net loss of $74 million, with a diluted net loss per share of $1.62, which was notably worse than the estimated loss per share of $0.87. This performance reflects challenges in profitability despite the growth in revenue and customer base.

Operational Achievements and Strategic Moves

During the quarter, Beyond Inc delivered 2.2 million orders, marking a 27% increase from the previous year, and grew its active customer base to 6 million, a 26% year-over-year rise. These metrics highlight the company's successful efforts in expanding its market reach. Additionally, the acquisition of Zulily and the early soft launch of the Overstock site are strategic moves aimed at diversifying and strengthening Beyond Inc's brand portfolio.

Management's Strategic Outlook

Executive Chairman Marcus Lemonis emphasized the company's focus on building a portfolio of profitable brands and enhancing customer lifetime value. The strategic acquisition of Zulily and investments in customer relationship management platforms are part of these efforts. CFO Adrianne Lee pointed out the focus on sustainable growth through prudent investments and cost management, aiming for improved profitability and shareholder returns.

Financial Statements Analysis

The company's gross profit stood at $74 million, representing 19.5% of total net revenue. The operating loss was reported at $58 million, and the adjusted EBITDA was negative $48 million, indicating challenges in operational efficiency and cost management. The balance sheet shows a healthy cash position of $256 million, providing the company with a solid foundation to support its strategic initiatives.

Investor and Market Implications

The financial performance of Beyond Inc, particularly the wider-than-expected loss per share and the minimal revenue growth, suggests areas of concern for investors. However, the strategic acquisitions and the expansion of customer base could set the stage for future growth. Investors and market watchers will likely keep a close eye on how the company's strategic initiatives unfold in the coming quarters.

For a deeper dive into Beyond Inc's financial details and future outlook, interested readers can access the full earnings report and additional investor resources on the company's investor relations website.

Explore the complete 8-K earnings release (here) from Beyond Inc for further details.

This article first appeared on GuruFocus.

雅虎香港財經

雅虎香港財經