BJ's Wholesale (BJ) Soars With Membership Growth and Innovation

In the ever-evolving retail landscape, BJ's Wholesale Club Holdings, Inc. BJ has been making significant strides, outpacing industry peers with robust performance and strategic initiatives. As the sector continues to evolve, BJ's Wholesale Club is not just keeping up but setting new benchmarks.

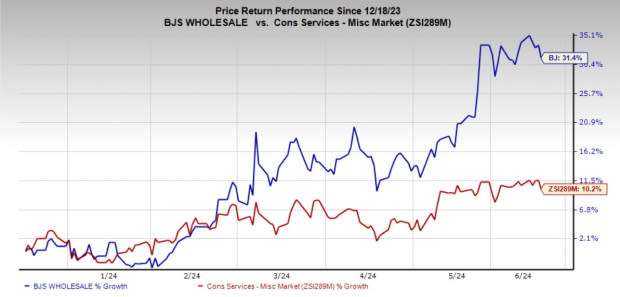

Shares of this operator of warehouse clubs have climbed 31.4% in the past six months compared with the industry’s rise of 10.2%. Sturdy membership trends, assortment initiatives, enhanced digital capabilities and a robust real estate pipeline have been aiding in sustaining decent performance. Hovering close to its 52-week high of $89.40, there is a likelihood that this Westborough, MA-based company will continue with its upward trajectory.

Strategies Unveiled

BJ's Wholesale Club’s commitment to bolstering marketing and merchandising capabilities, coupled with its foray into high-demand categories and expansion of its own-brand portfolio, has yielded remarkable results. The company has been steadily increasing its footprint, targeting high-growth regions and underserved markets. This methodical approach ensures maximum return on investment and helps BJ's tap into new customer bases. It plans to open 11 more clubs in the back half of fiscal 2024.

The membership model at BJ’s Wholesale Club is another cornerstone of its success. With consistent growth in renewals and new sign-ups, BJ's offers members significant savings on a wide array of products, which strengthens customer loyalty. These have played a pivotal role in a notable surge in the membership fee income.

In the first quarter of fiscal 2024, the membership fee income witnessed a year-over-year increase of 8.6%, fueled by strong renewal rates and successful membership acquisition. We foresee a sustained improvement in the membership fee income as new club openings ramp up. For fiscal 2024 and 2025, we expect the membership fee income to increase at a rate of approximately 6.9% and 6%.

Image Source: Zacks Investment Research

BJ's Wholesale Club's focus on expanding digital capabilities is another key aspect of its growth trajectory. Offering members convenient options such as same-day delivery, curbside pick-up and buy online and pick up in-club, the company ensures an engaging and seamless digital shopping experience. A robust digital portfolio, encompassing platforms like Bjs.com, BerkleyJensen.com, Wellsleyfarms.com and the BJ’s mobile app, underscores the commitment to digital excellence.

Management believes that digitally engaged members have higher average baskets and make more trips per year than members who shop in-club only. Digitally enabled comparable sales rose 21% in the first quarter of fiscal 2024. Clubs fulfill approximately 90% of digitally enabled sales.

Conclusion

BJ's Wholesale Club's growth strategies, effective price management, positive membership trends and digitization efforts are anticipated to continue supporting comparable sales trends. This Zacks Rank #3 (Hold) company aims for mid-single-digit revenue growth and high-single to low-double-digit earnings per share increases. Its long-term target also indicates low-to-mid single-digit comparable sales growth, excluding gasoline sales.

3 Picks You Can’t Miss Out On

Here, we have highlighted three better-ranked stocks, namely Vital Farms VITL, Ollie's Bargain Outlet OLLI and Tractor Supply Company TSCO.

Vital Farms offers a range of produced pasture-raised foods. It currently sports a Zacks Rank #1 (Strong Buy). VITL has a trailing four-quarter average earnings surprise of 102.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 22.5% and 59.3%, respectively, from the year-ago reported numbers.

Ollie's Bargain, the extreme-value retailer of brand-name merchandise, currently carries a Zacks Rank #2 (Buy). OLLI has a trailing four-quarter earnings surprise of 10.4%, on average.

The Zacks Consensus Estimate for Ollie's Bargain’s current financial-year sales and earnings implies growth of around 7.9% and 13.1%, respectively, from the year-ago reported numbers.

Tractor Supply Company, which operates as a rural lifestyle retailer, currently carries a Zacks Rank #2. TSCO has a trailing four-quarter earnings surprise of 2.7%, on average.

The Zacks Consensus Estimate for Tractor Supply Company’s current financial-year sales and earnings calls for growth of around 3% and 2.5%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經