BlackRock (BLK) Intends to Expand Overseas Offerings in Japan

BlackRock Inc.’s BLK Japan unit plans to boost its investment offerings to cater to the needs of overseas clients. This move aligns with the company’s organic growth strategy of product expansion.

Hiroyuki Arita, CEO of BlackRock Japan, said in an interview with Bloomberg that since last year, the company has increased the headcount of portfolio managers, analysts and other personnel associated with active management of Japan equities by roughly 20% in order to attract foreign funds.

At present, the Japan unit is primarily focused on addressing the overseas investment needs of local clients. Nonetheless, given the ongoing corporate governance changes and an emphasis on decarbonization in the country, foreign investors are likely to enhance their asset allocation in Japan, Arita stated.

BlackRock remains interested in further hiring to increase its staff in Japan as business grows, Arita added.

In the past, BLK has been engaged in strategic initiatives to boost its product offerings and deepen its market share. Last month, the company completed the acquisition of SpiderRock to boost its separately managed accounts (SMAs) offerings. This strengthens the company’s capabilities to provide a robust platform to its clients with customized SMA solutions.

Moreover, this April, BlackRock entered into an agreement with Public Investment Fund (PIF) to establish a Riyadh-based multi-asset class investment platform. The platform will be backed by an initial cash injection of up to $5 billion by the PIF, subject to certain milestones achieved. This move aims to encompass investment strategies across a diverse range of asset classes, thus leading to an expansion in offerings.

These efforts are expected to keep supporting BlackRock’s aim to diversify revenues and footprint.

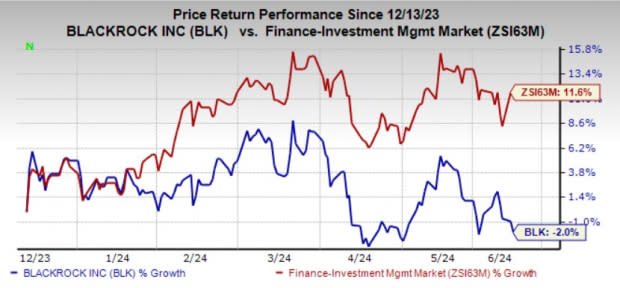

BlackRock’s shares have lost 2% in the past six months against the industry’s 11.6% growth.

Image Source: Zacks Investment Research

BLK presently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Financial Services Firms Taking Similar Steps

Earlier this month, The Bank of New York Mellon BK announced a bundled offering through Pershing, its subsidiary, enabling advisors to gain accessibility to a wide range of capabilities across BNY Mellon’s leading platforms, including BNY Mellon Investment Management and BNY Mellon Advisors.

The offering aims to cater to investors’ financial needs, which are becoming more complex over time. Through bundling, BK will be delivering a holistic, comprehensive and simplified offering to enable advisors to focus more of their time on addressing clients’ requirements.

Last month, Stifel Financial Corp SF and Marex Group PLC MRX entered into a prime brokerage referral partnership. This will enable both firms to use their broker-dealer affiliates to cater to their hedge fund and investment management clients in a better way.

Under the terms of the partnership, Stifel’s institutional sales and trading group will provide MRX’s trading and execution capabilities to its hedge fund’s institutional clients and investment managers. The services that will be part of this include multi-asset-class custody, financing, securities lending, and capital introduction. On the other hand, Marex’s institutional client base will gain accessibility to SF’s sophisticated research, banking and corporate access offerings.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Marex Group PLC (MRX) : Free Stock Analysis Report

Stifel Financial Corporation (SF) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經