Chemours (CC) Earnings Beat, Revenues Miss Estimates in Q1

The Chemours Company CC logged profits of $52 million or 34 cents per share in first-quarter 2024, down from the year-ago quarter's profit of $145 million or 96 cents.

Barring one-time items, earnings came in at 32 cents per share. It beat the Zacks Consensus Estimate of 25 cents.

The company reported net sales of $1,350 million in the first quarter, down roughly 12% year over year. It fell short of the Zacks Consensus Estimate of $1,360.3 million. The downside was primarily attributed to a 23% decline in the Advanced Performance Materials unit, a 7% decrease in Titanium Technologies and an 8% fall in the Thermal & Specialized Solutions Segment. Volumes in the quarter fell 6% while price declined 5%.

The Chemours Company Price, Consensus and EPS Surprise

The Chemours Company price-consensus-eps-surprise-chart | The Chemours Company Quote

Segment Highlights

The Titanium Technologies division recorded revenues of $588 million in the quarter, marking a 7% decline compared to the previous year. This was below our estimate of $592.5 million. The downside was due to a 7% decline in price with volume and currency remaining relatively stable.

In the Thermal & Specialized Solutions segment, revenues saw an 8% year-over-year decline, reaching $449 million in the reported quarter. It fell short of our estimate of $458.1 million. The downside was attributed to a 6% volume decrease and 2% price decline.

Revenues in the Advanced Performance Materials unit amounted to $299 million, marking a decline of 23% year over year. It surpassed our estimate of $290 million. The decline was primarily driven by an 18% drop in volumes and a 5% decrease in pricing.

Financials

Chemours ended the quarter with cash and cash equivalents of $746 million, down around 9% year over year. Long-term debt was $3,968 million, up roughly 10% year over year.

Cash used in operating activities was $290 million in the reported quarter.

Outlook

Moving ahead, CC expects Titanium Technologies to achieve sequential net sales growth of around 15% in the second quarter of 2024, reflecting the earlier communicated improvement in its TiO2 orderbook. Adjusted EBITDA growth is forecast to be in-line with the growth in net sales. Higher volumes and improved fixed cost absorption are projected to be partly offset by the shift in timing of higher-cost ore consumption, much of which is expected for the second quarter.

For the second quarter, Chemours sees consolidated net sales to rise around 15% sequentially. Consolidated adjusted EBITDA is expected to increase roughly 15% on a sequential comparison basis.

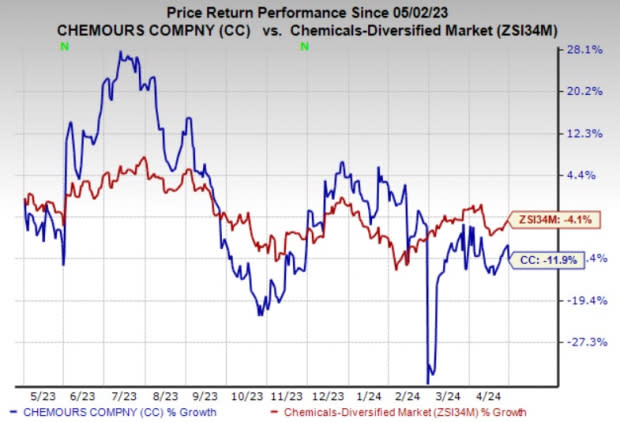

Price Performance

Shares of Chemours are down 11.9% in the past year compared with the industry’s fall of 4.1%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Chemours currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth a look in the basic materials space include Gold Fields Limited GFI, sporting a Zacks Rank #1 (Strong Buy), and L.B. Foster Company FSTR and American Vanguard Corporation AVD, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GFI’s first-quarter earnings is pegged at 22 cents per share. The consensus estimate for GFI’s first-quarter earnings has been stable in the past 60 days.

L.B. Foster is slated to report first-quarter results on May 7. The consensus estimate for FSTR’s first-quarter earnings is pegged at a loss of 16 cents per share. The company’s shares have rallied 114.7% in the past year.

American Vanguard is expected to report first-quarter results on May 14. The consensus estimate for AVD’ first-quarter earnings is pegged at 8 cents per share, indicating a year-over-year rise of 14.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gold Fields Limited (GFI) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

American Vanguard Corporation (AVD) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經