Cheniere Energy Partners LP (CQP) Q1 2024 Earnings: Surpasses Revenue Forecasts Despite Net ...

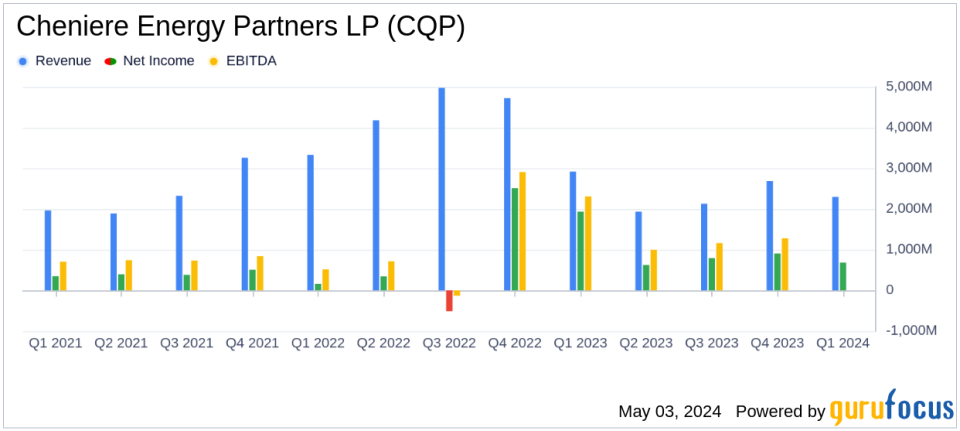

Revenue: $2.3 billion for Q1 2024, down 21% year-over-year, exceeding estimates of $2.205 billion.

Net Income: $682 million for Q1 2024, a significant decrease of 65% from $1.935 billion in Q1 2023, surpassing estimates of $526.86 million.

Earnings Per Share (EPS): Reported at $1.18, well above the estimated $0.97.

Adjusted EBITDA: Reached $1.0 billion, slightly below the previous year's $1.026 billion.

LNG Exported: Increased to 418 TBtu in Q1 2024 from 403 TBtu in Q1 2023, marking a 4% rise.

Capital Resources: Total available liquidity stood at approximately $2.1 billion as of March 31, 2024.

Distribution Guidance: Reconfirmed full year 2024 distribution guidance of $3.15 - $3.35 per common unit.

On May 3, 2024, Cheniere Energy Partners LP (NYSE:CQP) disclosed its financial outcomes for the first quarter of 2024, revealing a mix of surpassing revenue expectations and a notable decline in net income. The detailed earnings were published in their recent 8-K filing.

Cheniere Energy Partners, known for its ownership of the Sabine Pass LNG terminal and the Creole Trail Pipeline, reported a revenue of $2.3 billion for the quarter, a decrease from the previous year's $2.9 billion but still above the analyst's expectation of $2.2 billion. However, net income significantly dropped to $682 million from $1.9 billion in the same quarter last year, influenced largely by a $1.2 billion unfavorable change in the fair value of derivative instruments.

Financial Performance Analysis

The company's Adjusted EBITDA stood at $1.0 billion, slightly down by 3% from the previous year, reflecting challenges in maintaining margins per MMBtu of LNG delivered. Despite these hurdles, Cheniere managed to increase its LNG export volumes, marking a 4% rise in total TBtu exported.

Cheniere's strategic financial management was evident with a robust liquidity position of approximately $2.1 billion as of March 31, 2024. This includes cash, cash equivalents, and available commitments under various credit facilities, ensuring the company's operational and strategic flexibility.

Operational Highlights and Future Outlook

The company continues to advance its SPL Expansion Project, aiming to boost its production capacity significantly. The project's progress, coupled with regulatory applications to the FERC and DOE, underscores Cheniere's commitment to cementing its leadership in the LNG market.

Moreover, Cheniere reaffirmed its full-year 2024 distribution guidance, projecting a distribution per unit of $3.15 to $3.35. This forecast reflects the company's steady operational execution and strategic initiatives aimed at long-term value creation for its unitholders.

Investor Considerations

While the sharp decline in net income might concern some investors, the underlying reasonsprimarily non-cash changes in the valuation of derivative instrumentssuggest less impact on the operational cash flow. Furthermore, the company's ability to exceed revenue forecasts and maintain a solid liquidity position provides a cushion against operational volatilities.

Cheniere's ongoing expansion projects and strategic market positioning are critical for investors to consider, especially those looking at long-term growth and stability in the energy sector.

For more detailed information, investors and stakeholders are encouraged to review the full earnings report and tune into Cheniere's upcoming investor conference call, as detailed in their recent filings and press releases.

As Cheniere Energy Partners LP continues to navigate the complexities of the global energy market, its strategic initiatives and robust operational framework highlight its potential to maintain a leading position in the LNG industry.

Explore the complete 8-K earnings release (here) from Cheniere Energy Partners LP for further details.

This article first appeared on GuruFocus.

雅虎香港財經

雅虎香港財經