France Sees Wider Spreads Costing €800 Million After a Year

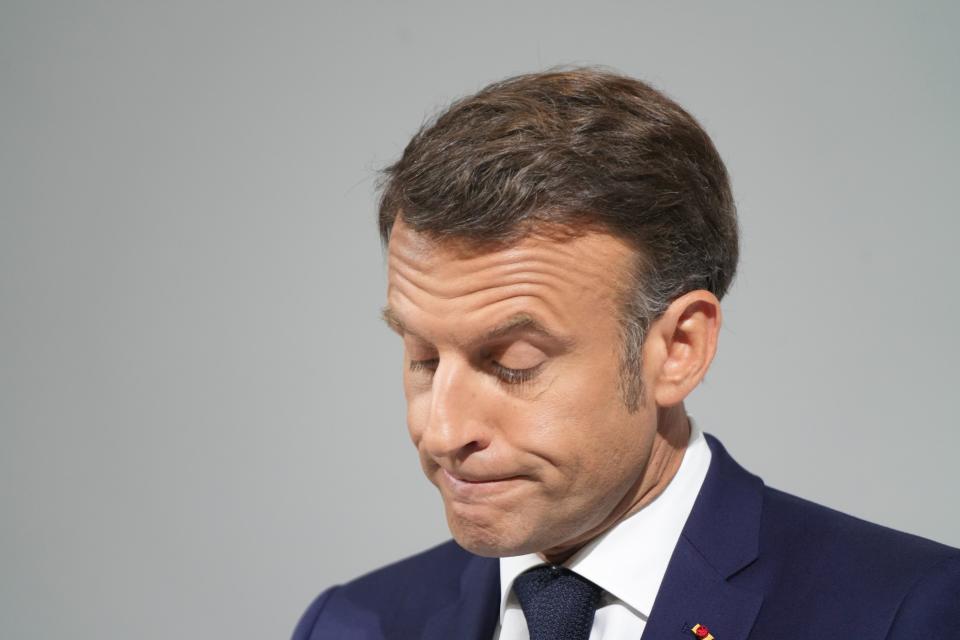

(Bloomberg) -- France’s Finance Ministry estimates the selloff in the country’s debt after President Emmanuel Macron called snap legislative elections would cost the state around an additional €800 million ($859 million) if the higher price of borrowing persisted for a year.

Most Read from Bloomberg

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

Nvidia’s 591,078% Rally to Most Valuable Stock Came in Waves

‘I Live in Hell’: Anti-Growth Fervor Grips US South After Pandemic Boom

Hedge Fund Talent Schools Are Looking for the Perfect Trader

The calculation is based on an increase in the premium of France’s borrowing costs over Germany’s of between 25 basis points and 30 basis points since the election was called on June 9.

After five years, the additional cost would be around €4 billion to €5 billion a year, and as much as €9 billion to €10 billion if it continued for 10 years, according to Finance Ministry officials.

Still, the calculation is theoretical as it presumes stability in the increase relative to Germany over the different time horizons. If the spread were to quickly return to levels seen before the election announcement, the impact would be much smaller, the officials said.

Most Read from Bloomberg Businessweek

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Google DeepMind Shifts From Research Lab to AI Product Factory

©2024 Bloomberg L.P.

雅虎香港財經

雅虎香港財經