FDA Expands AbbVie's (ABBV) Epkinly Label in Follicular Lymphoma

AbbVie ABBV announced that the FDA approved its lymphoma drug Epkinly (epcoritamab) for a second indication — follicular lymphoma (FL). The drug has been developed in partnership with Genmab GMAB.

The FDA approved Epkinlyunder the accelerated pathway to treat adults with relapsed or refractory (R/R) FL after two or more lines of therapies. The agency initially granted accelerated approval to the drug last year to treat patients with R/R diffuse large B-cell lymphoma (DLBCL) and high-grade B-cell lymphoma who have received at least two lines of therapies.

Post the label expansion, the AbbVie/Genmab drug is the first T-cell-engaging bispecific antibody approved in the U.S. to treat adult patients with R/R FL and R/R DLBCL who have already received two or more treatments.

FL is the most common form of indolent or slow-growing form of non-Hodgkin's lymphoma (NHL), while DLBCL is the most common form of aggressive or fast-growing form of NHL.

The FDA approval is based on data from the FL cohort of the phase I/II EPCORE NHL-1 study. Data from the study showed that patients who were treated with the drug achieved an overall response rate (ORR) of 82%, including a complete response (CR) rate of 60%.

In Europe, AbbVie markets the drug under the brand name Tepkinly which is currently authorized to treat adults with R/R DLBCL who have received at least two prior therapies. A regulatory application is currently under the EMA’s review seeking similar label expansion for the drug in FL indication, also supported by data from the EPCORE NHL-1 study.

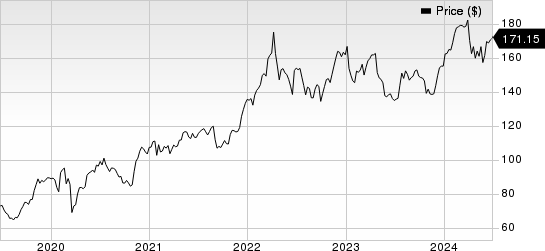

Year to date, AbbVie’s shares have risen 10.4% compared with the industry‘s 23.2% growth.

Image Source: Zacks Investment Research

Epkinly has been developed by AbbVie in collaboration with Genmab as part of an oncology collaboration deal signed in 2020 to jointly develop and market three of the latter’s early-stage investigational bispecific antibody product candidates.

Per the terms of the collaboration deal, AbbVie and Genmab share commercial responsibilities for epcoritamab in the United States and Japan. AbbVie is responsible for global commercialization.

AbbVie and Genmab are also evaluating Epkinly both as a monotherapy and as a combination regimen across lines of therapy in a range of hematologic malignancies in certain patients across different treatment settings.

The company has an exciting and diverse pipeline of promising new therapies in both blood cancers and solid tumors like ABBV-383 and Teliso-V, which are being evaluated in separate late-stage studies for multiple myeloma and non-small cell lung cancer indications, respectively. To strengthen its oncology pipeline, management also entered into agreements with companies like Umoja Biopharma and Tentarix Biotherapeutics to explore different modalities, like cell therapy and multi-functional biologics, to identify new treatment approaches.

These approvals and clinical developments highlight AbbVie’s efforts to strengthen its oncology/hematology sales. In February, management completed the acquisition of ImmunoGen, which added the latter’s antibody-drug conjugate (ADC) for ovarian cancer, Elahere, to the company’s oncology portfolio.

Despite being a recently approved drug and just recording a partial quarter of sales since the closing of this acquisition, AbbVie recorded revenues worth $64 million from Elahere sales in first-quarter 2024. Management believes that the recent positive updates in the NCCN guidelines and the inclusion of compelling overall survival data on the label will drive strong Elahere uptake in future quarters.

This latest approval comes a day after the company announced that the FDA issued a complete response letter (CRL) to its new drug application (NDA) seeking approval for ABBV-951 for the treatment of motor fluctuations in patients with advanced Parkinson's disease (PD). Per management, the CRL was issued based on some observations on inspection of one of the company’s third-party manufacturing facilities. The agency did not identify any issues related to the safety, efficacy, or labeling of the drug nor asked for conducting any additional clinical studies.

This is also the second the second time a CRL has been issued to ABBV-951. The FDA issued the first CRL last year. In that CRL, the FDA asked for some extra information about the pump device used to administer the medicine. Back then also, the agency had not requested any additional efficacy/safety studies.

AbbVie Inc. Price

AbbVie Inc. price | AbbVie Inc. Quote

Zacks Rank & Key Picks

AbbVie currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector are Arcutis Biotherapeutics ARQT and Heron Therapeutics HRTX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Arcutis Biotherapeutics’ 2024 loss per share have narrowed from $2.22 to $1.60. During the same period, the loss estimates per share for 2025 have narrowed from $1.37 to $1.14. Year to date, shares of Arcutis have surged 187.6%.

Earnings of Arcutis Biotherapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. Arcutis delivered a four-quarter average earnings surprise of 14.93%.

In the past 60 days, estimates for Heron Therapeutics’ 2024 loss per share have narrowed from 24 cents to 10 cents. During the same period, estimates for 2025 have improved from a loss of 8 cents to earnings of 1 cent. Year to date, HRTX’s shares have appreciated 79.4%.

Earnings of Heron Therapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. HRTX delivered a four-quarter average earnings surprise of 30.33%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Heron Therapeutics, Inc. (HRTX) : Free Stock Analysis Report

Genmab A/S Sponsored ADR (GMAB) : Free Stock Analysis Report

Arcutis Biotherapeutics, Inc. (ARQT) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經