Fortune Brands (FBIN) Expands Portfolio With Value Hybrid

Fortune Brands Innovations, Inc. FBIN has entered into a partnership with Value Hybrid Global, S.L. to enhance its Master Lock brand’s ability to offer new and innovative products in the emerging field of connected lockout tagout (cLOTO). The company also acquired a minority stake in Value Hybrid.

The partnership should help in transforming workplaces from mechanical to cLOTO and expand the reach for these solutions in the global market. LOTO solutions help improve workers' safety by preventing potentially dangerous equipment from releasing hazardous energy.

Given Fortune Brands’ lockout tagout expertise and channel strength, along with its Master Lock brand, this strategic collaboration with Value Hybrid should help it in expanding the portfolio of connected products.

FBIN is optimistic about the strategic move as it believes that this partnership will bring in top-tier connected solutions that will aid in increasing safety, improving efficiency and enhancing compliance at a global level.

Inorganic Growth Initiatives Bode Well

Fortune Brands focuses on strategic investments for inorganic as well as organic growth opportunities, while ensuring market outgrowth, margin preservation and cash generation. The company leveraged its market position and gained growth momentum in the past year despite uncertain economic conditions.

Regarding inorganic growth initiatives, the company’s accretive acquisitions impressively added to its growth momentum. On Feb 29, 2024, it acquired 100% of the outstanding equity of Wise Water Solutions LLC, doing business as SpringWell Water Filtration Systems, for a purchase price of $105.2 million. This acquisition paved the way for the company to invest and capture opportunities in the approximately $4 billion U.S. residential water filtration and water quality market. Furthermore, in June 2023, Fortune Brands acquired several businesses of ASSA ABLOY including Emtek and Schaub premium and luxury door and cabinet hardware business along with the U.S., Canadian Yale and August residential smart locks business.

Fortune Brands’ first-quarter net sales were notably driven by the aforementioned acquisitions, which brought the value to $1.11 billion, up 7% year over year.

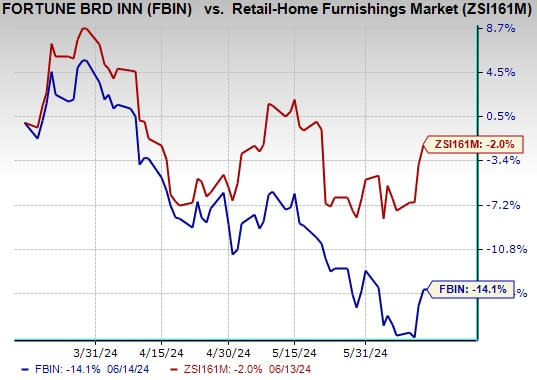

Image Source: Zacks Investment Research

Shares of this American manufacturer of home and security products fell 14.1% in the past three months compared with the Zacks Retail - Home Furnishings industry’s 2% decline. Although shares underperformed the industry, FBIN’s strategic investments in acquisitions, favorable pricing and cost reduction initiatives will drive its growth momentum in the upcoming quarters.

Zacks Rank & Key Picks

Fortune Brands currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Zacks Retail-Wholesale sector.

Wingstop Inc. WING currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

WING has a trailing four-quarter earnings surprise of 21.4%, on average. The stock has risen 115.3% in the past year. The Zacks Consensus Estimate for WING’s 2024 sales and earnings per share (EPS) indicates growth of 27.5% and 36.7%, respectively, from the year-ago period’s levels.

Sprouts Farmers Market, Inc. SFM currently sports a Zacks Rank of 1. SFM has a trailing four-quarter earnings surprise of 9.2%, on average. The stock has risen 117.4% in the past year.

The consensus estimate for SFM’s 2024 sales and EPS indicates growth of 8% and 9.9%, respectively, from the year-ago period’s levels.

The Gap, Inc. GPS currently sports a Zacks Rank of 1. GPS has a trailing four-quarter earnings surprise of 202.7%, on average. The stock has surged 166.2% in the past year.

The Zacks Consensus Estimate for GPS’ fiscal 2024 sales and EPS indicates a rise of 0.1% and 17.5%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

Fortune Brands Innovations, Inc. (FBIN) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經